AUD/USD outlook: Dips after less hawkish RBA, but larger bulls remain intact

AUD/USD

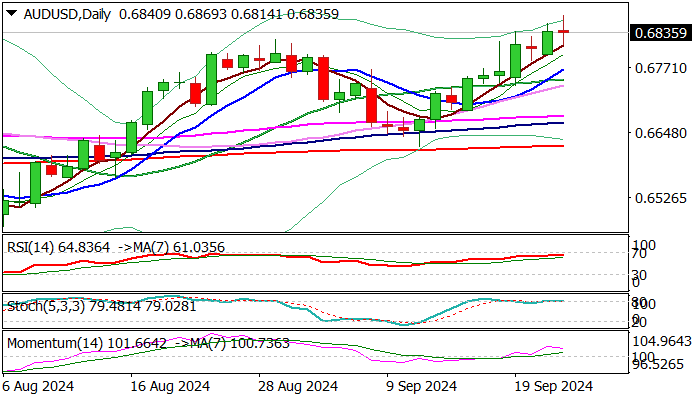

AUDUSD eased from new multi-month high on Tuesday after the Reserve Bank of Australia kept rates unchanged in today’s policy meeting, but comments from Governor Bullock were less hawkish than expected and sidelined expectations for possible policy tightening.

The pullback was so far shallow, as Aussie is underpinned by higher commodity prices and diverging Fed/RBA monetary policies, suggesting that larger bulls are just taking a breather.

Strong positive momentum on daily chart and formation of daily Tenkan/Kijun-sen contributes to bullish scenario however, overbought conditions warn that the price action may hold in prolonged consolidation.

Initial supports lay at 0.6814/0.6790 zone, ahead of more significant supports at 0.6774/66 (Fibo 38.2% of 0.6622/0.6869 / rising 10DMA) which should keep the downside protected and maintain bullish structure.

Res: 0.6869; 0.6900; 0.6948; 0.6961.

Sup: 0.6814; 0.6790; 0.6766; 0.6745.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.