AUD/USD outlook: Bulls crack important barriers

AUD/USD

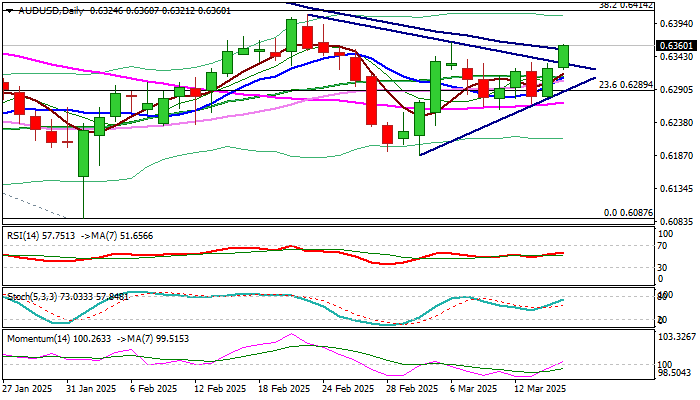

AUDUSD rose to two-week high on Monday, continuing to benefit from weaker dollar and boosted by signals of China’s stimulus plan to boost domestic consumption.

Fresh bulls crack pivotal resistance zone at 0.6353/63 (100DMA / Mar 6 high), with break here to firm near-term structure for attack at more significant barriers at 0.6410/14 (Feb 21 high / Fibo 38.2% of 0.6942/0.6087 downtrend).

Improved technical picture on daily chart (MA’s turned to bullish setup / 14-d momentum is entering positive territory/today’s break above upper boundary of triangle) adds to growing positive signals.

Holding above broken triangle upper boundary (0.6329, now reverted to support) is seen as minimum requirement to keep near-term action in bullish mode, with sustained break 0.6410/14 barriers to signal continuation of larger recovery from 0.6087 (2025 low posted on Feb 3).

Res: 0.6330; 0.6408; 0.6414; 0.6441.

Sup: 0.6329; 0.6307; 0.6295; 0.6269.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.