AUD/USD outlook: Bears pressure key support as markets await release of US labor report

AUD/USD

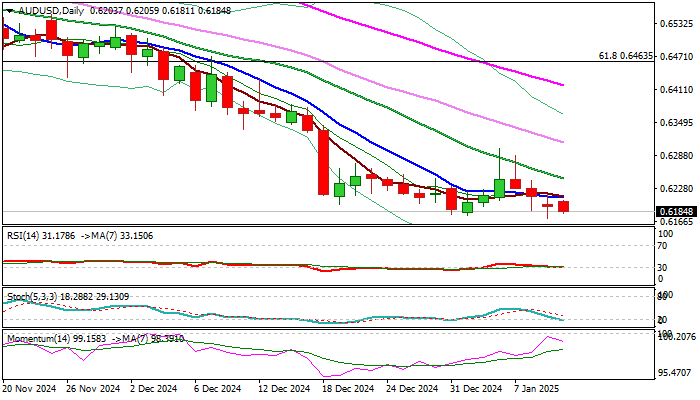

AUD/USD remains firmly in red and pressuring key support at 0.6170 (2022 low) after a brief recovery was repeatedly rejected above falling 20DMA and formed a double bull-trap on daily chart.

Bearish daily studies maintain downside pressure, though further headwinds in this zone should be anticipated as indicators are entering oversold territory.

On the longer run, the Aussie dollar may come under increased pressure if Trump’s administration proceeds with promised tariffs on China, while near-term focus is on US labor report (due later today) which would provide fresh direction signals.

Sustained break of 0.6170 trigger to open way for test of Fibo support at 0.6099 (76.4% retracement of 0.5509/0.8087) and expose psychological 0.60 level.

On the flip side, falling 10DMA offers immediate resistance at 0.6209, followed by more significant barriers at 0.6246 (20DMA) and 0.6302 (Jan 6 recovery spike), with break of the latter to sideline larger bears and allow for possible stronger correction.

Res: 0.6209; 0.6246; 0.6302; 0.6330.

Sup: 0.6170; 0.6099; 0.6040; 0.6000.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.