AUD/USD outlook: Aussie likely to remain in red as banking crisis weighs on risk sentiment

AUD/USD

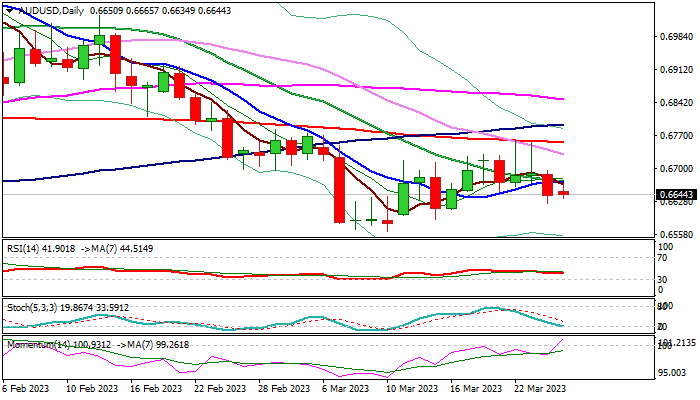

The AUDUSD is consolidating above one-week low (0.6625, hit last Friday after 0.7% daily fall), but keeps near-term bearish bias while the action is capped by converged 10/20 DMA’s (0.6668/70).

Repeated strong rejections under 200DMA (0.6755) last week, left two daily candles with long upper shadows, signaling that recovery from 0.6565 base lost traction, with subsequent drop on Friday, generating fresh bearish signals.

The Aussie is unlikely to make stronger gains as long as persisting fears about banking crisis continue to fuel risk aversion, despite daily indicators show opposite signals (rising 14-d momentum emerged into positive territory and stochastic is breaking into oversold zone).

We look for initial direction signals on break of 0.6625 (Friday’s low – bearish) or 0.6670 (20DMA – bullish).

Bearish scenario would risk retest of 2023 low (0.6563, Mar 10) and 0.6547 (61.8% retracement of larger 0.6170/0.7157 rally) loss of which would open way for continuation of the downtrend from 0.7157 (2023 high).

Conversely, break of 10/20DMA’s would ease immediate downside risk, but sustained break of 200DMA pivot remains a key requirement for bulls to regain full control.

Res: 0.6670; 0.6703; 0.6729; 0.6755.

Sup: 0.6625; 0.6589; 0.6563; 0.6547.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.