AUD/USD

AUDUSD was sharply down during Asian / early European sessions on Friday, falling over 2% so far and being the top loser of the day.

The Ausie dollar remains under strong pressure from risk aversion that continue to weaken stocks and commodities, with stronger dollar on Friday morning, adding to negative near term outlook.

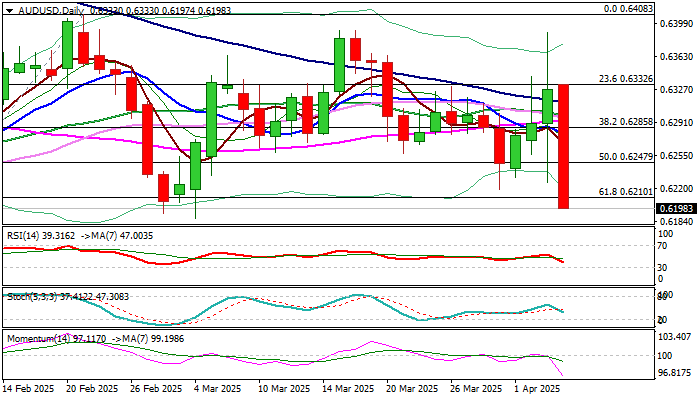

Today’s bearish acceleration has so far retraced over 61.8% of 0.6087/0.6408 and pressuring pivotal support at 0.6187 (Mar 4 low) with firm break here to generate fresh bearish signal.

Daily studies turned to full bearish configuration and contribute to growing risk of further losses (Australian dollar is on track for the biggest daily drop since 10 Apr 2024).

Broken daily cloud base at 0.6248 (also broken 50% retracement of 0.6087/0.6408) reverted to solid resistance which should cap upticks and keep bears in play.

We look for fresh signals from the US labor data (due later today).

Res: 0.6210; 0.6248; 0.6284; 0.6300.

Sup: 0.6187; 0.6163; 0.6131; 0.6100.

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

Gold remains close to record highs after poor US data

Gold now treads water near the $3,330 region on the back of safe-haven demand, usual trade effervescence, and another weaker-than-estimated US inflation gauge.

EUR/USD keeps its bullish bias near 1.1360 on US PPI

EUR/USD pulled back from its multi-year high above 1.1400 but still maintained a solid position around 1.1360 at the end of the week. The US Dollar remains on the back footing following disappointing results from US Producer Prices.

GBP/USD hovers around 1.3100, Dollar stays well offered

GBP/USD maintains its bullish streak, climbing to fresh tops around 1.3150 earlier in the day. The US Dollar trades with heavy gains on escalating China-US trade crisis, US recession fears and soft US Producer Prices.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.