The Australian dollar strengthened sharply, while the AUD/USD pair rose after the RBA meeting ended at the beginning of the month, at which the bank's leaders unexpectedly raised the interest rate by 25 basis points to 4.10%. In an accompanying statement, they noted that they made the decision against the backdrop of continued inflation pressure, which remains at an unacceptably high level of 7.0% (the RBA target is 2.0% - 3.0%), also not ruling out the possibility of a further increase in the interest rate, if the economic situation corresponds to this, and economic growth and the well-being of citizens will not be significantly damaged.

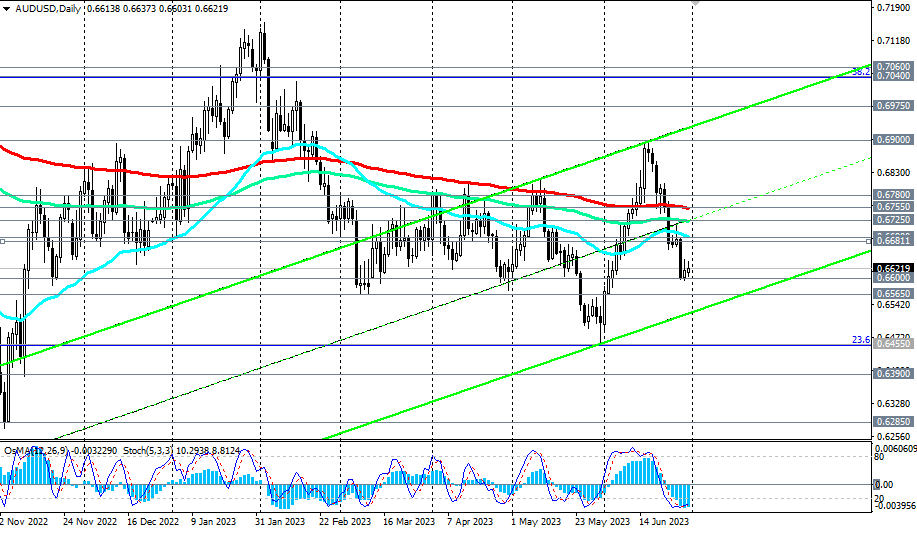

And yet, further on, the Australian dollar weakened, and the AUD/USD pair fell by now to the level of 0.6600, returning to the zone of bear markets - medium-term, long-term and global.

On Tuesday, July 4, the regular meeting of the Australian Central Bank will take place, and it is likely that a sharp decline in inflation in May will force RBA leaders to make another pause in raising interest rates. This is likely to negatively affect the position of the AUD, accelerating the decline in AUD /USD, including against the backdrop of continued expectations of a further increase in the Fed's interest rate.

This week the price tested the local support level 0.6600. A breakdown of the local support level at 0.6565 will be a confirming signal for the revival of the long-term downward dynamics of AUD/USD, sending the pair towards the lower border of the above downward channel, which is currently passing near local lows (since April 2020) and marks 0.6200, 0.6285.

Below the key resistance levels 0.7060, 0.7040 AUD/USD remains in the long-term bear market zone, and below the resistance levels 0.6755, 0.6725 and in the medium-term bear market zone, which makes short positions preferable in the current situation.

Support levels: 0.6600, 0.6565, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170.

Resistance levels: 0.6640, 0.6681, 0.6690, 0.6700, 0.6725, 0.6755, 0.6780, 0.6800, 0.6900, 0.6975, 0.7000, 0.7040, 0.7060.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction and bounces off daily lows

After bottoming out near 1.0450, EUR/USD managed to regain some balance and revisit the 1.0470 zone on the back of alternating risk appetite trends in the FX world and amid investors' assessment of the German elections.

GBP/USD hovers around 1.2630 amid a vacillating Dollar

GBP/USD alternates gains with losses in the low-1.2600s in response to the lack of a clear direction in the global markets and a lacklustre price action surrounding the Greenback.

Gold extends consolidative phase near record highs

Prices of Gold glimmered higher on Monday, hitting an all-time high around $2,955 per ounce troy on the back of the US Dollar's inconclusive price action as investors are warming up for a key inflation report due toward the end of the week.

Bitcoin Price Forecast: BTC standoff continues

Bitcoin has been consolidating between $94,000 and $100,000 since early February. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $540 million net outflow last week, signaling institutional demand weakness.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.