AUD/USD hits six-month high amid RBA rate hike speculations

The AUD/USD pair reached a six-month high of 0.6752, marking its fifth consecutive day of gains. The currency's strength is largely driven by market expectations that the Reserve Bank of Australia (RBA) might diverge from the global trend of lowering interest rates, raising them in response to escalating inflation pressures. May's CPI figures have intensified discussions around monetary tightening.

Market sentiment is split between expectations for a rate hike and maintaining the current rates at the RBA's next meeting in August. High domestic yields draw international capital, boost the Australian dollar, and provide a haven from the political uncertainties in the US and Europe.

Moreover, a weaker US dollar, underscored by unimpressive economic data released on Friday, has also bolstered the AUD. This data reinforced the Federal Reserve's dovish stance on monetary policy.

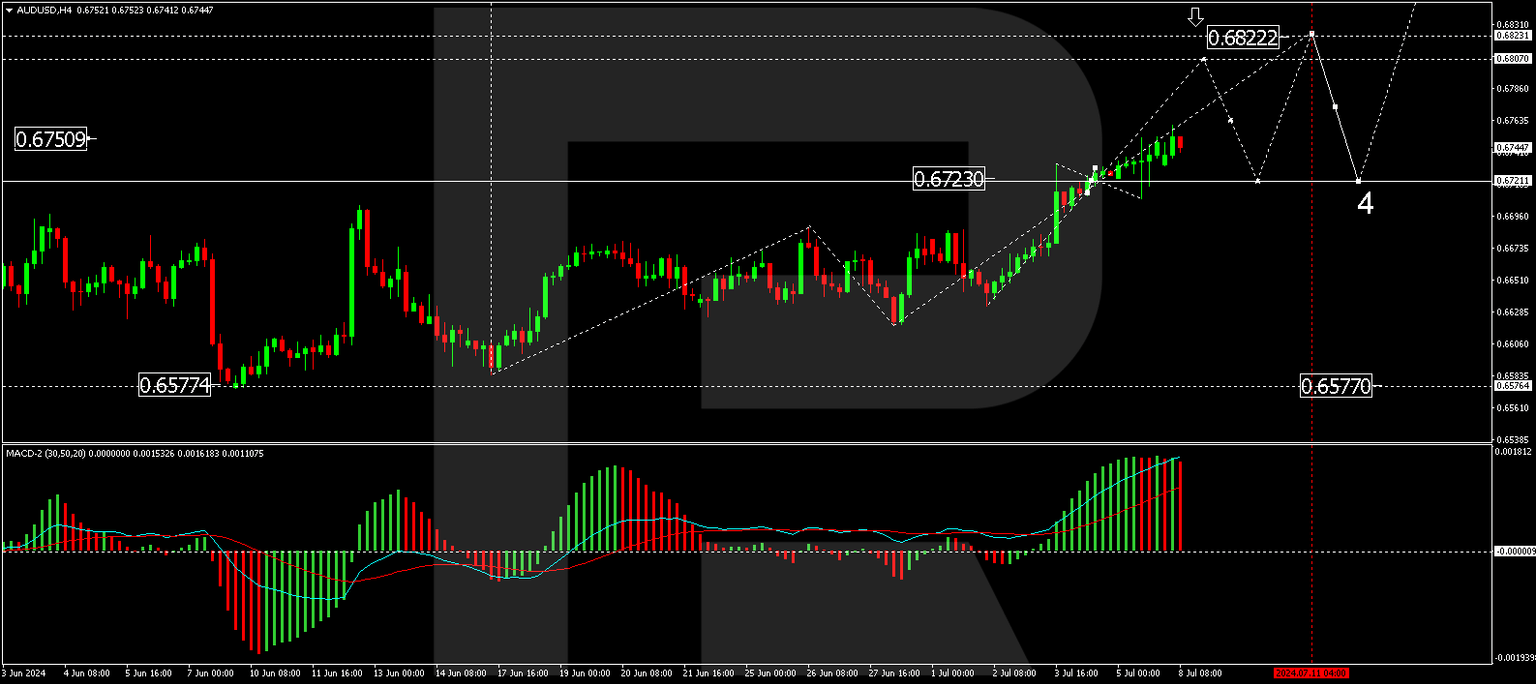

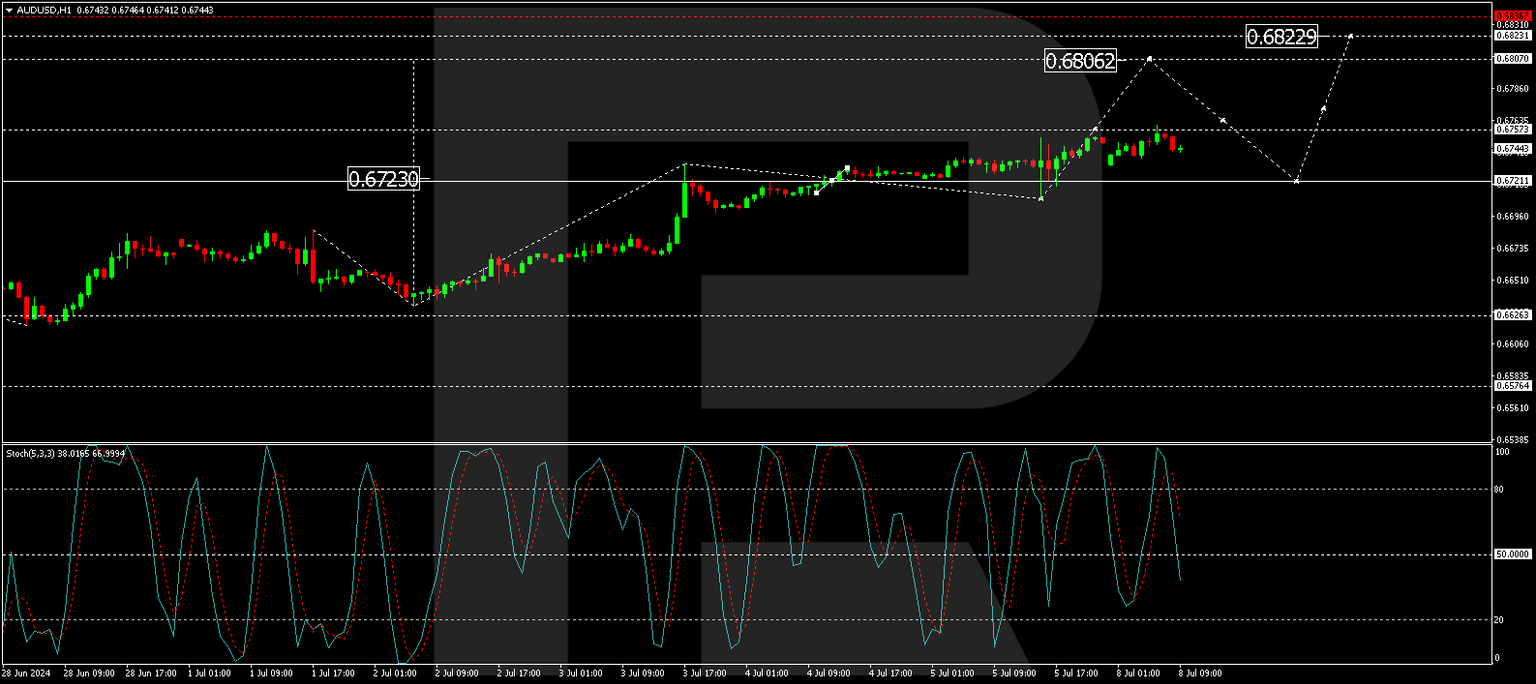

Technical analysis of AUD/USD

The market has established a broad consolidation pattern centred around 0.6723. Moving forward, there is a potential for an upward movement to 0.6822. Once this level is reached, a retraction to 0.6750 for a retest might occur, followed by a continuation of the upward trajectory towards 0.6858. This bullish outlook is supported by the MACD indicator, with its signal line positioned above zero and trending upwards.

The AUD/USD pair is currently challenging the 0.6757 level, with the potential to extend the rally towards 0.6806. Following this target, a pullback to 0.6757 could occur, setting the stage for another rise to 0.6822. The stochastic oscillator, situated above the 50 mark, suggests an imminent climb to 80, reinforcing the bullish momentum forecasted.

Traders and investors are closely monitoring developments, especially the upcoming RBA meeting, which could significantly influence the direction of the AUD/USD pair.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.