AUD/USD gets bearish vibes [Video]

-

AUD/USD violates key support zone.

-

Bearish pressures could persist in short-term.

![AUD/USD gets bearish vibes [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/AUDUSD/macro-of-aussie-100-note-8615104_XtraLarge.jpg)

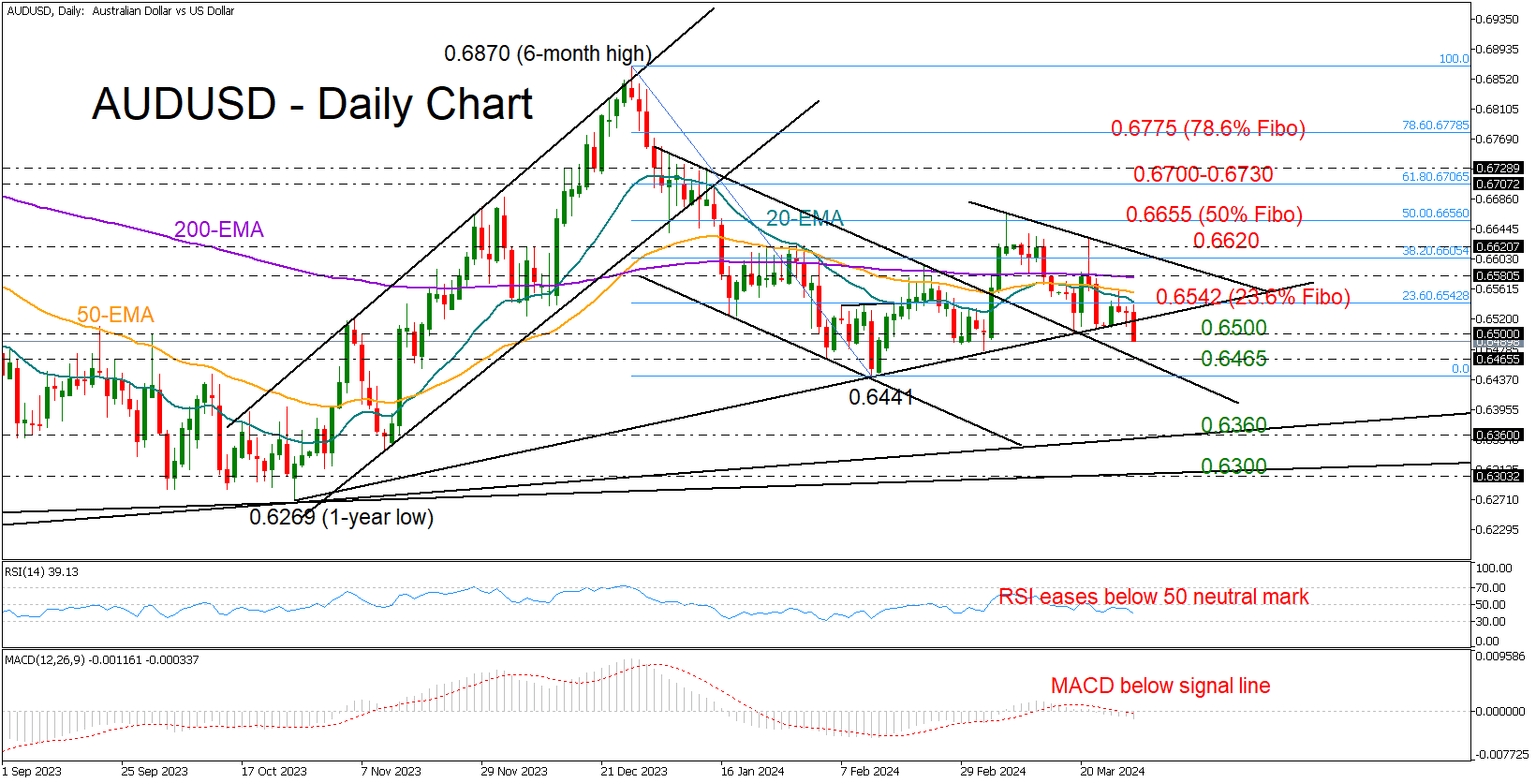

AUD/USD’s short-term upward pattern is under threat as it faces the risk of closing below the October support trendline at 0.6500, following another rejection near its exponential moving averages (EMAs).

Technical indicators suggest the bears are in control as the RSI is decelerating below its 50 neutral mark and the MACD is weakening within the negative region.

If the price stays below 0.6500, there is a possibility of it retesting the upper band of the broken bearish channel (January-March) at 0.6465 and February’s low at 0.6440. Neglecting to pivot there could result in a drop towards 0.6370, where the ascending trendline linking the pandemic and 2023 lows is positioned. The 0.6269-0.6300 territory could be the next destination if selling forces further strengthen.

To improve market sentiment, the pair will have to surpass its EMAs and exceed the March barrier of 0.6620. In the event that scenario plays out, resistance might be encountered around the 0.6655 level, which represents the 50% Fibonacci retracement of the December-February downtrend, and then within the range of 0.6700-0.6730.

In summary, the short-term bias for AUD/USD appears to be tilted downwards. Once the bears successfully claim the 0.6500 floor, the January-February downtrend will come back into focus.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.