AUD/USD Forecast: Wall Street’s rally underpins the Aussie

AUD/USD Current Price: 0.6918

- Chinese May data missed the markets’ expectations, weighing on the Aussie.

- The Reserve Bank of Australia will release the Minutes of its latest meeting this Tuesday.

- AUD/USD recovery could extend during the upcoming Asian session.

The AUD/USD pair started the day with a sour tone, falling to 0.6776, its lowest since the month began, but changed course during US trading hours, to settle above 0.6920. The pair traded alongside equities, falling during Asian trading hours as indexes edged sharply lower, but advancing at the end of the day with Wall Street’s rally. Also, dismal Chinese data weighed on the Aussie, as Retail Sales in the country decreased by 2.8% YoY in May, worse than the -2.0% expected, while Industrial Production in the same period increased by 4.4%, missing expectations of 5.0%.

This Tuesday, the AUD will present the Minutes of its latest monetary policy meeting. The document is not expected to surprise investors, but instead, repeat the latest Lowe’s message that the economic downturn is not as bad as initially estimated and that bond-buying will continue.

AUD/USD short-term technical outlook

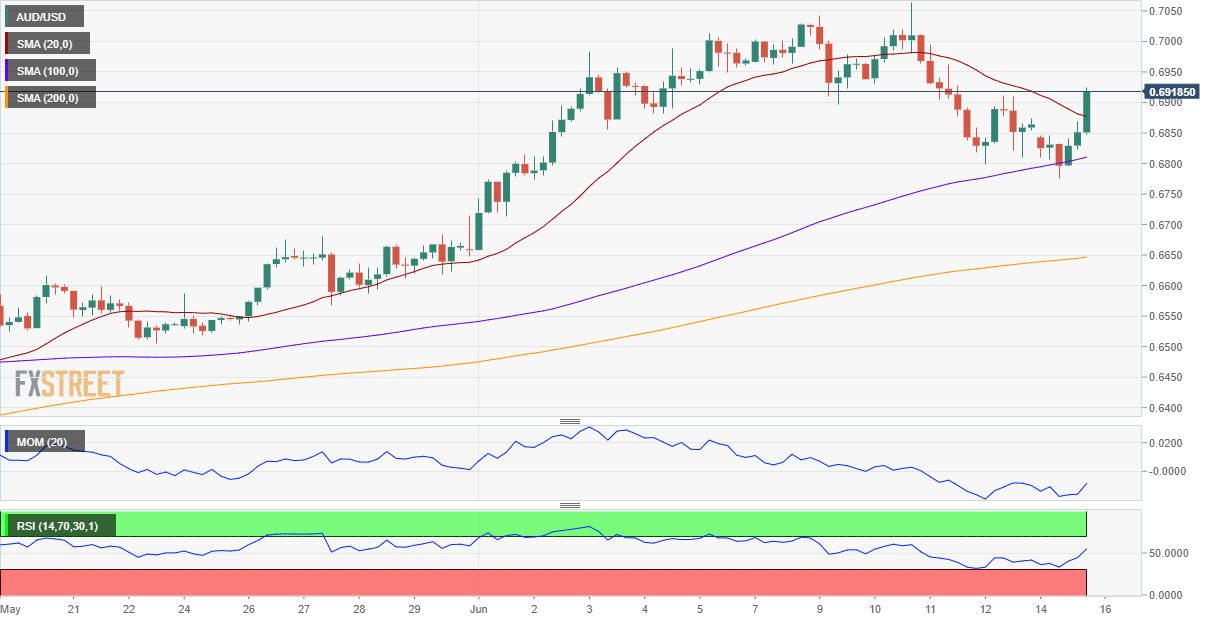

The AUD/USD pair has room to extend its advance during the upcoming hours, as, in the 4-hour chart, it has crossed above a still bearish 20 SMA, after finding support earlier in the day around a bullish 100 SMA. Technical indicators, in the meantime, head firmly higher above their mid-lines, as the price stands above its Friday intraday high.

Support levels: 0.6890 0.6850 0.6810

Resistance levels: 0.6935 0.6980 0.7020

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.