AUD/USD Forecast: Underpinned by surging gold and plummeting yields

AUD/USD Current Price: 0.6489

- Australian trade surplus hit a record of 10602 million in March.

- Gold prices soared on speculation fed funds rates could turn negative.

- AUD/USD poised to extend its advance toward the 0.6600 region.

The AUD/USD pair surged to 0.6505, its highest for the week, ending the day around 0.6480. The Aussie got a boost during London trading hours from rising equities, later underpinned by the broad dollar’s weakness and resurgent gold prices. The commodity recovered to $1,720.00 during US trading hours on the back of speculation that the fed funds rate could turn negative.

Also, data released at the beginning of the day showed that the Australian trade balance posted a surplus of 10602 million in March, while the Chinese one surged to $45.34B in April, both beating the market’s expectations. The Australian AIG Performance of Services Index for April was down to 27.1 from 38.7. The Reserve Bank of Australia will release the minutes of its latest meeting this Friday.

AUD/USD short-term technical outlook

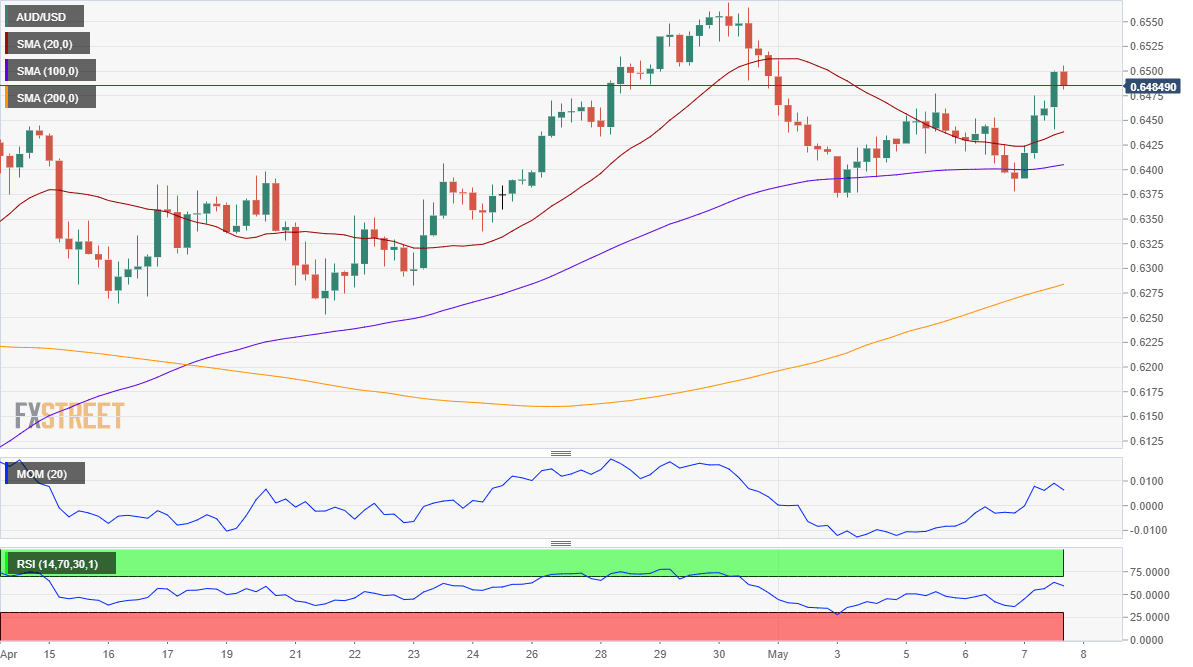

The AUD/USD pair holds on to daily gains, offering a mildly positive stance in its intraday charts. The 4-hour one shows that the price is holding above all of its moving averages, with the 20 SMA aiming to regain the upside. Technical indicators remain within positive levels but lost part of their bullish strength. Nevertheless, the pair has room to extend its advance, particularly if it breaks above 0.6515 the immediate resistance level.

Support levels: 0.6450 0.6405 0.6370

Resistance levels: 0.6515 0.6550 0.6590

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.