AUD/USD Forecast: The hunt for a stronger catalyst

- AUD/USD kept its multi-week range bound in place on Tuesday.

- The FX world traded within a broad-based consolidative range.

- The RBA is expected to keep its policy rate unchanged this year.

AUD/USD alternated gains with losses once again around the 0.6650 region against the backdrop of an equally vacillating price action in the US Dollar (USD) on turnaround Tuesday.

The pair's irresolute movement mirrored the mood in the broader FX galaxy ahead of an eventful week, where the FOMC Minutes (July 3) and the Nonfarm Payrolls (July 5) are the salient events.

Once again, the Aussie dollar did not benefit from the slight recovery in copper prices and the small gains in iron ore prices, which extended the side-line pattern seen since the beginning of June.

On the monetary policy front, the Reserve Bank of Australia (RBA), similar to the Federal Reserve, is expected to be one of the last G10 central banks to begin lowering interest rates. In its recent meeting, the RBA took a hawkish stance, keeping the official cash rate at 4.35% and indicating flexibility for future decisions.

Furthermore, around the RBA, the bank published its Minutes of its latest hawkish hold, revealing that the primary reason members felt the case for keeping the policy rate unchanged was due to "uncertainty around the data for consumption and clear evidence that many households were experiencing financial stress."

The above now seems to highlight the upcoming release of May Retail Sales in Australia (July 3), which carries the potential to either bolster or weaken the case for a rate hike.

Additionally, the swaps market is currently pricing in a 25% chance of a 25 bps increase of the RBA policy rate at the next meeting on August 6, rising to 35% on September 24, and over 50% on November 5.

The potential easing by the Fed, contrasted with the RBA's likely prolonged restrictive stance, could support AUD/USD in the coming months. However, concerns about the slow momentum in the Chinese economy may hinder a sustained recovery of the Australian currency as China continues to face post-pandemic challenges.

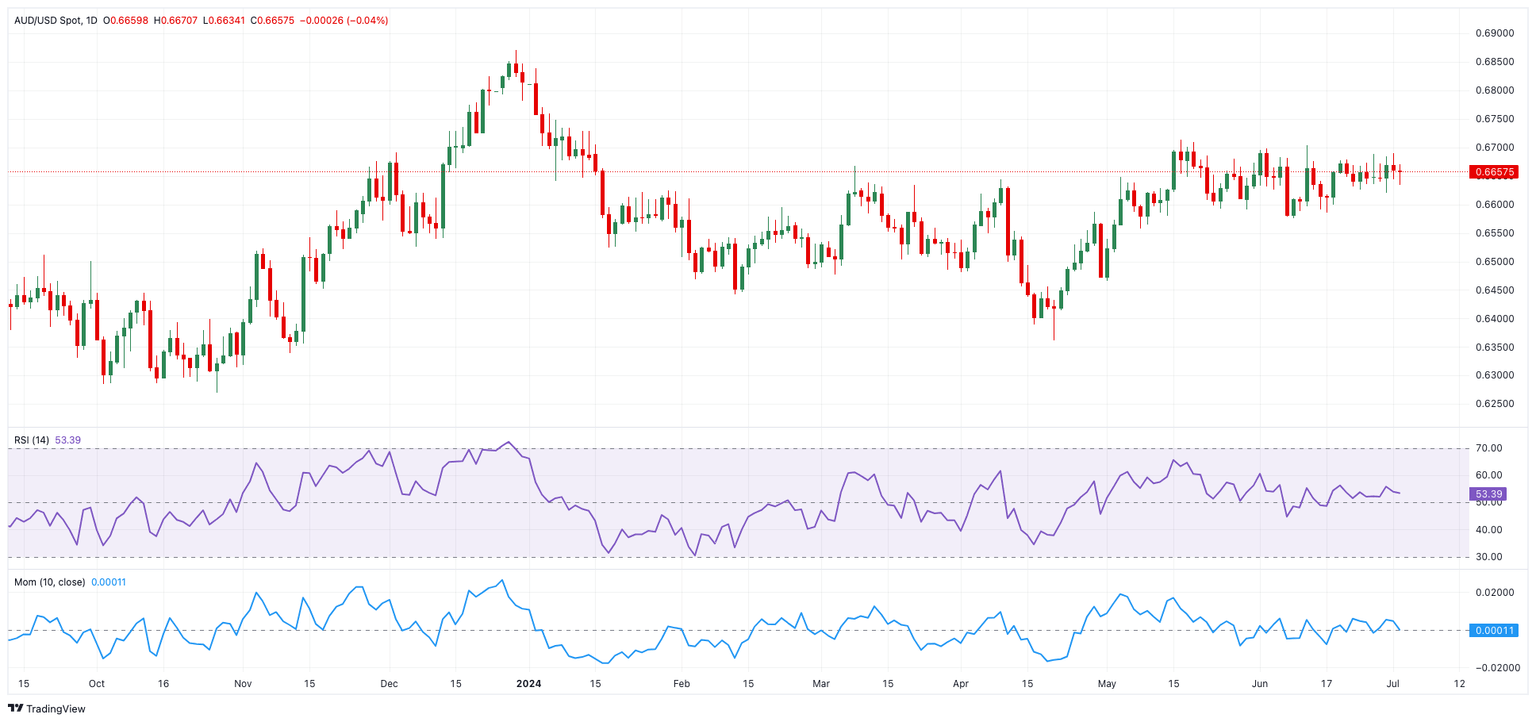

AUD/USD daily chart

AUD/USD short-term technical outlook

If bulls seize control, the AUD/USD may reach its May peak of 0.6714 (May 16), followed by the December 2023 high of 0.6871 and the July 2023 top of 0.6894 (July 14), all before hitting the critical 0.7000 level.

Bearish efforts, on the other side, might push the pair lower, first to the June low of 0.6574 (June 10) and subsequently to the important 200-day SMA of 0.6556. A further drop might result in a return to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Overall, the uptrend should continue as long as the AUD/USD remains above the 200-day SMA.

The 4-hour chart indicates a lack of significant growing momentum thus far. However, the initial barrier appears to be 0.6714, prior to 0.6728 and 0.6759. In contrast, the immediate support is about 0.6574, followed by 0.6558. The RSI rose to around 50.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.