AUD/USD Forecast: The bearish outlook remains unchanged near term

- AUD/USD traded in an inconclusive fashion in the low 0.6400s.

- The Dollar’s rebound weighed on the pair.

- The Australian labour market came in mixed in March.

The Australian Dollar (AUD) remained under pressure following Wednesday’s marked rebound vs. the Greenback, motivating AUD/USD to hover around the 0.6430 region on Thursday.

The irresolute movement of the Aussie dollar came on the back of further buying pressure on the US Dollar (USD) amidst investors’ growing speculation of a delayed interest rate hike by the Federal Reserve (Fed), while the mixed results from the Australian labour market report did not help the currency either.

On another front, further gains in both copper prices, which tested the $840.00 region, and iron ore prices, which rose past $107.00, limited the pair’s daily downside.

Regarding monetary policy, the Reserve Bank of Australia (RBA) reaffirmed its commitment to maintaining current policies in the minutes of its March meeting. Additionally, the market currently reflects a 90% likelihood of a 25 bps rate cut in 2024, compared to the nearly 50 bps of total easing observed earlier this month.

It's notable that the RBA, along with the Fed, is among the last G10 central banks anticipated to consider interest rate adjustments this year.

Considering the Fed's resolute stance on tightening monetary policies and the possibility of the RBA initiating an easing cycle later in the year, AUD/USD is likely to encounter sustained downward pressure in both the short and medium terms.

Additionally, recent Chinese results from key fundamentals remained far from reigniting hopes of a sustainable rebound in that economy, which is expected to eventually lend legs to an equally strong and convincing bounce in AUD.

AUD/USD daily chart

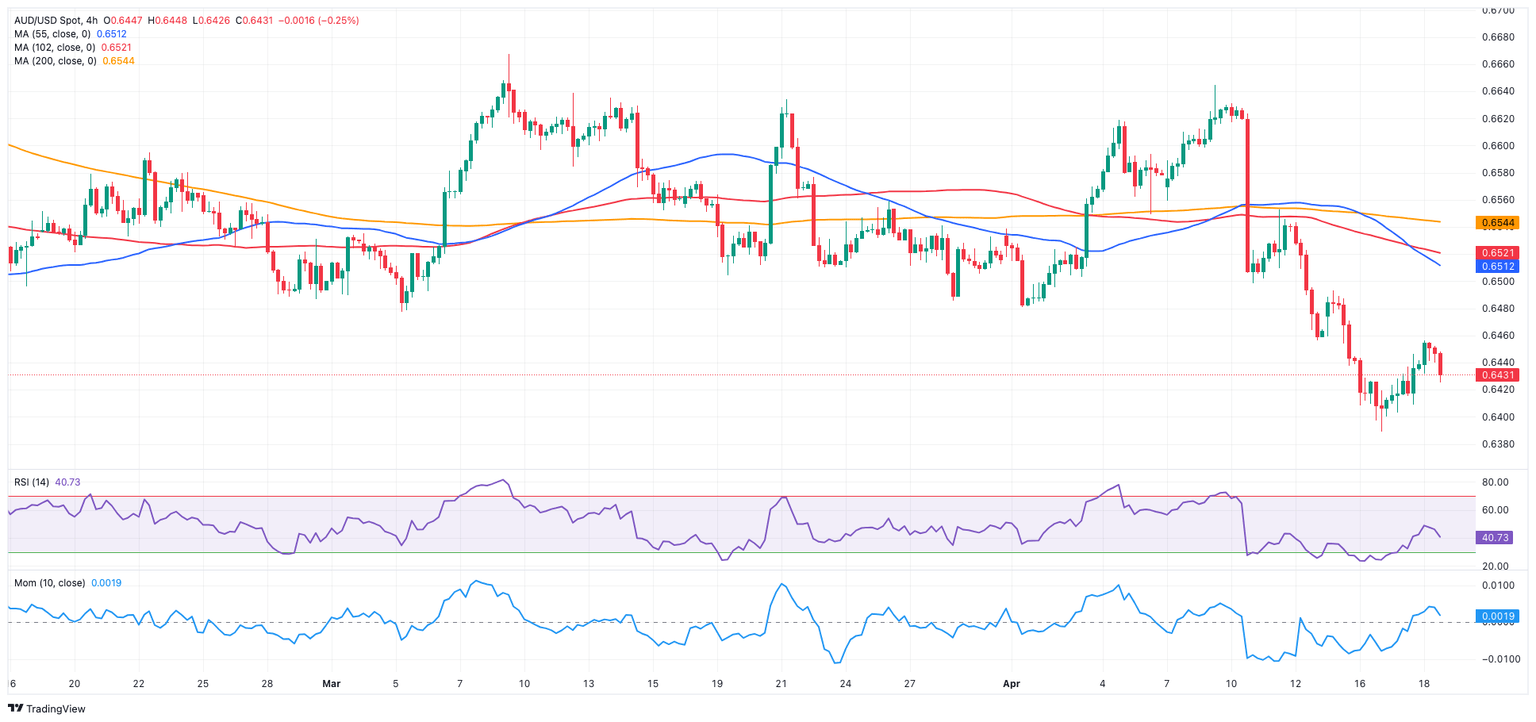

AUD/USD short-term technical outlook

If sellers maintain control and the AUD/USD falls below its 2024 low of 0.6389 (April 16), spot may return to its 2023 low of 0.6270 (October 26), before reaching the round level of 0.6200.

On the other hand, there is an immediate obstacle at the important 200-day SMA of 0.6535, which comes before the April high of 0.6644, followed by the March top of 0.6667 (March 8) and the December 2023 peak of 0.6871. Further north, the July high of 0.6894 (July 14) is just ahead of the June top of 0.6899 (June 16) and the crucial 0.7000 mark.

Looking at the big picture, the pair is expected to continue its downward trend while maintaining below the key 200-day SMA.

On the 4-hour chart, the pair's recent bounce appears to have struggled to extend further. Nonetheless, the initial support is 0.6389, seconded by 0.6338. On the upside, 0.6456 provides immediate resistance before 0.6493. Furthermore, the RSI dropped to about 43.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.