AUD/USD Forecast: The 200-day SMA emerges as a formidable support

- AUD/USD partially reverses Friday’s steep retracement.

- Gains in the US Dollar mainly affect the Euro following elections.

- The next risk event for AUD comes from the FOMC meeting.

The decent advance in the US Dollar (USD) did not prevent the Aussie dollar from regaining some composure and encouraging AUD/USD to reclaim the area past 0.6600 the figure following Friday’s strong decline.

The greenback's recovery was mainly driven by increased caution and renewed effervescence in the European political scenario in the wake of Sunday’s parliamentary elections and France’s E. Macron call for snap elections on June 30.

Contributing to the pair’s noticeable advance emerged the recovery in copper prices, while iron ore prices navigated an inconclusive session.

A glimpse at the monetary policy scenario sees the Reserve Bank of Australia (RBA), like the Fed, among the last major central banks to adjust its stance. Supporting this, officials even considered the possibility of interest rate hikes if inflation picks up, as per the latest Minutes.

Currently, money markets are forecasting about a 20-bps easing by May 2025, with potential rate hikes still possible in August and November. Supporting this, the RBA's Monthly CPI Indicator (Weighted Mean CPI) rose more than expected in April, increasing to 3.6% from 3.5%.

Given the Fed's commitment to tightening and the likelihood that the RBA will maintain its restrictive stance for an extended period, AUD/USD is expected to further consolidate in the coming months.

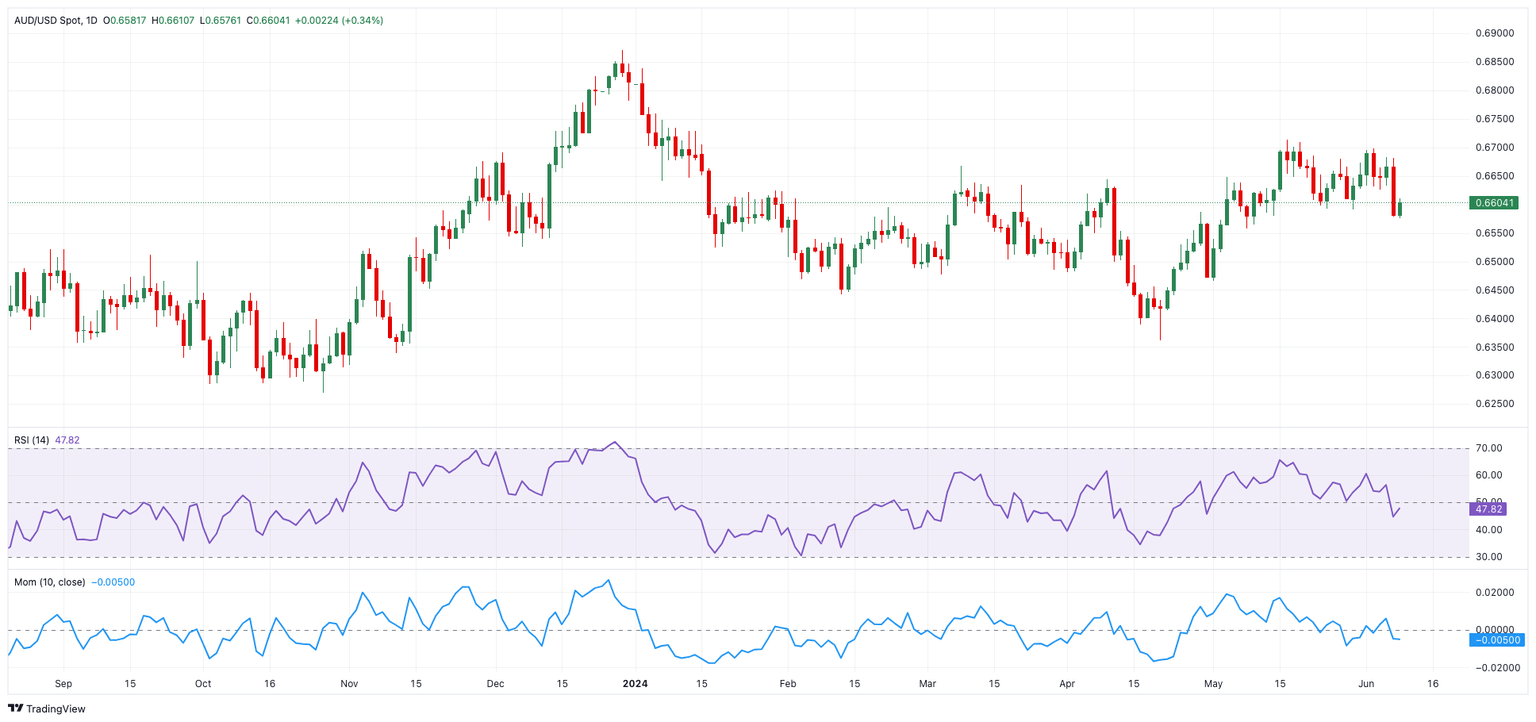

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra gains may propel the AUD/USD to the May peak of 0.6714 (May 16), seconded by the December 2023 high of 0.6871 and the July 2023 top of 0.6894 (July 14), all before the key 0.7000 level.

Meanwhile, bearish attempts may drive the pair towards the key 200day SMA of 0.6538 ahead of the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Overall, gains are expected as long as the price maintains above the 200-day SMA.

The 4-hour chart reveals a pick-up in momentum after recent lows. The said, immediate contention comes at 0.6574 prior to 0.6557. On the upside, the 200-SMA comes first at 0.6612 ahead of 0.6698 and 0.6709. The RSI rose past 42.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.