AUD/USD Forecast: The 0.6700 region limits the upside for the time being

- AUD/USD faded three consecutive daily upticks on Tuesday.

- The slight rebound in the US Dollar put the risk complex under pressure.

- Australia’s Current Account deficit hit A$4.9B in Q1.

The renewed buying interest on the US Dollar (USD) resulted in significant losses in AUD/USD, halting a multi-session positive streak, including another failed attempt to test or surpass the key 0.6700 barrier.

The fresh upside traction on the greenback came as investors assessed the possibility of the Federal Reserve (Fed) beginning its easing plan later this year, probably in November (and December?). This viewpoint was supported by lower-than-expected US JOLTs Job Openings in April, which signalled some cooling of the labour market.

This optimism regarding rate cuts appeared to contrast with previous cautious statements from some Fed policymakers, who emphasised the need for additional proof of inflation approaching the Fed's objective before considering rate decreases.

Daily losses in the Australian dollar were also supported by the resurgence of the downward bias in copper prices, while iron ore prices retreated to multi-week lows.

On the monetary policy front, the Reserve Bank of Australia (RBA), like the Fed, may be one of the last major central banks to modify its monetary policy. According to the bank’s last Minutes, officials unveiled discussions around interest rate rises.

So far, money markets expect roughly 25 bps of easing by May 2025, with rate rises still on the table in August and September. On the latter, it is worth noting that the RBA's Monthly CPI Indicator (also known as the Weighted Mean CPI) increased more than predicted by 3.6% in April, up from 3.5%.

Given the Fed's commitment to tightening monetary policy and the possibility that the RBA will continue its restrictive posture for a lengthy period of time, AUD/USD is projected to consolidate further in the coming months.

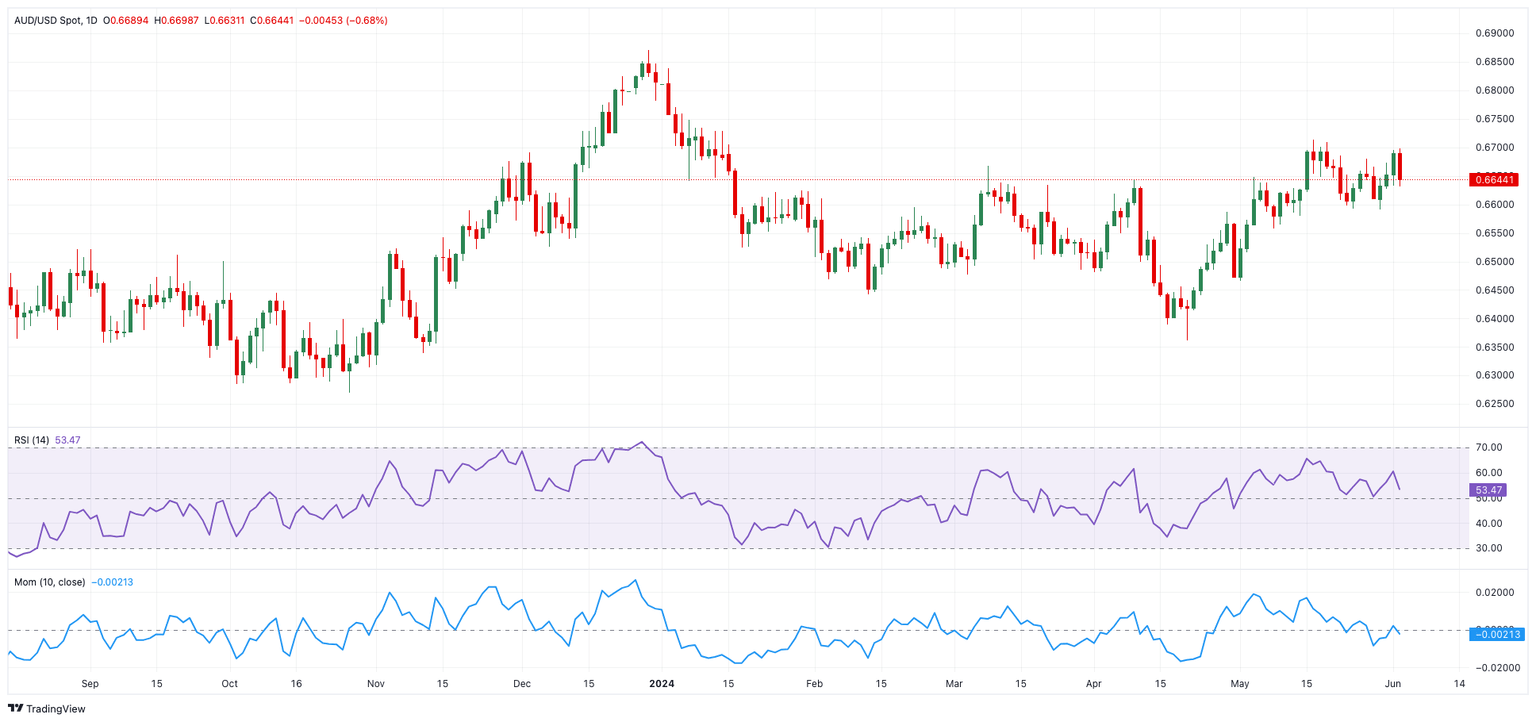

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra gains may push the AUD/USD to target the May high of 0.6714 (May 16), before aiming for the December 2023 top of 0.6871 and the July 2023 peak of 0.6894 (July 14), all ahead of the critical 0.7000 mark.

Meanwhile, bearish attempts may first drive the pair to the intermediate 100-day and 55-day SMAs in the 0.6560 zone, then to the key 200-day SMA at 0.6535. The loss of the latter might result in a return to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Overall, further increases are likely as long as the price remains above the 200-day SMA.

The 4-hour chart shows some loss of upside impetus as of late. Nonetheless, 0.6698 is the first up-barrier, followed by 0.6709 and 0.6714. On the other hand, 0.6590 provides immediate support, followed by 0.6579 and then 0.6557. The RSI decreased to approximately 47.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.