AUD/USD Forecast: Stuck around 0.6900, upside limited

AUD/USD Current Price: 0.6904

- US-China phase one trade deal failed to impress speculative interest.

- Australia to release housing-related data during the upcoming Asian session.

- AUD/USD could resume decline on a break below 0.6885, the immediate support.

The AUD/USD pair recovered from a daily low of 0.6876, but once again was unable to extend gains beyond a critical Fibonacci resistance level at around 0.6915. The daily behavior indicates that the Aussie remains among the weakest currencies, as the pair was unable to advance despite dollar’s weakness and Wall Street rallying to record highs. Australia didn’t release relevant macroeconomic data but will publish November Home Loans, foreseen up by 0.4% and Investment Lending for Homes during the upcoming Asian session. China, on the other hand, will unveil minor money figures.

The announcement of phase one of the US-China trade deal, which should have been a positive factor for the pair, it remained mute. Among other things, the mentioned agreement means that China will be spending $75 billion on manufacturing imports, $50 billion on energy imports, $50 billion agriculture imports and $40-50 billion on service imports from the US.

AUD/USD short-term technical outlook

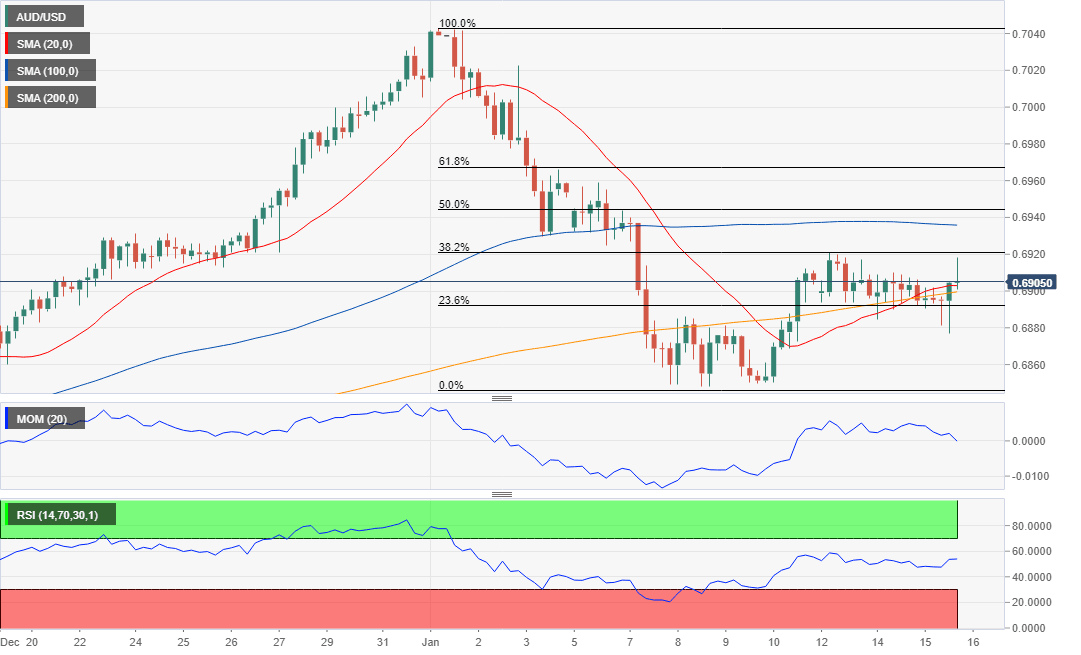

The AUD/USD pair settled just above the 0.6900 figure retaining its neutral stance in the short-term and according to the 4-hour chart, as it remains contained by moving averages, with the 200 SMA providing support at around 0.6885. Technical indicators, in the meantime, recovered from weekly lows, but lost momentum after reaching their midlines, now turning back south.

Support levels: 0.6885 0.6840 0.6800

Resistance levels: 0.6915 0.6950 0.6990

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.