AUD/USD Forecast: Slowly grinding lower

AUD/USD Current Price: 0.6049

- Australian NAB’s Consumer Confidence plunged to -11 in Q1 from -2.

- Crude oil prices’ bounce lent temporal support to the commodity-linked Aussie.

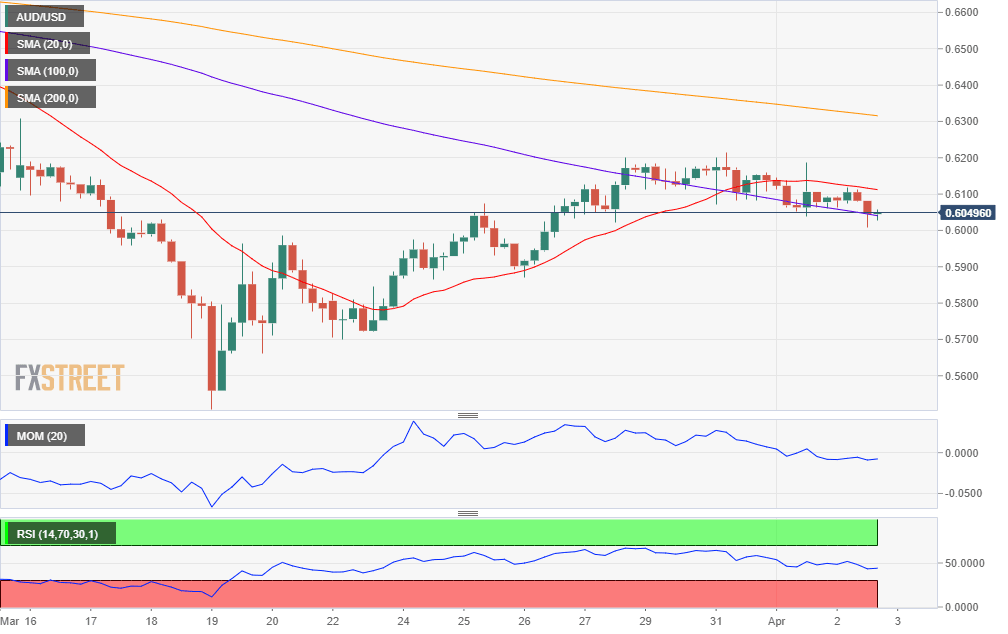

- AUD/USD with the risk skewed to the downside, about to challenge 0.6000.

The AUD/USD pair has fallen for a third consecutive day, ending the American session around 0.6040 and having posted a daily low of 0.6006. The pair bounced from the mentioned low amid the strong comeback in oil prices giving temporal support to commodity-linked currencies, although the advance was limited by the prevalent dollar’s demand. Australia released at the beginning of the day the Q1 NAB’s Business Confidence Index, which fell to -11 from -2. During the upcoming Asian session, the country will release the March AIG Performance of Construction Index, previously at 42.7, and the Commonwealth Bank Services PMI, expected to match the preliminary estimate and result at 39.8.

AUD/USD short-term technical outlook

The AUD/USD pair is offering a moderate bearish stance, according to the 4-hour chart, as it continues to trade below its 20 SMA, while around a bearish 100 SMA. Technical indicators in the mentioned chart hold within negative levels, although lacking directional strength. A break below the 0.6000 threshold should open doors for a steeper decline.

Support levels: 0.6035 0.6000 0.5960

Resistance levels: 0.6075 0.6110 0.6150

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.