AUD/USD Forecast: Relations with China reversed the rally, can an improvement revive it?

- AUD/USD has hit new highs over vaccine hopes but lost ground amid geopolitical concerns.

- Sino-American relations, China's rate decision, the RBA's minutes, and coronavirus statistics stand out.

- Late May's daily chart is painting a mildly bullish picture for the pair.

- The FX Poll is pointing to the downside.

Worsening relations between China with both the US and Australia limited enthusiasm triggered by vaccine hoes and support from the Federal Reserve. Coronavirus statistics, geopolitics, and several economic releases are eyed in May's final week.

This week in AUD/USD: Between hope and hardening stances

Australia's relations with its No. 1 trading partner have further deteriorated. The latest move was Beijing's decision to slap a whopping 80% tariff on barley coming from the land down under, coming on top of other commercial spats. The background is Canberra's call to investigate China's coronavirus response.

US President Donald Trump has also had his share of criticizing China, with the novel being pointing the finger also at his counterpart Xi Jinping. Trump accused Xi of leading a disinformation campaign and even for the disease.

Both parties in Congress and the White House have been advancing plans to scrutinize Chinese actions and re-shore American manufacturing. The consequent risk-off sentiment weighed on markets and boosted the safe-haven dollar.

Perhaps the most significant downer for AUD/USD in that context was China's plan to tighten its grip over Hong Kong, causing anger worldwide. That seemed to have tipped the scales fully in favor of the risk-off sentiment.

Republicans' reluctance to approve further fiscal stimulus also weighed on sentiment. Democrats passed a package worth $3 trillion, which was rejected. Jerome Powell, Chairman of the Federal Reserve, called on elected officials to do more.

While the Fed continues objecting negative interest rates – it was not mentioned in the bank's recent meeting minutes – Powell and his colleagues are ready to do more. That helped improve the mood.

Perhaps the most significant upside driver of markets and he Aussie came from hopes for a vaccine. Moderna announced that eight subjects developed antibodies for the COVID-19. While details were lacking, this optimism was a contributor to AUD/USD's advance over 0.66.

The Reserve Bank of Australia's meeting minutes did not reveal anything unknown beforehand but still reflected concerns about the recession – first Australia is experiencing since the early 1990s. Preliminary Retail Sales figures from the land down under showed a plunged of nearly 18%.

Australia's disease-related deaths and cases continued climbing at a minuscule rate, allowing for further reopening and a gradual return of sports that Aussie love so much – bullish for the national psyche.

Australian and Chinese events: All about relationships

Relationships with China – with Australia and the US – will likely remain center-stage. The lack of any adverse developments may be enough to lift the A$ – as China's steps against Australia are on the sidelines of trade between them. Additional tariffs or harsh rhetoric may weigh.

Sino-American tensions will likely remain tense ahead of November's US Presidential Elections, and as long as China refrains from transparency regarding its actions to curb the disease. Flareups of the virus in Jilin province has seemed under control so far but may snowball into a more significant story affecting the global mood.

The economic calendar features only third-tier publications, such as construction, private sector expenditure, and private sector credit – with the latter standing out as it is for April, already during the lockdown.

Here the most prominent Australian and Chinese releases on the economic calendar:

US events: Gradual reopening, GDP, housing, and more

US coronavirus statistics are declining, but over 1,000 people are dying every day in the world's richest economy. After all 50 states have moved forward with loosening restrictions, some fear that cases and deaths will flare up in new hotspots. As long as the reopening continues without spikes in infections, the mood will probably remain upbeat.

The last week of May kicks off with several housing figures, which will likely show declines in April. The Conference Board's consumer confidence gauge probably bounced from the lows in May, as life is returning to normal.

Economists expect the 4.8% annualized fall in Gross Domestic Product to be confirmed in the second read. Changes in personal consumption – the main drag – will be eyed. Durable Goods Orders statistics for April will provide a picture of investment in the second quarter.

Core Personal Consumption Expenditure (Core PCE) is the Federal Reserve's favorite inflation measure, and it has probably tumbled in April. Personal Spending sharply declined in March and likely extended its fall in April.

It is essential to note that end-of-month flows may trigger choppy trading.

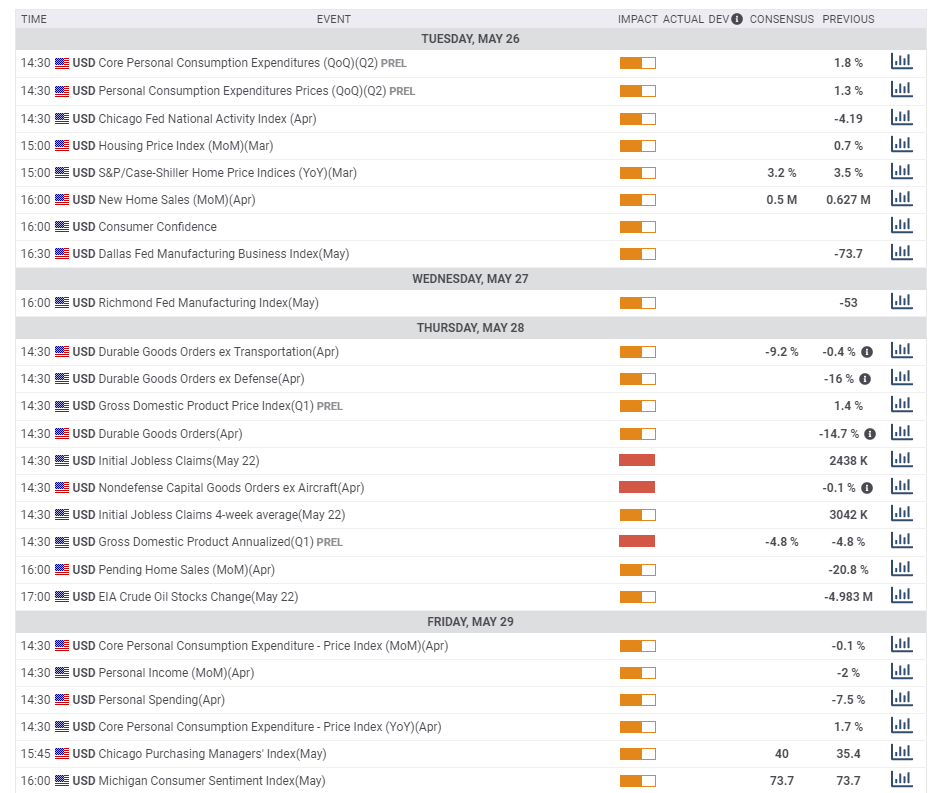

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

Aussie/USD is trading within an uptrend channel, formed around the end of April. While upside momentum on the daily chart has waned, the currency pair has topped the 100-day SMA. It remains below the 200-day SMA but above the 50-day one.

All in all, bulls are in the lead.

Some resistance awaits at 0.6560, which held AUD/USD down in mid-May. It is followed by 0.6610, the peak this month, and then by 0.6680 and 0.6750 which date to pre-pandemic times.

Support awaits at 0.65, which is a psychologically significant level and nearly converges with the 100-day SMA. Below the uptrend support line, the next cushion is at 0.6375, which is a double-top from early May. The next levels to watch are 0.6250 and 0.6210.

AUD/USD Sentiment

If Sino-American relations slip into the background again, the Aussie may continue rising for another week. That is far from certain, and in the bigger scheme of things, the ongoing spread of the disease in the US and the severe economic damage may turn the tables against the pair.

The FXStreet Forecast Poll is pointing an ongoing downtrend, with lower targets as time goes by. It seems that experts are skeptical about the possibility of recovery. The short term target has been upgraded while the medium and long-term ones are little-changed.

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637257367524184072.png&w=1536&q=95)