AUD/USD Forecast: Rallying beyond 0.7000

AUD/USD Current Price: 0.7016

- The positive tone of Wall Street kept the pair up throughout the day.

- NAB’s Business Confidence Index for May foreseen at -32 from -46 in the previous month.

- AUD/USD extending its rally above 0.7000 and poised to continue advancing.

The AUD/USD pair saw little action at the beginning of the week, confined this Monday to a 60 pips’ range yet reaching a fresh multi-month high of 0.7020. Australian markets remained closed this Monday amid a local holiday, and the macroeconomic calendar remained empty. Nevertheless, the Aussie was underpinned by upbeat Chinese data released during the weekend. The positive tone of equities kept the pair up throughout the day.

This Tuesday, the country will return with the release of the NAB’s Business Confidence Index for May, foreseen at -32 from -46 in the previous month, and the NAB’s Business Conditions Index for the same month, expected at -16 from -34 in April.

AUD/USD short-term technical outlook

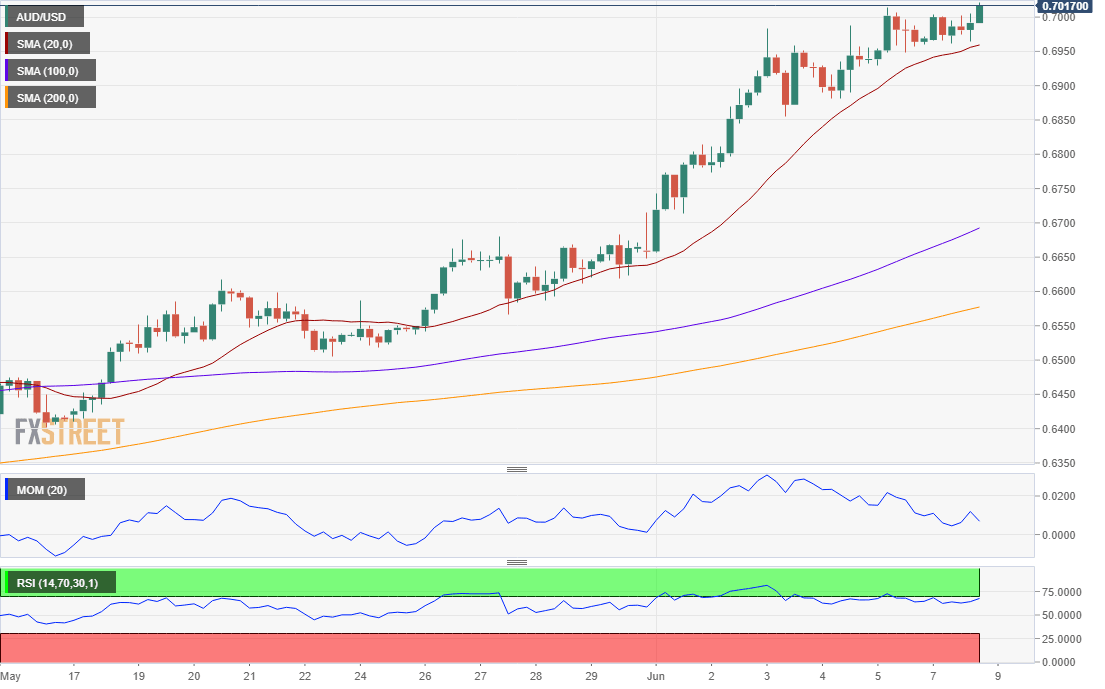

The AUD/USD pair is pressuring its daily high by the end of the American session, maintaining its bullish stance. In the 4-hour chart, the 20 SMA continues to advance below the current level, while the larger ones gain bullish traction well below the shorter one. The Momentum indicator lacks directional strength, hovering within positive levels, while the RSI turned higher at around 72, all of which favors a bullish continuation during the upcoming Asian session.

Support levels: 0.6995 0.6960 0.6925

Resistance levels: 0.7025 0.7060 0.7100

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.