AUD/USD Forecast: Provisional support emerges around 0.6560

- AUD/USD adds to Tuesday’s losses near 0.6600.

- Higher yields and hawkish Fedspeak lent support to the US Dollar.

- Australian inflation surprised to the upside in April.

The sustained buying pressure on the US Dollar (USD) led to additional losses in AUD/USD, driving it to a three-day low near 0.6610 on Wednesday.

The persistent bullish sentiment towards the Greenback coincided with investors' assessments of the potential for the Federal Reserve (Fed) to commence its easing programme later this year, possibly in the fourth quarter.

This outlook has been reinforced by cautious comments from several Fed officials in recent sessions, who emphasized the need for more evidence of inflation moving towards the Fed's target before considering rate cuts.

On a different page, the daily decline in copper prices in tandem with some consolidation around iron ore prices also contributed to the downward bias surrounding the Australian dollar.

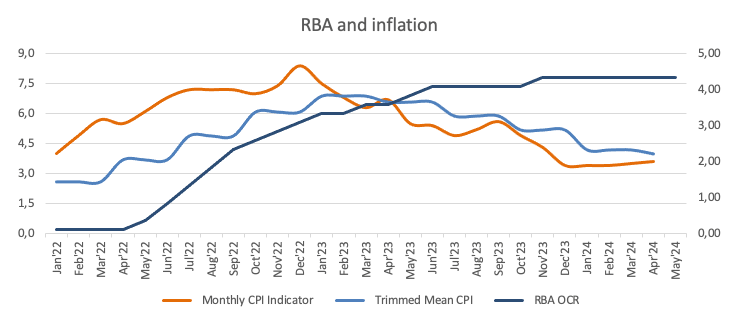

In terms of monetary policy, the Minutes of the Reserve Bank of Australia (RBA) published in the past few days highlighted discussions on interest rate hikes. The RBA may be among the last major central banks, along with the Fed, to adjust its monetary policy.

Reinforcing the latter, the RBA’s Monthly CPI Indicator (also known as the Weighed Mean CPI) rose more than expected by 3.6% in April (from 3.5%).

Notably, the RBA kept its interest rate steady at 4.35% this month, adopting a neutral stance while maintaining flexibility. The RBA's economic forecasts suggest that inflation will remain high until Q2 2025, driven by service price inflation, before returning to the 2%–3% target range by late 2025 and reaching the midpoint by 2026. Investors currently expect the RBA to keep its Official Cash Rate (OCR) unchanged at its June 18 meeting, while money markets see the first rate cut by the RBA in April 2025.

Given the Fed's commitment to monetary policy tightening and the possibility of the RBA maintaining its restrictive stance for an extended period, further consolidation in AUD/USD is likely in the coming months.

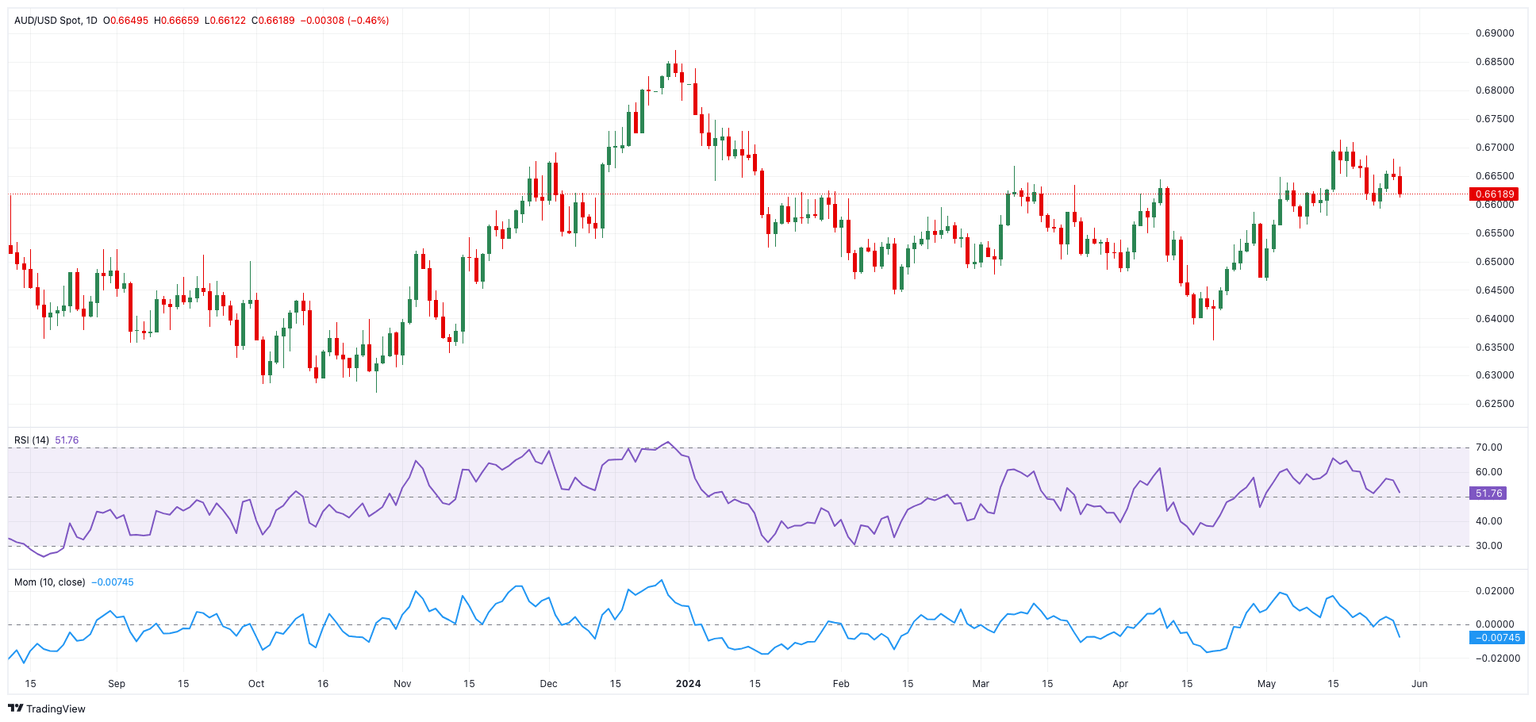

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra gains may lead the AUD/USD to test the May high of 0.6714 (May 16), before aiming for the December 2023 top of 0.6871 and the July 2023 peak of 0.6894 (July 14), all ahead of the critical 0.7000 level.

Meanwhile, bearish attempts might drive the pair to the intermediate 100-day and 55-day SMAs in the 0.6560 zone, followed by the crucial 200-day SMA at 0.6531. The loss of the later might open the door to a visit to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Looking at the larger picture, more gains are expected as long as the price stays above the 200-day SMA.

On the four-hour chart, the loss of momentum appears to have regained fresh pace. That said, first on the upswing comes 0.6685, followed by 0.6709 and 0.6714. On the other side, 0.6612 provides immediate support, prior to 0.6592 and the 200-SMA at 0.6565. The RSI lost ground and dropped below 40.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.