AUD/USD Forecast: Next target remains at 0.6700

- AUD/USD could not sustain a move to 0.6680 on Wednesday.

- A further advance in the US Dollar weighed on the risk complex.

- The RBA’s Monthly CPI Indicator surprised to the upside.

AUD/USD partially reversed Tuesday’s drop and advanced marginally despite the continuation of the intense recovery in the US Dollar (USD) on Wednesday.

In fact, the pair’s slight advance came in response to the higher-than-expected inflation figures in Australia tracked by the Reserve Bank of Australia’s Monthly CPI Indicator, which further underpinned the insofar hawkish stance by the bank.

The daily gain in the Aussie dollar came in spite of another solid performance of the Greenback and US yields across the curve, which kept price action within the risk-related universe subdued.

Other than the dollar’s gains, the bearish performance of both copper and iron ore prices also contributed to the loss of upside traction in the pair.

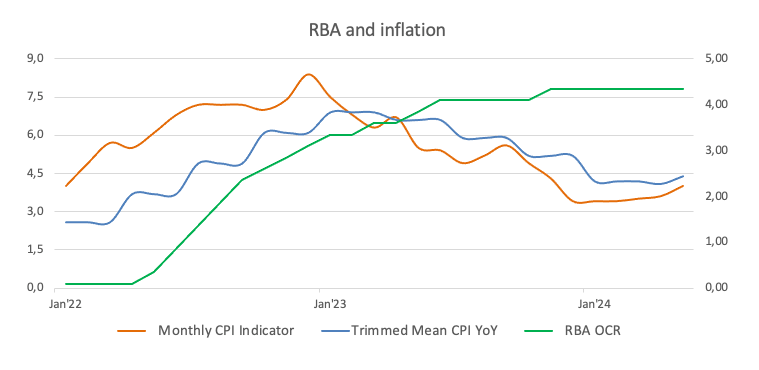

Regarding monetary policy, the Reserve Bank of Australia (RBA), like the Federal Reserve, has been among the last major central banks to change its stance. In its latest meeting, the RBA met expectations by maintaining a hawkish approach, keeping the official cash rate (OCR) at 4.35%, and signalling flexibility for future decisions.

During her press conference, Governor Bullock confirmed that the board discussed potential rate hikes while ruling out cuts. The bank remains focused on inflation, showing a reluctance to ease policy unless necessary. The central bank emphasized that inflation is still above target and reiterated its commitment to taking the necessary actions to bring inflation back within the target range.

The contrast between potential Fed easing and the RBA's likely prolonged restrictive stance could support AUD/USD in the coming months.

However, persistent concerns about the slow momentum in the Chinese economy could hinder a sustained recovery in the Australian currency as China continues to face post-pandemic challenges.

Meanwhile, in Oz, the RBA’s Monthly CPI Indicator (Weighed mean CPI) rose by 4.0% in the year to May (from 3.6%), and the Trimmed mean CPI rose by 4.4% YoY.

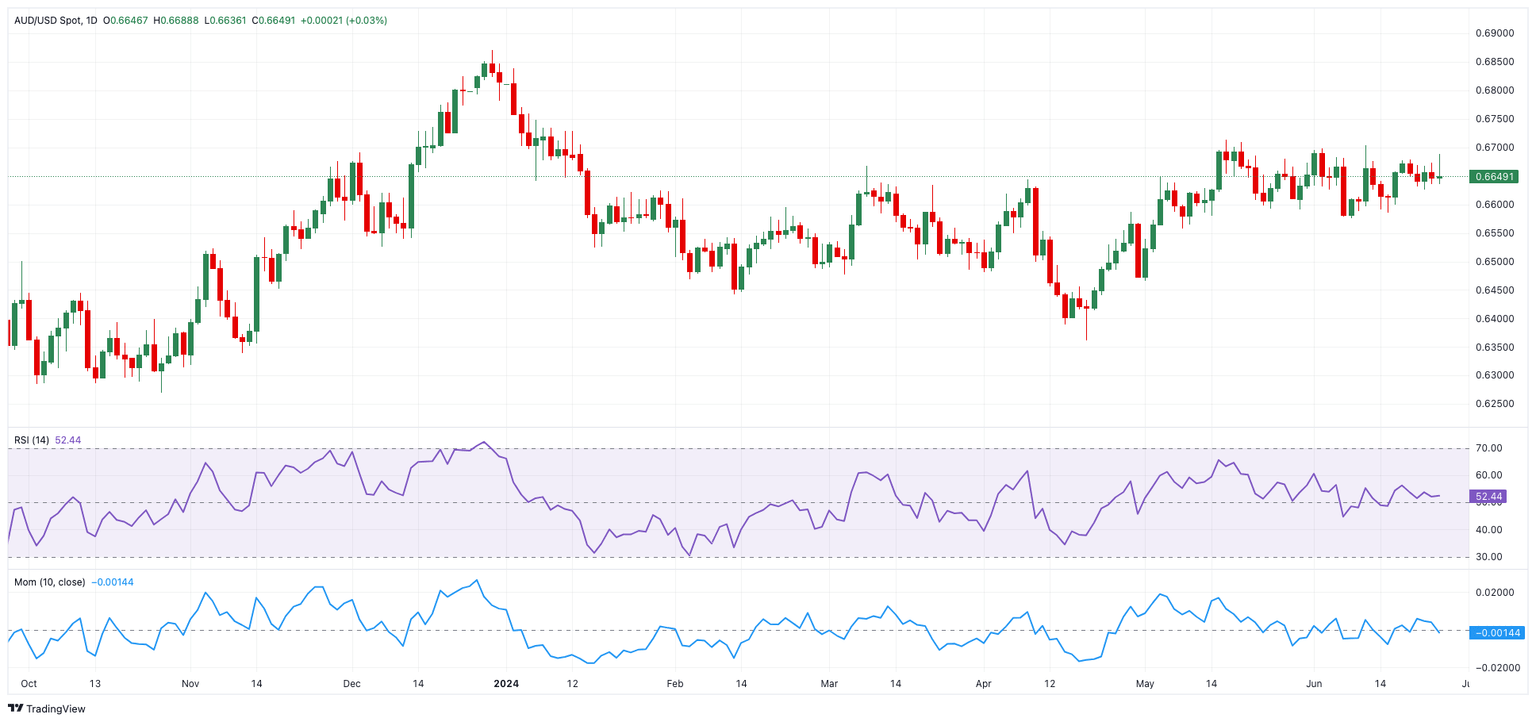

AUD/USD daily chart

AUD/USD short-term technical outlook

If bulls assume control, the AUD/USD may hit its May peak of 0.6714 (May 16), followed by the December 2023 high of 0.6871 and the July 2023 top of 0.6894 (July 14), all before the critical 0.7000 level.

Bearish attempts, on the other hand, may lead the pair lower, first striking the June low of 0.6574 (June 10) and then reaching the key 200-day SMA of 0.6552. A further slide might include a return to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Overall, the uptrend should continue as long as AUD/USD remains above the 200-day SMA.

The 4-hour chart shows a lack of convincing upward momentum thus far. However, the initial barrier looks to be 0.6714, ahead of 0.6728 and 0.6759. In contrast, the immediate support is around 0.6574, followed by 0.6558. The RSI decreased to around 48.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.