AUD/USD Forecast: Next on the upside comes 0.6560

- AUD/USD met some selling pressure and revisited 0.6500.

- Next support of note emerges at the 2024 low near 0.6440.

- Final Services PMI in Oz and Chinese PMI take centre stage on Tuesday.

AUD/USD started the new trading week on the back foot, revisiting the 0.6500 support after two consecutive sessions of gains.

The resumption of the downward bias in the Aussie Dollar occurred as the Greenback regained composure, always against the context of steady speculation over the timing of the first interest rate cut by the Federal Reserve (Fed), which is likely to be in June.

Adding to the prevailing selling pressure around the Australian dollar, there were nos signs of improvement in iron ore prices, which remained on the downside and navigating levels last observed in late August around $110 per tonne. This decline stemmed from ongoing concerns regarding the lack of economic recovery in China, as well as rising jitters around the country’s housing sector.

While potential stimulus measures in China may offer temporary relief, sustained positive economic news from the country holds more significant importance in supporting the Australian dollar and possibly initiating a more convincing upward trend in AUD/USD. A resurgence in the Chinese economy is also anticipated to coincide with a rise in commodity prices, bolstering the Australian currency.

However, the Reserve Bank of Australia's (RBA) cautious approach is expected to mitigate significant downward pressure on the AUD. Being one of the latest major central banks to consider interest rate cuts, the RBA's actions contribute to this expectation.

Looking at data releases from Australia, advanced Building Permits are expected to have contracted by 1.0% in January vs. the previous month, while Business Inventories contracted by 1.7% QoQ in Q4 and Company Gross Profits rose by 7.4% in the October-December period from a quarter earlier.

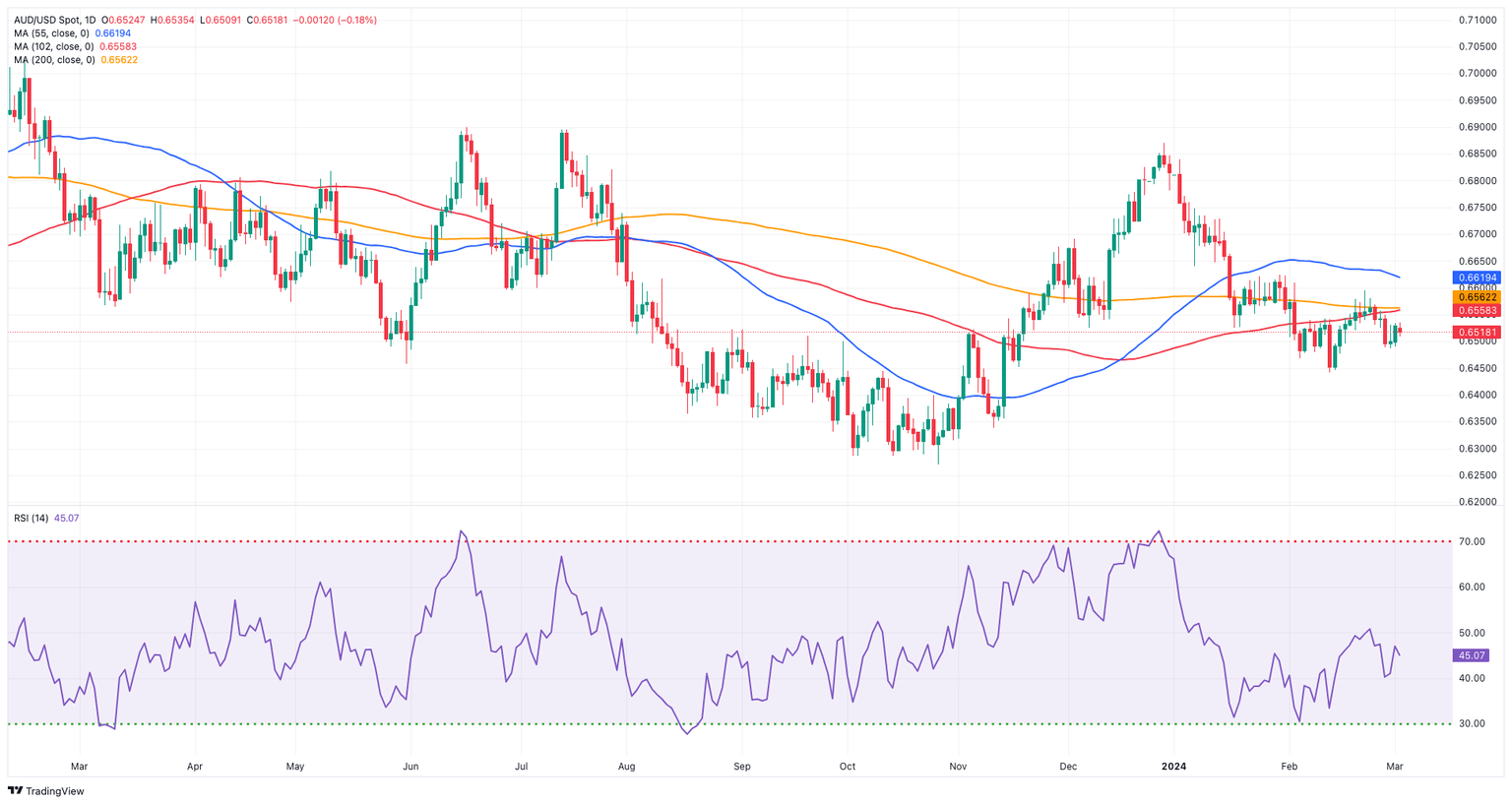

AUD/USD daily chart

AUD/USD short-term technical outlook

If sellers regain control, AUD/USD should meet initial contention at its 2024 low of 0.6442 (February 13). Breaking below this level may result in a potential visit to the 2023 low of 0.6270 (October 26), followed by the round level of 0.6200 and the 2022 low of 0.6169 (October 13).

On the upside, once the pair clears the weekly top of 0.6595 (February 22), it might retest the temporary 55-day SMA at 0.6616, which coincides with the late-January peaks (January 30). A break above this range might lead to the December 2023 high of 0.6871 (December 28), followed by the July 2023 top of 0.6894 (July 14) and the June 2023 peak of 0.6899 (June 16), all before the critical 0.7000 barrier.

It is worth mentioning that the AUD/USD's bearish tendency should be reduced once it successfully clears the critical 200-day SMA at 0.6559.

According to the 4-hour chart, more retracements are not ruled out for the time being. The initial support level is 0.6442, then 0.6347 and 0.6338. On the other hand, the 200-SMA aligns at 0.6543 ahead of 0.6595 and 0.6611. Furthermore, the MACD attempts a rebound, while the RSI breaks above 51.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.