AUD/USD Forecast: Immediately to the upside now comes 0.6870

- AUD/USD added to Tuesday’s gains above the 0.6700 mark.

- Extra losses in the US Dollar bolstered the sharp rebound in AUD.

- Retail Sales in Australia surprised to the upside in May.

AUD/USD grabbed a strong impulse, added to Tuesday’s advance, and finally surpassed the 0.6700 barrier to print new six-month peaks on Wednesday. The sharp move higher in the pair came in response to the equally strong sell-off in the US Dollar (USD), particularly after disappointing results from the US docket.

Adding to the robust bounce in the Aussie dollar, both copper prices and iron ore prices seem to have broken above the multi-week consolidative phase, ending the session with decent gains.

Regarding monetary policy, the Reserve Bank of Australia (RBA), like the Federal Reserve, is expected to be among the last G10 central banks to start cutting interest rates. In its recent meeting, the RBA maintained a hawkish stance, keeping the official cash rate at 4.35% and signalling flexibility for future decisions.

On the latter, the RBA's minutes from its latest meeting revealed that the decision to hold the policy rate was primarily due to "uncertainty around consumption data and clear evidence of financial stress among many households."

Furthermore, the swaps market continues to assign a 25% probability of a rate hike at the upcoming August 6 meeting, increasing to around 50% over the subsequent meetings. Overall, the RBA is in no hurry to ease policy, anticipating that it will take some time before inflation is sustainably within the 2-3% target range.

Finally, stronger-than-expected Retail Sales in May (+0.6% MoM) also lent extra legs to AUD and added to the tighter-for-longer narrative surrounding the RBA.

Potential easing by the Fed, contrasted with the RBA's likely extended restrictive stance, could support AUD/USD in the coming months. However, concerns about the sluggish momentum in the Chinese economy may impede a sustained recovery of the Australian currency as China continues to face post-pandemic challenges.

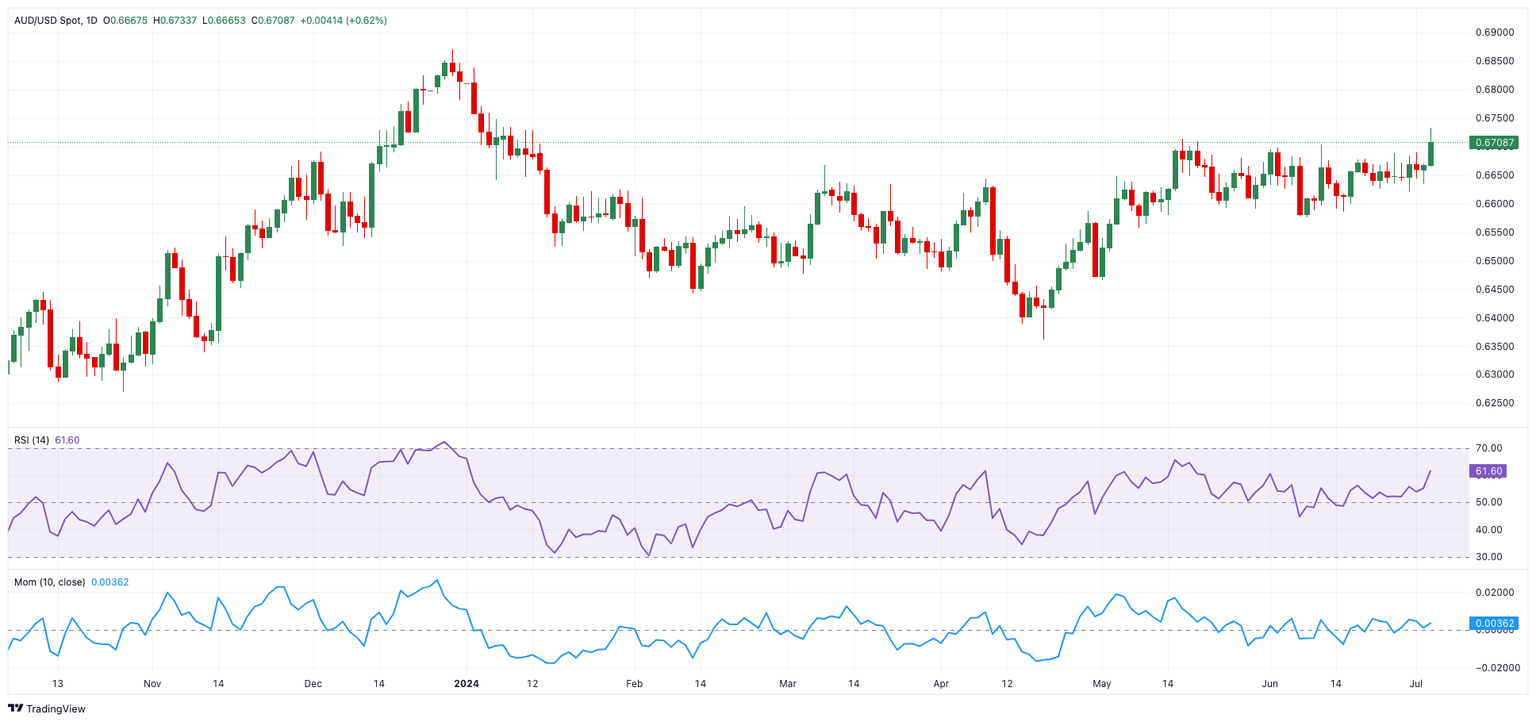

AUD/USD daily chart

AUD/USD short-term technical outlook

If bulls push harder and AUD/USD clears the July high of 0.6733 (July 3), it might then confront the December 2023 top of 0.6871, which comes prior to the July 2023 peak of 0.6894 (July 14), and the key 0.7000 level.

Bearish attempts, on the other hand, might drive the pair lower, first to the June low of 0.6574 (June 10) and then to the key 200-day SMA of 0.6558. A further dip might mean a return to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Overall, the uptrend should continue as long as AUD/USD trades above the 200-day SMA.

The 4-hour chart shows a marked recovery of the upside impetus so far. However, the earliest barrier looks to be 0.6733, ahead of 0.6759 and 0.6871. In contrast, the immediate support is at the 200-SMA of 0.6645 seconded by 0.6574, and 0.6558. The RSI climbed to approximately 67.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.