AUD/USD Forecast: Holding on higher ground, needs to take 0.6200

AUD/USD Current Price: 0.6162

- The Australian government will release another rescue package worth A$80 billion.

- China will release the official Manufacturing PMI and the Non-Manufacturing PMI.

- AUD/USD neutral-to-bullish in the short-term, as long as above 0.6100/10 price zone.

The AUD/USD pair saw little action this Monday, ending the day as it started it around 0.6160. The pair remained confined to the upper end of Friday’s range, holding below the 0.6200 figure and meeting buyers ahead of the 0.6100 figure. The pair lacked directional conviction throughout the day, showing no reaction to the Australian government’s decision to announce another rescue package. According to the latest news, authorities will release $80 billion to rescue jobs affected by the coronavirus, bringing the total stimulus package to A$320 billion.

The country has a light calendar this Tuesday, as it will release February Private Sector Credit, with attention during the Asian session shifting to Chinese data, as the country will release March’s official Manufacturing PMI, foreseen at 45 from 35.7 previously, and the Non-Manufacturing PMI, expected to have recovered to 37.8 from 29.6.

AUD/USD short-term technical outlook

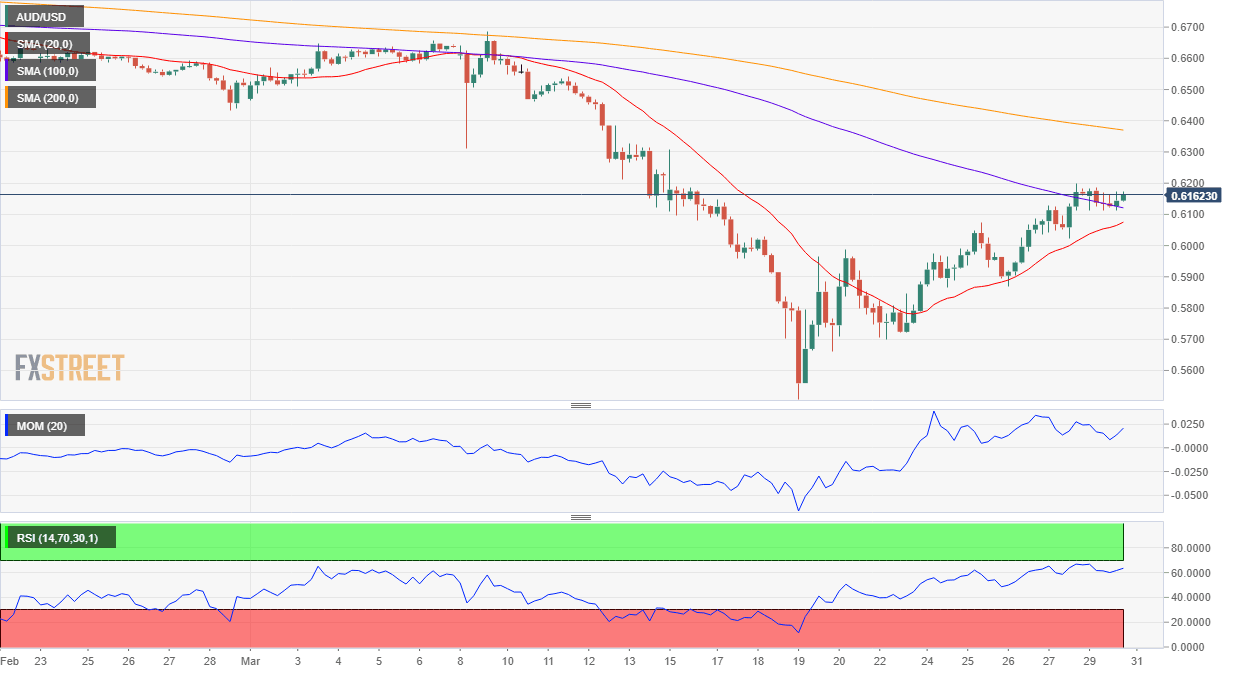

The AUD/USD pair is offering a neutral-to-bullish stance in its 4-hour chart, as it has spent the day struggling around a bearish 100 SMA, but also above a bullish 20 SMA. Technical indicators remain within positive levels, the Momentum easing and the RSI flat at around 62, limiting chances of a steeper decline, as long as the pair holds above the mentioned 0.6110 level.

Support levels: 0.6110 0.6070 0.6030

Resistance levels: 0.6200 0.6240 0.6280

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.