AUD/USD Forecast: Further weakness could revisit the 2024 low

- AUD/USD reversed Monday’s losses and rebounded from 0.6480.

- Further selling could drag the pair to the YTD low near 0.6440.

- Final Services PMI in Australia improved more than expected in February.

The Aussie dollar managed to reverse the pessimistic start of the week and motivated AUD/USD to chart modest gains following an earlier drop to the sub-0.6500 region on turnaround Tuesday.

This renewed bullish sentiment towards the Australian currency coincided with a daily retracement in the Greenback, always amidst ongoing speculation regarding the timing of the first interest rate cut by the Federal Reserve (Fed), projected for June.

Accompanying the bounce in AUD, iron ore prices showed some signs of improvement after they bounced to the $117 zone per tonne after bottoming out in levels last seen in late August around the $110 zone.

The persistent uncertainty around the Chinese economy should remain a key driver behind the pair’s price action for the time being. Speaking about China, the Caixin Services PMI eased marginally to 52.5 in February, while Chinese Premier Li Qiang presented his annual work report at the National People's Congress, announcing an ambitious growth target of 5% for the year, while the deficit-to-GDP ratio for 2024 was established at -3%, mirroring the same target as last year, which eventually saw an increase to -3.8%.

While potential stimulus measures in China could provide temporary relief, sustained positive economic indicators from the country hold greater significance in bolstering the Australian dollar and potentially triggering a more robust uptrend in AUD/USD. A resurgence in the Chinese economy is also expected to coincide with an upswing in commodity prices, lending support to the Australian currency.

Nonetheless, the cautious stance of the Reserve Bank of Australia (RBA) is anticipated to temper significant downward pressure on the AUD. As one of the most recent major central banks to contemplate interest rate cuts, the RBA's policy decisions contribute to this expectation.

In terms of data releases from Australia, the final Judo Bank Services PMI rose to 53.1 in February, and the Current Account surplus widened to A$11.8B in Q4.

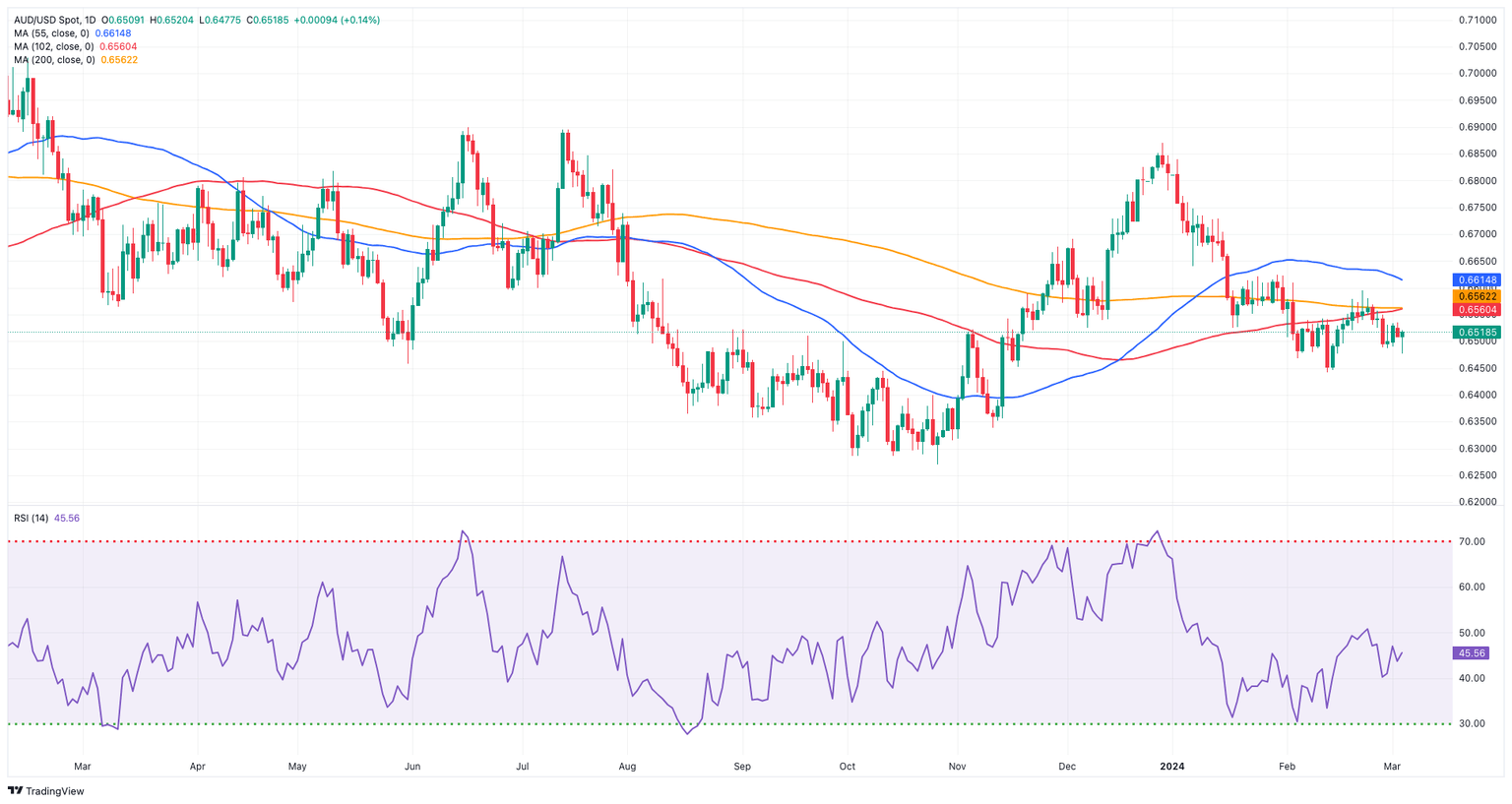

AUD/USD daily chart

AUD/USD short-term technical outlook

If sellers regain control, AUD/USD should meet initial contention at its 2024 low of 0.6442 (February 13). Breaking below this level may result in a potential visit to the 2023 low of 0.6270 (October 26), followed by the round level of 0.6200 and the 2022 low of 0.6169 (October 13).

On the upside, once the pair clears the weekly top of 0.6595 (February 22), it might retest the temporary 55-day SMA at 0.6613, which coincides with the late-January peaks (January 30). A break above this range might lead to the December 2023 peak of 0.6871 (December 28), followed by the July 2023 high of 0.6894 (July 14) and the June 2023 top of 0.6899 (June 16), all before the critical 0.7000 milestone.

It is worth noting that the AUD/USD's negative trend should be decreased once it clears the important 200-day SMA at 0.6559.

According to the 4-hour chart, the door seems to be open to a potential rebound in the very near term. That said, initial hurdle emerges at the 200-SMA at 0.6541 followed by 0.6595 and 0.6611. On the other hand, immediate support comes at 0.6442, seconded by 0.6347 and 0.6338. Furthermore, the MACD strives to recover, while the RSI rises above 52.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.