AUD/USD Forecast: Further losses not ruled out

- AUD/USD gives away part of the recent recovery.

- Dollar dynamics continue to weigh on the Aussie dollar.

- No changes to expectations around an interest rate hold by the RBA.

The noticeable resumption of the selling bias around the Aussie dollar prompted AUS/USD to leave behind a two-day recovery and remain under pressure in the sub-0.6600 zone at the beginning of a new trading week.

So far, dollar dynamics coupled with still-absent signs of a convincing economic bounce in the post-pandemic era in China are expected to keep dictating the mood around spot and maintain its price action subdued, all in combination with a predicted steady hand by the RBA at its gathering in February.

Also contributing to the negative kickstart of the new trading week emerged an equally discouraging session of both copper prices and iron ore.

Back to the RBA, the central bank is largely anticipated to leave its OCR unchanged at 4.35% next month. The downtick in inflation figures recorded in December, coupled with further cooling of the (still tight) labour market, have underpinned that consensus among market participants for the time being.

That said, the near-term prospect for the AUD remains tilted to the dovish side, a view that could gather extra traction in case the Federal Reserve continues to push back bets for an interest rate cut in the next few months.

Moving forward, the domestic calendar only shows preliminary January Manufacturing and Services PMIs due on Tuesday, along with Westpac's Leading Index on Wednesday.

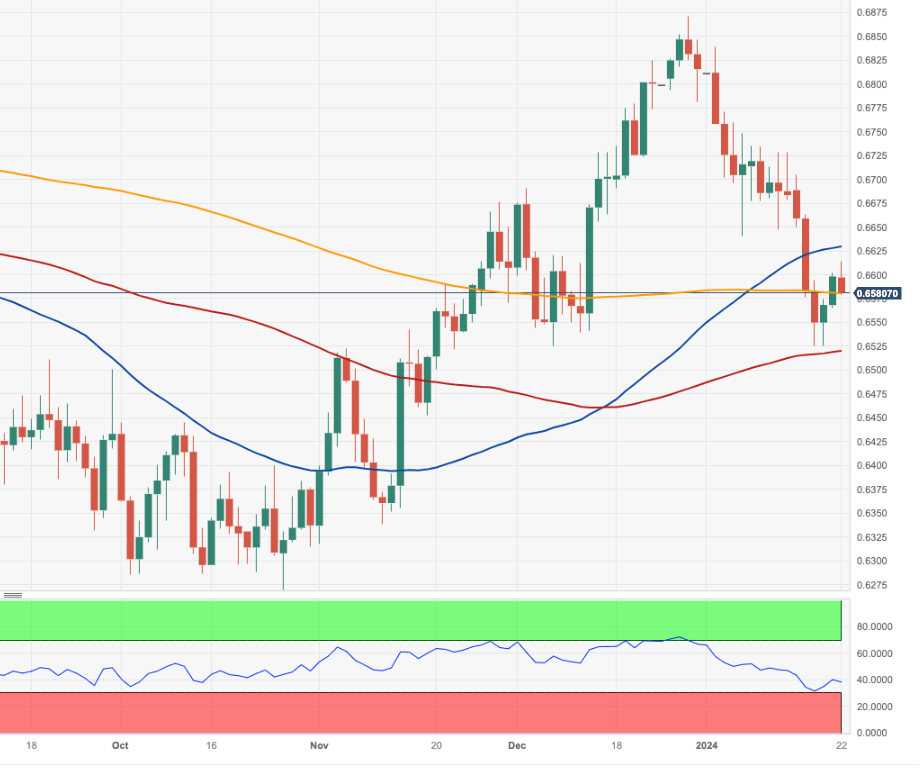

AUD/USD daily chart

AUD/USD short-term technical outlook

Further declines in the AUD/USD could dispute the 2024 low of 0.6524 (January 17), ahead of the interim 100-day SMA at 0.6515. The loss of this region should find the next support not before the 2023 bottom of 0.6270 (October 26). If bulls regain control, there is an initial hurdle at the provisional 55-day SMA at 0.6623 prior to the December 2023 peak of 0.6871 (December 28), which comes before the July 2023 high of 0.6894 (July 14) and the June 2023 op of 0.6899 (June 16), both of which precede the critical 0.7000 threshold.

According to the 4-hour chart, there is a decent contention area around 0.6525. If this zone is breached, there is no significant disagreement until 0.6452. The MACD continues bearish, while the RSI remains around 50. The bullish trend, on the other hand, may face first resistance around the 55-SMA at 0.6631, which aligns ahead of the 200-SMA at 0.66982 and precedes 0.6728.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.