AUD/USD Forecast: Further gains appear likely near term

- AUD/USD revisited the 0.6600 region on Monday.

- Further upward bias looks likely for the time being.

- Australia’s Consumer Confidence is due on Tuesday.

The slight downward pressure on the US Dollar (USD) seems to have been enough to spark a marked rebound in the Aussie dollar, lifting AUD/USD back to the 0.6600 barrier at the beginning of a new trading week.

At the same time, the ongoing surge in copper prices, reaching levels not seen since April 2022 around $815.00, and a minor uptick in iron ore prices, which breached the critical $100.00 mark per tonne, bolstered the upward momentum of the Australian dollar.

Moreover, analysts anticipate that recent encouraging results from Chinese PMIs and the anticipation of potential stimulus measures from the government and the PBoC will keep the positive bias unchanged around the AUD. Consistent improvements in economic indicators are crucial for strengthening the Australian currency and potentially starting a sustained uptrend in AUD/USD.

Regarding the Reserve Bank of Australia (RBA), the release of its March meeting Minutes last week confirmed the central bank's stance on refraining from tightening monetary policy. Unlike the February session, there was no discussion about increasing the cash rate target in March. So far, RBA cash rate futures still suggest an expectation of nearly 50 basis points of policy rate cuts in 2024.

It is worth noting that the RBA is among the last G10 central banks expected to consider interest rate adjustments this year.

Due to the divergence in monetary policy timelines between the RBA and the Fed, the Australian dollar could gain momentum later in the year, potentially leading to further appreciation in AUD/USD. If the pair surpasses the December 2023 peak of 0.6871, it may target the significant level of 0.7000 in the near future.

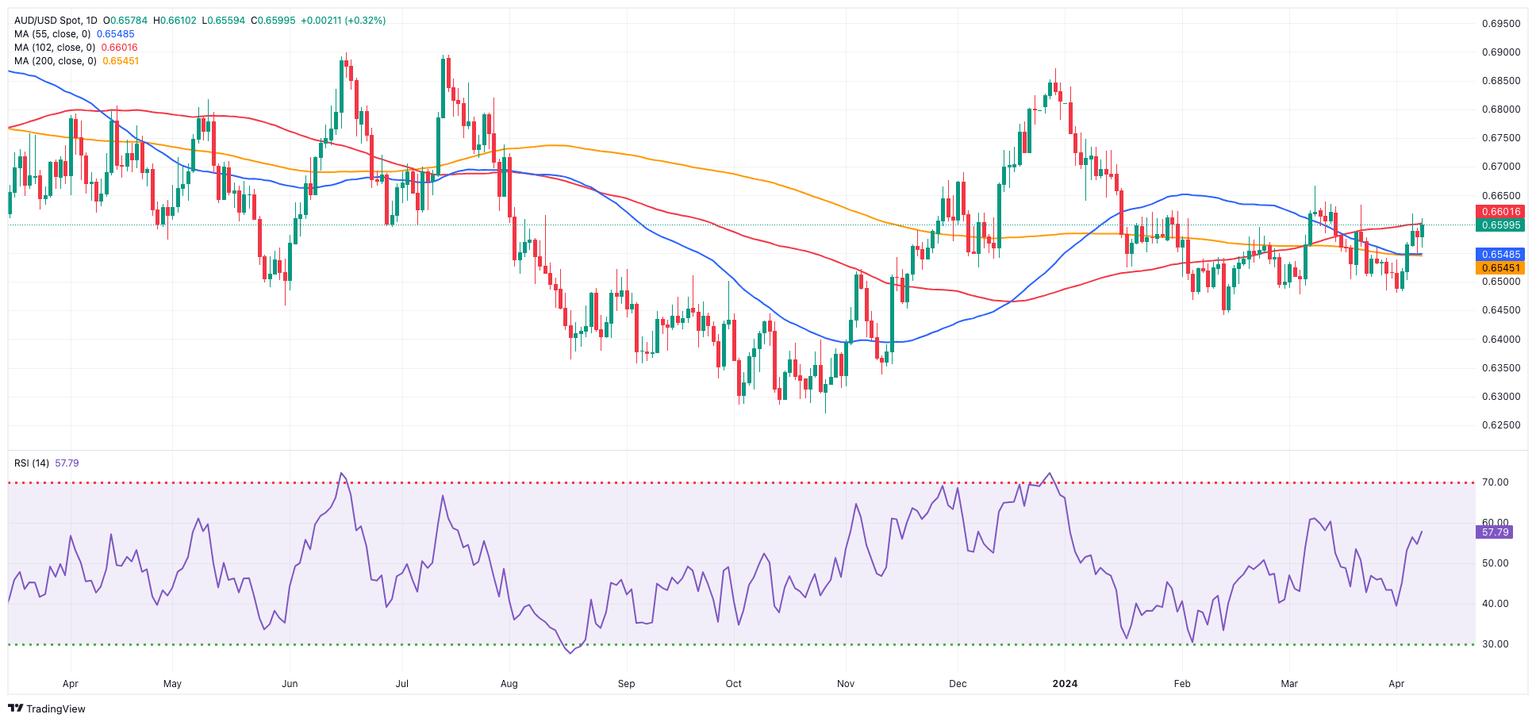

AUD/USD daily chart

AUD/USD short-term technical outlook

AUD/USD is expected to challenge its March high of 0.6667 (March 8) before reaching its December 2023 top of 0.6871 (December 28). Further north, monthly peaks of 0.6894 (July 14) and 0.6899 (June 16) occur prior to the key 0.7000 mark.

If sellers regain control, the pair may fall to its April bottom of 0.6480 (April 1), then the March low of 0.6477 (March 5), and finally the 2024 low of 0.6442 (February 13). Breaking below this level may force a test of 2023's lowest level, 0.6270 (October 26), before the round level of 0.6200.

Looking at the big picture, the pair is expected to continue its bullish trend if it convincingly surpasses the key 200-day SMA at 0.6543.

On the 4-hour chart, the pair's constructive bias appears to be intact for the time being. The initial resistance is at 0.6619 ahead of 0.6634. On the other hand, new losses may cause the pair to retest 0.6480, then 06477, and eventually 0.6442. Furthermore, the MACD remained in the positive zone, and the RSI rose above 60.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.