AUD/USD Forecast: Further decline likely below the 200-day SMA

- AUD/USD clinched new two-month lows near 0.6500.

- The Aussie dollar keeps looking to commodities and China.

- The pair lost nearly 3 cents in the last two weeks.

The AUD/USD continued its significant multi-day decline on Thursday, extending the recent breakdown of the key 200-day SMA (0.6585) and reaching new two-month lows near the 0.6500 level. Furthermore, spot gave away nearly 3 cents since July peaks near 0.6800 the figure (July 11).

The recent pronounced reversal erased its monthly gains due to poor economic prospects from China, declining commodity prices, intermittent US Dollar (USD) strength, and the recent interest rate cut by the People’s Bank of China (PBoC).

On the latter, the PBoC's unexpected rate cuts earlier in the week weakened the Chinese yuan, adversely impacting the Aussie dollar because of Australia's economic ties with China and the AUD's use as a liquid proxy for the yuan.

Additionally, persistent weakness in copper and iron ore prices contributed to the AUD's decline, mirroring a broader downturn in the commodity sector.

Regarding monetary policy, the Reserve Bank of Australia (RBA) maintained a hawkish stance at its latest meeting, keeping the official cash rate at 4.35% and showing flexibility for future decisions. Subsequent meeting Minutes indicated officials considered another rate hike to curb inflation but refrained, partly due to concerns about a potential sharp slowdown in the labour market.

All in all, the RBA is expected to be the last G10 central bank to begin cutting interest rates. Indeed, the central bank is not in a hurry to ease policy, anticipating that it will take time for inflation to consistently fall within the 2-3% target range.

Potential easing by the Federal Reserve (Fed) in the medium term, contrasted with the RBA's likely prolonged restrictive stance, could support AUD/USD in the coming months. However, slow momentum in the Chinese economy might hinder a sustained recovery of the Australian dollar as China continues to face post-pandemic challenges, deflation, and insufficient stimulus for a convincing recovery.

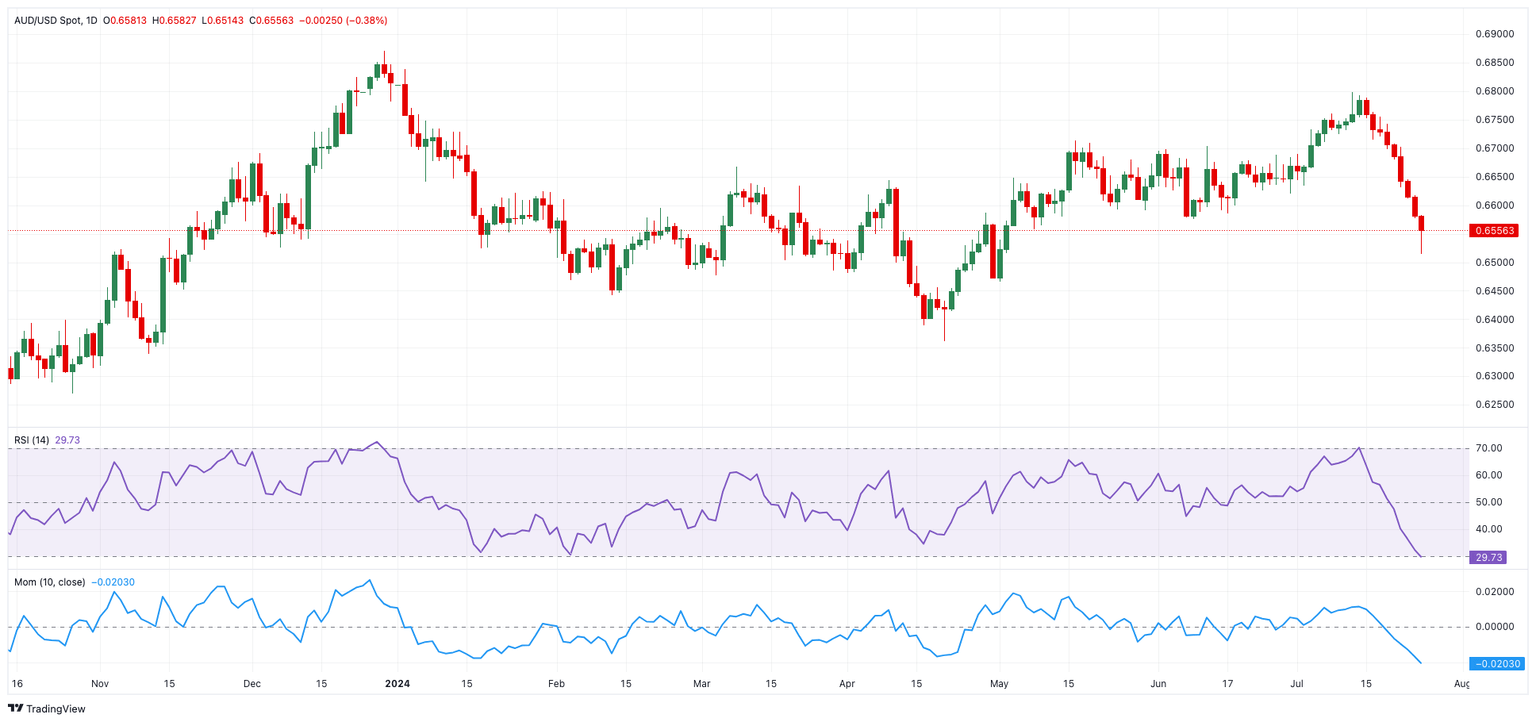

AUD/USD daily chart

AUD/USD short-term technical outlook

Further losses in the AUD/USD may find first support at the July low of 0.6513 (July 25). From here, the May low of 0.6465 comes next prior to the 2024 bottom of 0.6362 (April 19).

Occasional bullish surges, on the other hand, could face early resistance at the key 200-day SMA of 0.6585, seconded by the temporary 100-day and 55-day SMAs at 0.6606 and 0.6662, respectively, before the July top of 0.6798 (July 8) and the December peak of 0.6871.

Overall, the outlook for AUD/USD should shift to bearish while below the 200-day SMA.

The four-hour figure shows a considerable increase in the negative bias. Against this, immediate support emerges at 0.6513, ahead of 0.6465. On the plus side, the initial obstacle is 0.6610 ahead of the 200-SMA of 0.6675, and 0.6754. The RSI rebounded to around 29.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.