AUD/USD Forecast: Further consolidation not ruled out

- AUD/USD faded part of Wednesday’s strong advance.

- The Greenback regained its smile as investors assessed the FOMC event.

- The Australian labour market report came in on the strong side.

The renewed upside bias in the US Dollar (USD) kept the price action around the Australian dollar subdued on Thursday, prompting AUD/USD to give away part of the important gains recorded in the previous session.

The uptick in the Greenback came despite lower US yields and followed investors’ evaluation of the Fed’s hawkish hold and the likelihood that only one interest rate will be cut by the central bank this year, most likely in December.

Adding to the sour sentiment around AUD, copper prices resumed their downward bias, while iron ore prices slipped back to multi-week lows near the $105.00 region per tonne.

Regarding monetary policy, the Reserve Bank of Australia (RBA), like the Fed, remains one of the last major central banks to adjust its stance. Recent RBA Minutes indicated that officials were considering possible interest rate hikes if inflation rose.

Currently, money markets are predicting about 25 bps of easing by May 2025, with potential rate hikes still possible in August. Supporting this outlook, the RBA's Monthly CPI Indicator (Weighted Mean CPI) increased more than expected in April, rising to 3.6% from 3.5%.

Given the prospects of the Fed easing its monetary policy later in the year vs. the likelihood that the RBA will maintain its restrictive stance for an extended period, AUD/USD could see potential gains in the short term.

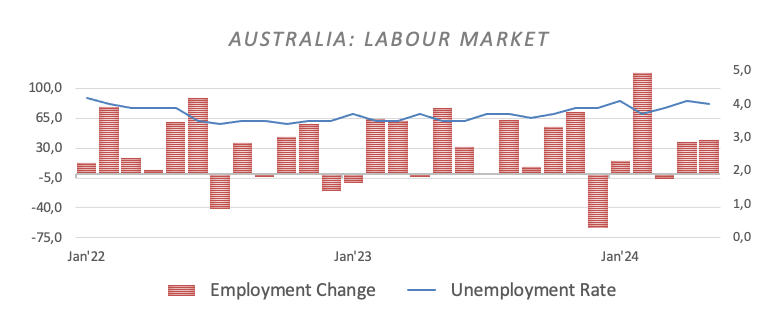

On the domestic docket, the Australian labour market remained well and sound after the Unemployment Rate ticked lower to 4.0% and the Employment Change increased by 39.7K individuals in May.

AUD/USD daily chart

AUD/USD short-term technical outlook

The resumption of the upward bias may cause spot to revisit its May peak of 0.6714 (May 16), followed by the December 2023 high of 0.6871 and the July 2023 top of 0.6894 (July 14), all before the critical 0.7000 barrier.

Occasional bearish efforts, on another front, might push AUD/USD to test the key 200-day SMA of 0.6541, ahead of the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Overall, the constructive outlook is expected to remain unchanged while above the 200-day SMA.

The 4-hour chart now shows an acceleration of the selling pressure. On that, the next support comes at the 200-SMA of 0.6622 seconded by 0.6574 and 0.6558. On the other hand, there is immediate up-barrier at 0.6714 prior to 0.6728 and then 0.6759. The RSI tumbled to around 48.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.