AUD/USD Forecast: Further consolidation is not ruled out

- AUD/USD reversed part of the recent weakness.

- The weaker US Dollar provided some relief to the pair.

- RBA’s Hunter said wage growth is around its peak.

The renewed selling pressure on the US Dollar (USD) led to additional gains in AUD/USD, motivating it to two consecutive sessions of losses on Thursday.

The fresh offered stance on the Greenback came amidst investors' assessments of the potential for the Federal Reserve (Fed) to begin its easing programme later this year, possibly in the fourth quarter.

This outlook has been reinforced by cautious comments from several Fed officials, who emphasized the need for more evidence of inflation moving towards the Fed's target before considering rate cuts.

Daily gains in the Australian dollar, however, contrasted with the daily decline in copper prices and some consolidation around iron ore prices.

Regarding monetary policy, the recent Minutes of the Reserve Bank of Australia (RBA) highlighted discussions on interest rate hikes. The RBA might be among the last major central banks, along with the Fed, to adjust its monetary policy, with money markets expecting the first rate cut by the RBA in April 2025.

Supporting this, the RBA’s Monthly CPI Indicator (also known as the Weighted Mean CPI) rose more than expected by 3.6% in April, up from 3.5%.

Still around the RBA, Chief Economist Sarah Hunter reported early on Thursday that the CPI confirmed strength in certain price sectors. She also noted that the RBA Board is clearly focused on ensuring inflation remains outside of the band, indicating a strength in inflation. Additionally, she mentioned that wage growth is currently at its peak.

Given the Fed's commitment to monetary policy tightening and the likelihood of the RBA maintaining its restrictive stance for an extended period, further consolidation in AUD/USD is expected in the coming months.

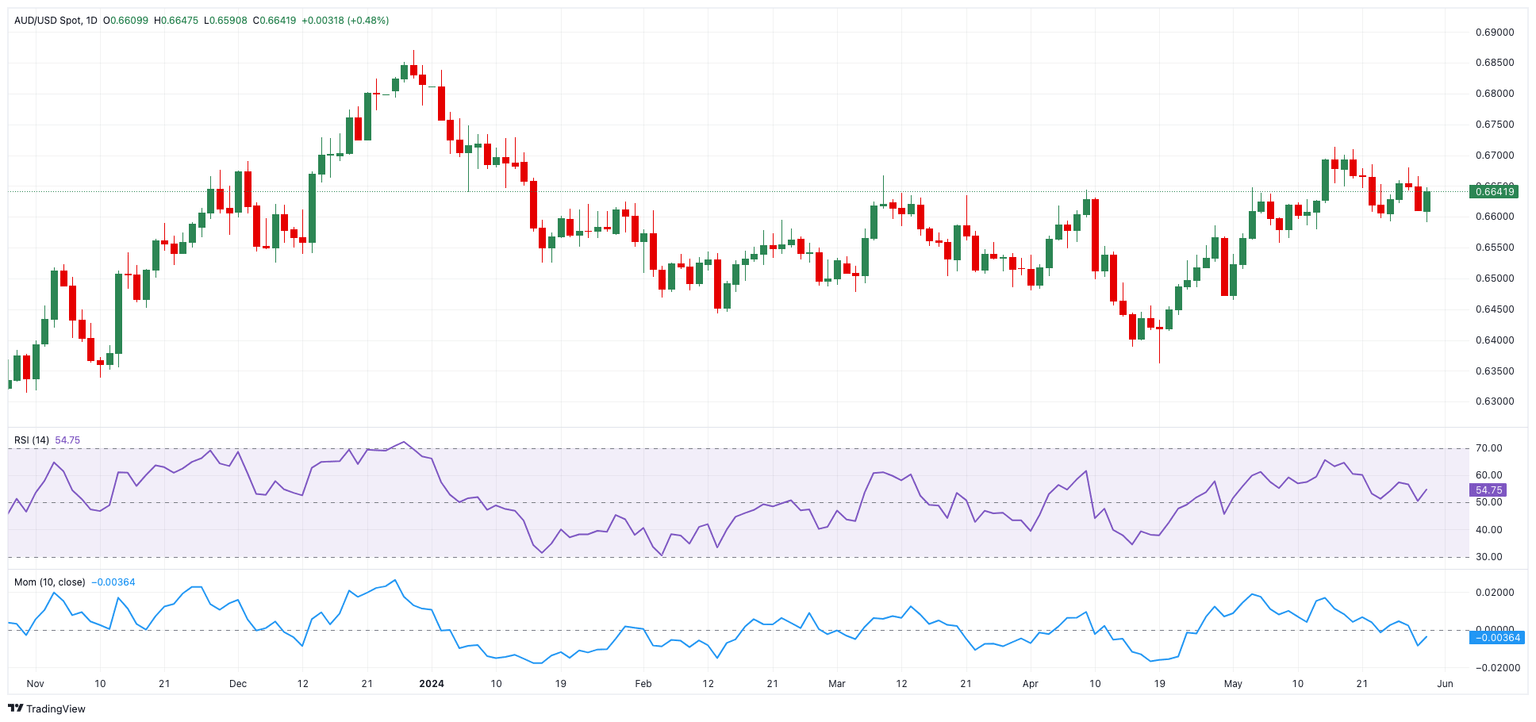

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra gains may push the AUD/USD to challenge the May high of 0.6714 (May 16), before aiming for the December 2023 top of 0.6871 and the July 2023 peak of 0.6894 (July 14), all ahead of the key 0.7000 yardstick.

Meanwhile, bearish attempts can initially drive the pair to the intermediate 100-day and 55-day SMAs in the 0.6560 zone, closely followed by the key 200-day SMA at 0.6531. The loss of the latter might lead to a return to the May low of 0.6465 and the 2024 low of 0.6362 (April 19).

Overall, extra gains are likely as long as the price remains above the 200-day SMA.

Some bullish mood emerged on the four-hour chart. Nonetheless, 0.6685 is the first up-barrier, followed by 0.6709 and 0.6714, respectively. On the other hand, 0.6590 offers immediate support before the 200-SMA at 0.6570. The RSI rose past 53.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.