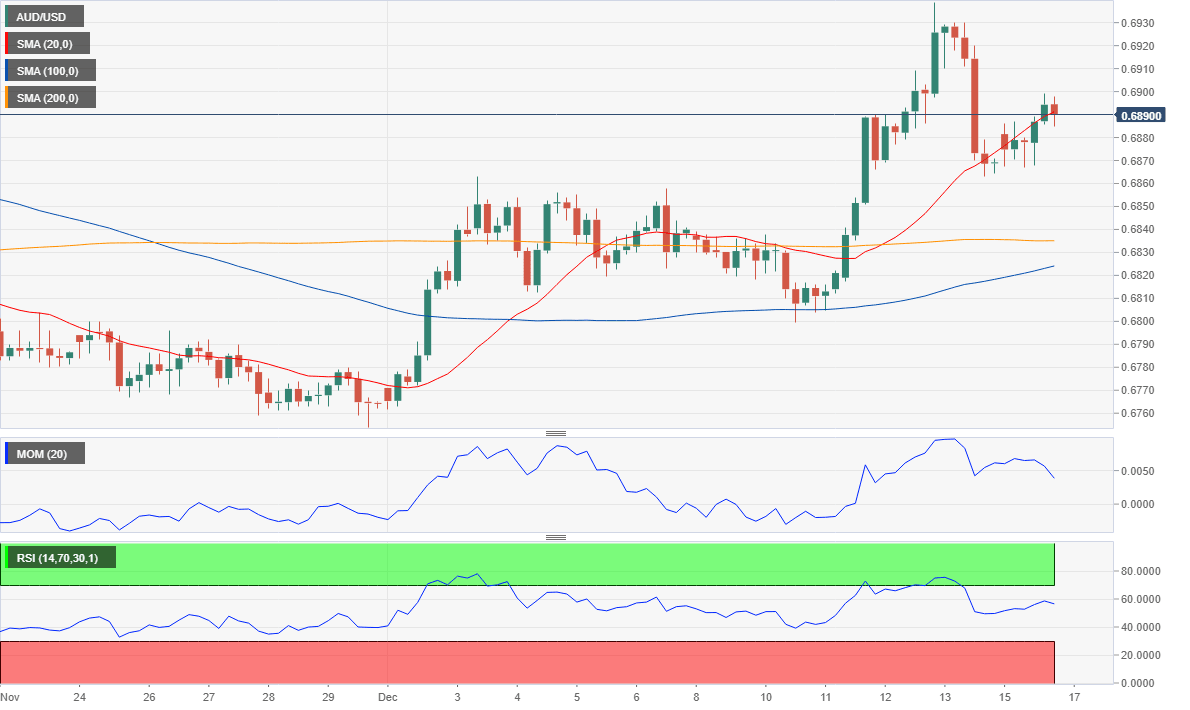

AUD/USD Forecast: Declines limited as long as above 0.6865

AUD/USD Current Price: 0.6890

- Chinese encouraging data and a deal with the US keeping Aussie underpinned.

- AUD/USD needs to extend gains beyond 0.6930/40 to turn bullish.

The AUD/USD pair has recovered some ground at the beginning of the week but has been unable to recover the 0.6900 threshold, despite encouraging developments in the US-China trade front and prevalent risk-appetite. Australia released the December preliminary Commonwealth Bank Services PMI, which printed at 49.5, better than the 49.1 expected although below the previous one. The Manufacturing PMI, however, missed the market’s expectations as it contracted to 49.4. China released encouraging numbers, as, in November, Industrial Production rose by 6.2% while Retail Sales increased by 8%, both beating the market’s expectations.

Australia will release October Home Loans during the upcoming Asian session, foreseen up by 1.0% following a 1.4% advance in September. The RBA will release the Minutes of its latest meeting.

AUD/USD short-term technical outlook

The AUD/USD pair is neutral-to-bullish in the short-term, as, in the 4-hour chart, it held above the 0.6865 support level. In the 4-hour chart, the pair has spent the day struggling to hold above a bullish 20 SMA, which continues advancing above the larger ones. Technical indicators, however, have lost their directional strength, heading nowhere around their midlines. Chances of a bullish extension will increase on a clear advance beyond the 0.6930/40 price zone, where the pair has multiple relevant highs.

Support levels: 0.6865 0.6830 0.6800

Resistance levels: 0.6900 0.6935 0.6970

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.