- AUD/USD little hopes of soon-to-come definitions.

- Chinese key growth figures to be out this upcoming week.

It was a tough week for the Aussie, as hopes for a recovery were smashed by China. The pair aims to end the week as it started it, holding a few pips above the 0.7100 level. Technically, the AUD/USD pair posted a higher high and a higher low when compared to the previous one, which means not all is lost for bulls, but the macroeconomic picture is quite bearish, the main reason why it can't catch directional strength, and holds near its monthly lows. The pair peaked at 0.7206 on the back of an impressive Australian employment report, which showed that the country added 39.1K new jobs in January, largely surpassing the 15.0K expected, while the unemployment rate remained steady at 5%, despite the participation rate rose to 65.7%. Furthermore, the report showed that a whopping 65.4K new full-time positions were created, while part-time employment decreased by 26.3K.

The rally would have continued, as there's no reason to turn long in the greenback, if it weren't by a Chinese announcement that hit the core of the Australian economy: customs at Dalian, one of China's biggest ports has banned imports of Australian coal, and will cap overall coal imports from all sources for this year at 12M tonnes. Despite the ban will only affect a relatively small portion of coal exports, it was enough to take the AUD down, particularly after the latest RBA shift towards a more neutral view on rates.

Fears of a Chinese economic downturn are still high, although there were some shy positive signs. These days we knew that Chinese New Loans surged in January to their highest on record, with credit expansion indicating that BOC measures to stimulate the economy are starting to work. Is a very tiny sign, but sign anyway, that the bottom could be close.

Meanwhile, talks between China and the US continue. Representatives from both countries agreed that progress had been made, with hopes that an agreement in principle will be reached soon.

Next week calendar has little to offer, as the only relevant figure scheduled in Australia is the AIG Performance of Manufacturing Index for February, while China will release the official manufacturing and non-manufacturing PMI for February, and the Caixin Manufacturing Index for the same month.

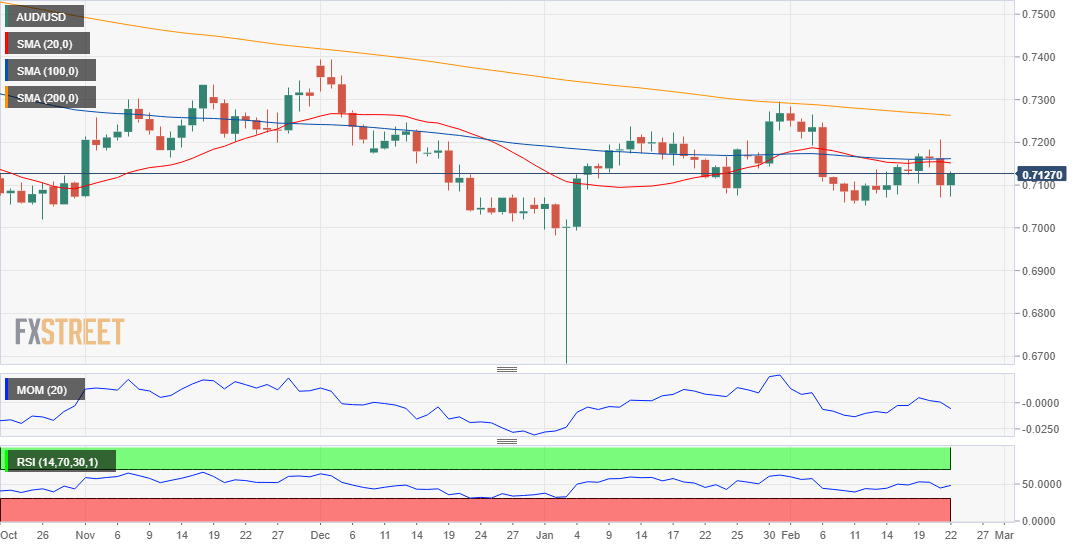

AUD/USD Technical Outlook

The AUD/USD pair maintains its bearish stance in the weekly chart, as its settling below a flat 20 SMA following an attempt to run beyond it, while the Momentum indicator maintains its bearish slope within negative levels, reaching fresh yearly lows. The RSI in the mentioned chart heads nowhere, hovering around 45 also keeping the risk skewed to the downside.

In the daily chart, the 20 and 100 SMA converge around 0.7160, with the pair unable to settle above it, and technical indicators bouncing modestly but holding within negative levels, leaving a neutral-to-bearish stance.

The pair bottomed for the week at 0.7069, confirming the relevance of the 0.7070 support area. Once below it, a decline toward 0.7000 is likely, while below it, the next probable bearish target comes at 0.6920. To the upside, 0.7200 and 0.7250 are the main resistances and again, seems unlikely the pair could go beyond the latest in the upcoming days.

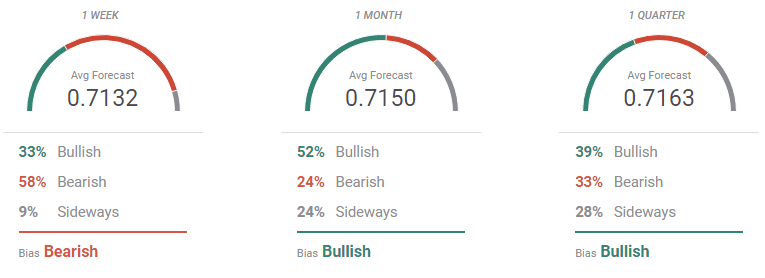

AUD/USD sentiment poll

The FXStreet Forecast Poll shows that the AUD/USD pair will remain around the current levels next week, despite market's intentions are on the selling side. Bulls are a bit more convinced in the 1-month perspective, while things turn even in the quarterly view, reflecting the lack of directional conviction around the pair these days.

The overview chart shows that, while in the monthly view the larger accumulation of targets is above the current level, but below it the 3-month view, when the pair is seen closer to the 0.7000 figure.

Related content:

USD/JPY Forecast: Awaiting Powell's power-play to get out of range

USD/CAD Forecast: Can CAD continue higher? CPI and GDP stand out

Bitcoin Price Top Forecast: waiting for another magic trigger

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Next stop emerges at 0.6580

The downward bias around AUD/USD remained unabated for yet another day, motivating spot to flirt with the area of four-week lows well south of the key 0.6700 region.

EUR/USD looks cautious near 1.0900 ahead of key data

The humble advance in EUR/USD was enough to partially leave behind two consecutive sessions of marked losses, although a convincing surpass of the 1.0900 barrier was still elusive.

Gold extends slide below $2,400

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

SEC gives final approval for Ethereum ETFs to begin trading

The Securities and Exchange Commission approved the S-1 registration statements of spot Ethereum ETF issuers on Monday, making it the second digital asset ETF to go live in the US, according to the latest filings on its website.

Commodity FX gets no help from higher US equities

Markets were all over the place on Monday. US equities put in a decent recovery, though this did nothing to help beaten down commodity FX, with the Australian Dollar, New Zealand Dollar and Canadian Dollar all getting hammered.