AUD/USD Forecast: Bulls need to conquer the 0.6715 level

AUD/USD Current Price: 0.6674

- Record highs in Gold and Copper propelled the Aussie during Asian trading hours.

- The Reserve Bank of Australia will release the May meeting Minutes on Tuesday.

- AUD/USD turned neutral in the near term, could accelerate south once below 0.6660.

The Australian Dollar (AUD) advanced against the US Dollar at the beginning of the day, underpinned, underpinned by soaring metal prices. Gold and Copper reached record highs in the Asian session, propelling AUD/USD. Easing metals triggered a corrective decline in the pair towards 0.6660, the intraday low posted ahead during European trading hours. It is worth adding most local markets were closed amid the celebration of Whit Monday, leaving metals as the main market driver.

Wall Street opened in the green, helping the pair recover some ground, although the absence of macroeconomic data kept the FX board quiet. In fact, the calendar had little to offer this week without any relevant American data. On the contrary, Federal Reserve (Fed) speakers seem to have much to say. Multiple Fed officials have hit the wires throughout the last few days, and many more are scheduled to do it in the upcoming sessions. However, most of them repeat well-known messages, are cautious about the inflation outlook overall, and tilt towards the hawkish side, that is, maintaining interest rates higher for as long as needed.

Australia did not release relevant figures, but will unveil May Westpac Consumer Confidence early on Tuesday. Additionally, the Reserve Bank of Australia (RBA) will publish the meeting minutes held earlier in May. The Board then decided to hold the official Cash Rate (OCR) at a 12-year high of 4.35%. At the same time, policymakers refrained from reinstating the tightening bias they dropped in the previous meeting. The Minutes could shed some light on what the Board has on the docket for the upcoming months.

AUD/USD short-term technical outlook

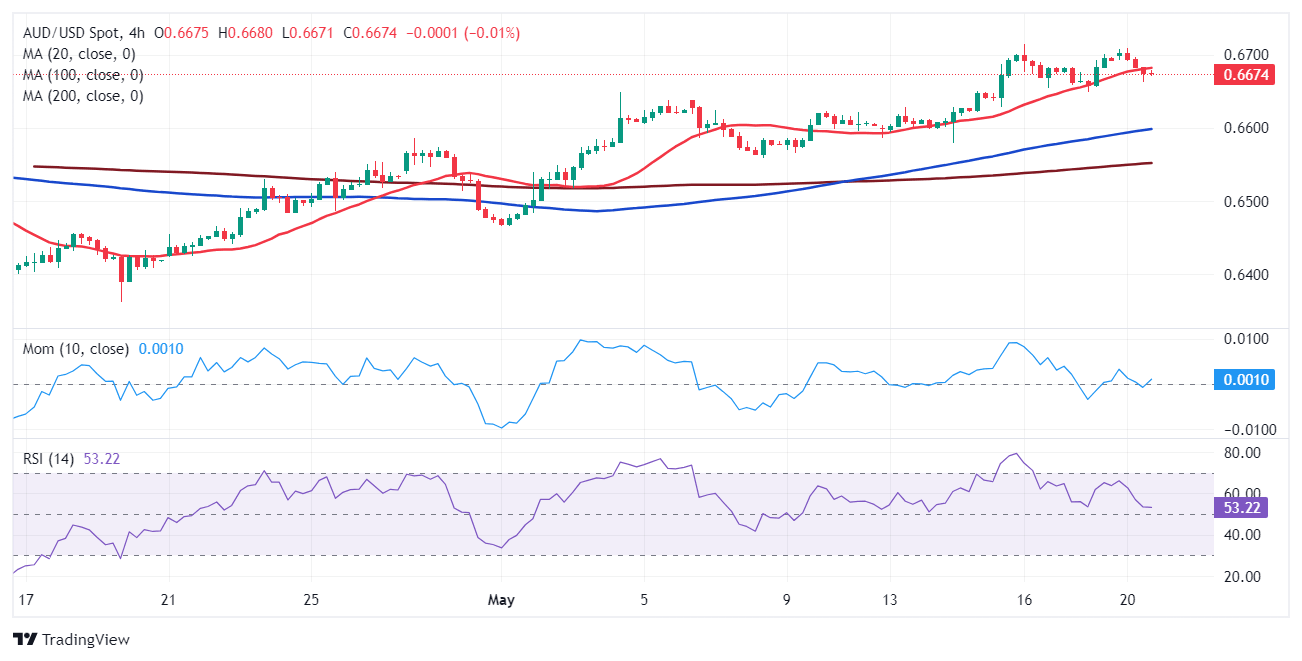

From a technical point of view, AUD/USD retains the bullish bias despite posting modest intraday losses. The pair has posted a higher high and a higher low while it keeps developing far above all its moving averages. Furthermore, the 20 Simple Moving Average (SMA) heads firmly north after crossing above directionless 100 and 200 SMAs. At the same time, the Momentum indicator advances within positive levels, while the Relative Strength Index (RSI) indicator consolidates near overbought readings. The pair traded as high as 0.6713 last week, its highest since mid-January and the level to surpass to confirm another leg north.

In the near term, and according to the 4-hour chart, AUD/USD turned neutral. The pair is below a mildly bullish 20 SMA, while the longer ones maintain their upward slopes far below the current level. At the same time, technical indicators head nowhere around their midlines, reflecting the absence of directional interest. A steeper decline seems likely if the pair accelerates south through 0.6660, a near-term static support area.

Support levels: 0.6660 0.6620 0.6590

Resistance levels: 0.6715 0.6770 0.6810

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.