AUD/USD Forecast: Bears on pause, but still in control

AUD/USD Current Price: 0.7183

- Chinese September PMIs will likely set the tone for the Asian session.

- Weaker gold prices undermined demand for the Australian currency.

- AUD/USD is bearish, trading at fresh one-month lows below the 0.7200 level.

The AUD/USD pair bounced just modestly from an intraday low of 0.7172, trading at levels last seen in August. Demand for the greenback was fueled by speculation the US Federal Reserve will soon start trimming its massive stimulus programs. That coupled with a dismal sentiment triggered by concerns related to global growth, as supply chain disruptions keep delaying economic progress while pushing prices higher.

Plummeting gold prices added pressure on the aussie, alongside a scarce Asian macroeconomic calendar. Australia will release August Building Permits and Private Credit for August, while China will publish the official September PMIs, which will likely set the tone for the session. The Manufacturing PMI is foreseen unchanged at 50.1 while the Non-Manufacturing PMI is expected to have recovered from 47.5 to 52.7.

AUD/USD short-term technical outlook

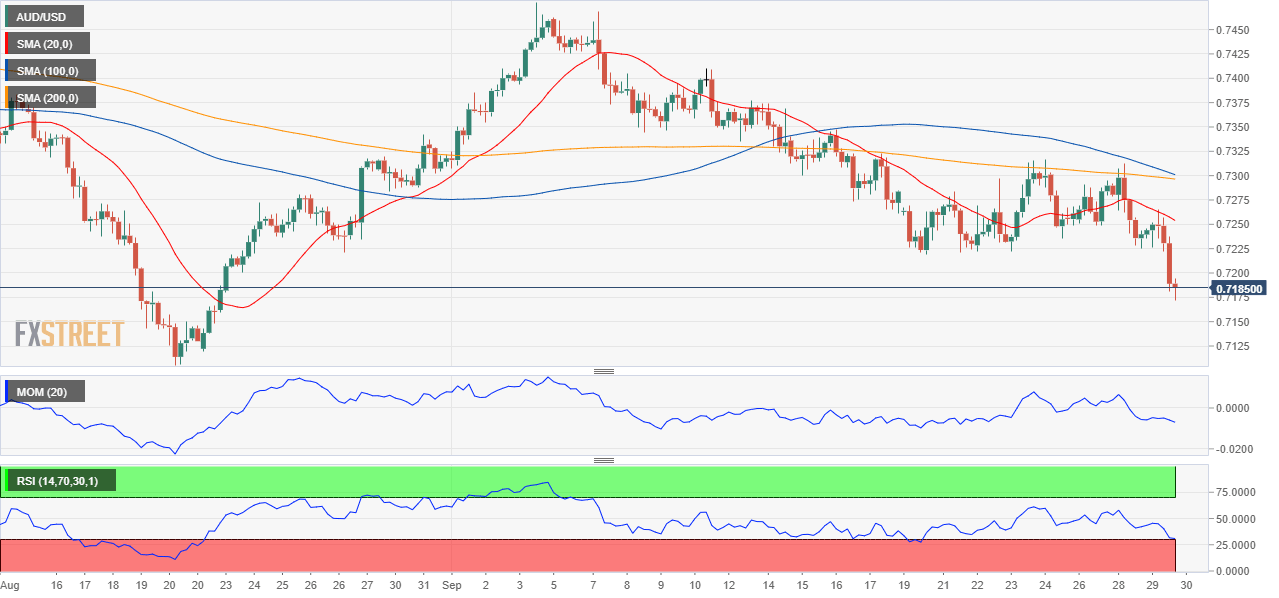

The AUD/USD pair remains below the 0.7200 threshold, and at risk of falling further. The daily chart shows that technical indicators head firmly lower at fresh monthly lows, as the pair develops well below all of its moving average.

In the 4-hour chart, technical indicators consolidate at daily lows and within negative levels, reflecting the latest modest bounce rather than suggesting easing selling interest. The 20 SMA accelerated its decline, currently converging with a critical Fibonacci resistance level at around 0.7250. The pair would lose its bearish stance if it manages to recover above the latter.

Support levels: 0.7175 0.7130 0.7090

Resistance levels: 0.7210 0.7250 0.7290

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.