AUD/USD Forecast: Australian inflation next in the docket

AUD/USD Current Price: 0.6878

- The RBA left rates unchanged, as expected, Australian inflation coming up next.

- Disappointing United States data fueled speculation of another Fed’s 50 bps rate cut.

- AUD/USD maintains the positive tone near a fresh 2024 high of 0.6883.

The AUD/USD pair reached 0.6868 during Asian trading hours, following the Reserve Bank of Australia (RBA) monetary policy decision, later surpassing the level in the American session to reach a fresh 2024 high of 0.6883.

As widely anticipated, board members kept the Official Cash Rate (OCR) unchanged at 4.35%, a level set in November 2023. RBA Governor Michele Bullock then delivered a press conference, repeating her well-known hawkish message. Bullocks affirmed rates will remain on hold for the time being, adding the Board does not see rate cuts in the near term, as recent data has not “materially affected” the policy outlook. The hawkish bias was no surprise to investors, and despite the overall optimism, the pair quickly retreated.

Meanwhile, The People’s Bank of China (PBoC) announced a series of measures to support the economy. On the one hand, the PBoC announced it will cut the Reserve Requirement Ratio (RRR) by 50 basis points (bps) in the near term, also that they would cut the seven-day repo rate by 0.2%, without giving much more detail on the date. Additionally, the central bank outlined plans to support the property market, which include cutting the interest rates on mortgages.

AUD/USD turned back north following tepid United States (US) data that fueled speculation the Federal Reserve (Fed) could deliver another 50 basis points (bps) rate cut when it meets in November. Early on Wednesday, Australia will publish the August Monthly Consumer Price Index, foreseen at 2.8% following the 3.5% posted in July.

AUD/USD short-term technical outlook

The daily chart for AUD/USD shows a strong upward momentum, supportive of higher highs. Technical indicators have partially lost their bullish strength but keep heading higher near overwrought readings. At the same time, the pair has advanced far above bullish moving averages, with the 20 Simple Moving Average (SMA) over 100 pips below the current level and far above the longer ones.

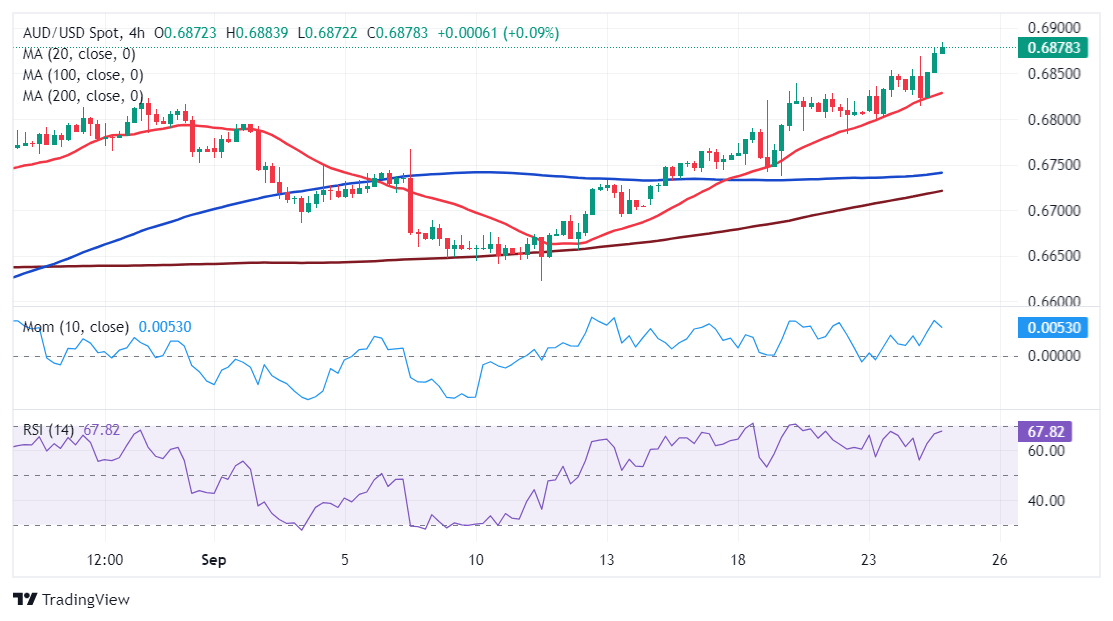

In the near term, and according to the 4-hour chart, the risk skews to the upside, albeit the momentum eased. Technical indicators retreated modestly from near overbought readings, heading marginally lower, not enough to anticipate another leg south. At the same time, a bullish 20 SMA keeps attracting intraday buyers, now providing dynamic support at around 0.6830.

Support levels: 0.6830 0.6775 0.6730

Resistance levels: 0.6910 0.6945 0.6980

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.