AUD/USD Forecast: Aussie’s comeback hints at more gains

AUD/USD Current Price: 0.6511

- Stocks are battling to maintain the optimism amid uncertainty about the Federal Reserve's path.

- Australian August Trade Balance could be a bullish catalyst for the aussie.

- AUD/USD could resume its advance after falling to an intraday low of 0.6419.

The AUD/USD pair gapped lower at the opening, finishing a second consecutive day little changed around 0.6510. The pair fell at the beginning of the day on the back of renewed greenback demand despite positive Australian data. The September S&P Global Services PMI was upwardly revised to 50.6 from a preliminary estimate of 50.4, while the Composite PMI was up to 50.9 from 50.8.

Nevertheless, stocks pulled back after rallying in the previous days, while US government bond yields resumed their advances, underpinning demand for the American currency. Renewed tensions between Russia and Europe and mounting concerns about the US Federal Reserve hiking policy. Despite the latest US figures being generally encouraging, market players are concerned inflation will not recede, and hence, the central bank could extend its aggressive monetary policy, which may end up triggering a recession.

The Australian currency may get a boost from local data on Tuesday, as the country will release the August Trade Balance expected to post a surplus of $A10.5 billion. The government will publish the September AIG Performance of Construction Index at 47.9.

AUD/USD short-term technical outlook

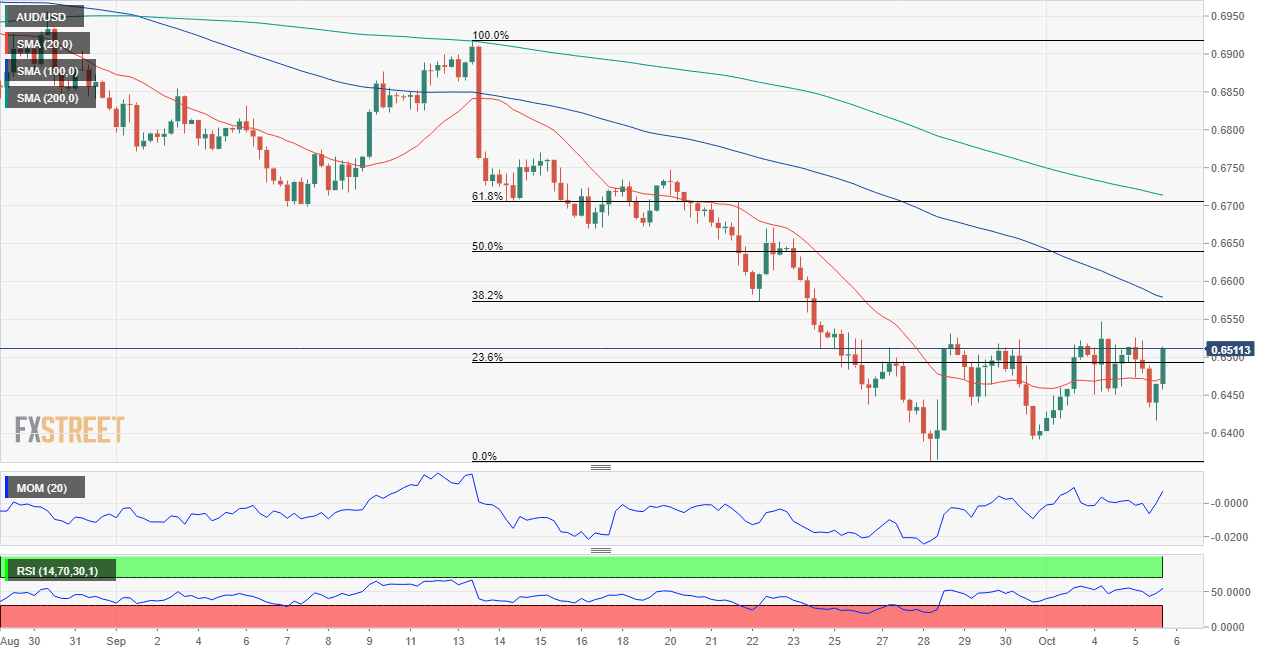

According to the daily chart, the AUD/USD pair keeps trading around the 23.6% retracement of its latest daily slide at 0.6490, with a bearish bias. In addition, the pair keeps developing below a firmly bearish 20 SMA, while technical indicators remain directionless below their midlines. Meanwhile, the longer moving averages maintain their firmly bearish slopes far above the current level, hinting at general selling interest.

However, there are increased chances of a bullish extension in the near term. In the 4-hour chart, technical indicators have bounced from around their midlines, maintaining modest upward slopes. At the same time, the pair has managed to recover above a still directionless 20 SMA. The 38.2% retracement of the aforementioned daily decline comes at 0.6570, the level to break to confirm a sustained rally.

Support levels: 0.6435 0.6400 0.6360

Resistance levels: 0.6535 0.6570 0.6610

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.