AUD/USD Forecast: Aussie under pressure, RBNZ could introduce some noise

AUD/USD Current Price: 0.6664

- The RBA Meeting Minutes had a limited impact on the Aussie amid retaining the hawkish tilt.

- The Reserve Bank of New Zealand will announce its monetary policy decision on Wednesday.

- AUD/USD pressures the lower end of its weekly range, bearish momentum absent.

The AUD/USD pair trades in the 0.6660 price zone ahead of the Asian opening, little changed from its daily opening. The pair eased early on Tuesday, weighed down by the poor performance of global indexes while barely affected by local news.

Australia published May Westpac Consumer Confidence, which improved to -0.3% from -2.4% in April. Additionally, the Reserve Bank of Australia (RBA) released the Minutes of its May monetary policy meeting, which maintained the overall hawkish stance adopted in the previous meeting. Policymakers considered raising interest rates but decided keeping the Official Cash Rate (OCR) was the better choice. Furthermore, the Broad agreed it's difficult to either rule in or rule out future changes in the cash rate, while risks around the forecasts were judged to be “balanced.” Finally, the document showed policymakers will try to avoid “excessive fine tunning” by looking at a near-term variation in inflation.

Australia will not release relevant macroeconomic data on Wednesday, although news from neighbouring New Zealand may affect the Aussie. The Reserve Bank of New Zealand is set to announce its decision on monetary policy after leaving the OCR unchanged at 5.50% for five consecutive meetings.

AUD/USD short-term technical outlook

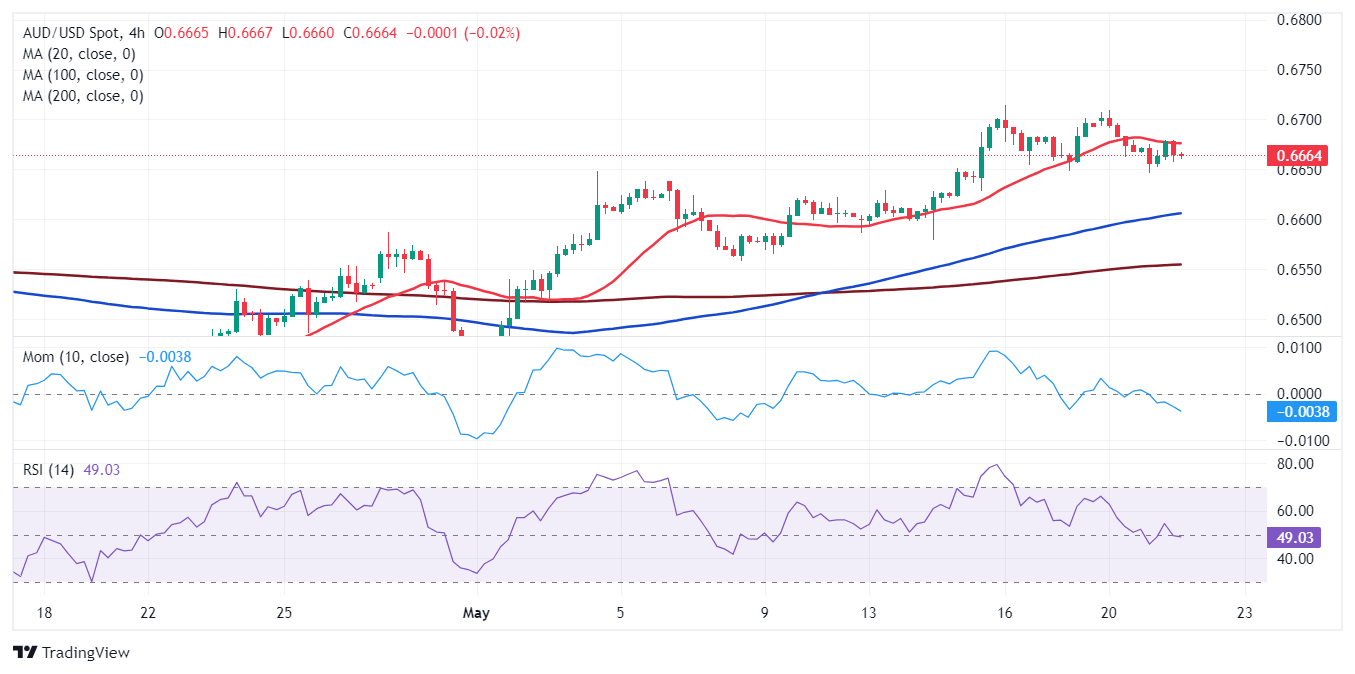

The AUD/USD pair bottomed at 0.6645, now an immediate support level. The daily chart shows the bearish potential remains limited, although the pair keeps losing upward momentum. AUD/USD keeps developing above all its moving averages, with the 20 Simple Moving Average (SMA) heading north above directionless 100 and 200 SMAs. In the meantime, technical indicators turned marginally lower within positive levels, lacking strength enough to confirm an upcoming leg lower.

The AUD/USD pair is neutral-to-bearish in the near term. The 4-hour chart shows a mildly bearish 20 SMA contains advances at around 0.6680, while the longer moving averages maintain their bullish slopes far below the current level. Finally, technical indicators seesaw around their midlines without clear directional strength.

Support levels: 0.6645 0.6600 0.6570

Resistance levels: 0.6680 0.6715 0.6770

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.