AUD/USD Forecast: Aussie retreats alongside equities

AUD/USD Current Price: 0.6067

- Australian and Chinese March manufacturing output beat the market’s expectations.

- US stocks back under pressure amid coronavirus crisis deepening.

- AUD/USD bottomed at 0.6038, at risk of losing the 0.6000 level.

The Australian dollar gave up against the greenback this Wednesday, with the AUD/USD pair losing the 0.6100 threshold. The pair was hardly affected by macroeconomic data released during the Asian session, despite better than anticipated. The Australian AIG Performance of Manufacturing Index jumped to 53.9 from 44.3, while the Commonwealth Bank Manufacturing PMI for the same month printed 49.8 from 50.1 in February. Also, China released the Caixin Manufacturing PMI, which jumped to 50.1 from 40.3, well above the expected 46.

Commodity-linked currencies surged at the beginning of the American session, but gains were short-lived, amid prevalent demand for the American currency, and the sour tone of Wall Street, as the three major indexes closed in the red. There are no data scheduled in Australia and China this Thursday.

AUD/USD short-term technical outlook

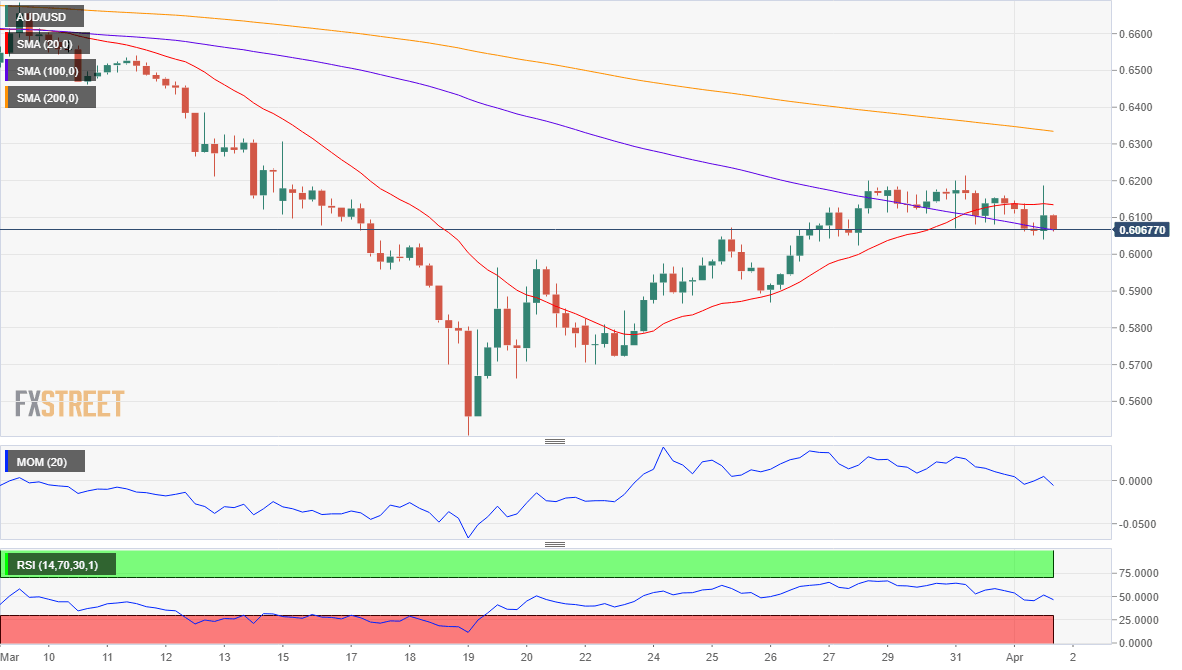

The AUD/USD pair is trading near a daily low of 0.6038, neutral-to-bearish in the short-term. The 4-hour chart shows that it has been unable to advance beyond its 20 SMA, which is now flat, as the pair struggles around a mild-bearish 100 SMA. Technical indicators in the mentioned time-frame lack directional strength, but stand within negative levels, skewing the risk to the downside.

Support levels: 0.6035 0.6000 0.5960

Resistance levels: 0.6110 0.6150 0.6190

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.