- Solid employment data partially offset by trade war uncertainty

- AUD/USD bullish sentiment sees a challenge of critical 0.7250 region coming.

The Australian dollar posted a nice come back this week but would it last? which are the reasons behind the recovery from yearly lows? The market turned against the greenback, that's it. Partially, because the greenback´s rally was quite overstretched, and speculative interest was looking for a reason to take some profits out. Headlines indicating that US officers were proposing a new round of trade talks with China before taking the decision of implementing additional tariffs on imports from the country, provided such reason. The American currency came under strong selling pressure late Wednesday, while Australian employment data, released early Thursday, further underpinned the pair.

According to the official release, Australia added 44,000 new jobs in August, largely beating the market's forecast of 15,000. 33,700 of those were in full-time positions. The unemployment rate remained steady at 5.3%, despite the participation rate rose by more-than-expected, up to 65.7%. More relevant, the underutilization rate fell to 13.4%, the lowest level in over five years, this last an encouraging sign of future wage growth. On balance, employment indicators continue to signal further improvement ahead, finally some encouraging news coming from the sector.

Risk appetite triggered by the mentioned news suggesting easing trade tension prevailed through Thursday, although US President Trump cooled it down, tweeting "we are under no pressure to make a deal with China, they are under pressure to make a deal with us. Our markets are surging, theirs are collapsing. We will soon be taking in Billions in Tariffs & making products at home. If we meet, we meet?". The good mood deteriorated further Friday on a report indicating that the UK Labour Party is set to vote against the Brexit deal. Not a surprise, but surely, another bump in the road.

Chinese data released early Friday, with Retail Sales and Industrial Production beating market's expectations, kept the AUD/USD pair afloat and around 0.7200.

The upcoming week the RBA will release the minutes of its latest meeting and Westpac will release August Leading Index, with nothing else of relevance coming from the data front, leaving the pair in the hands of trade war's headlines.

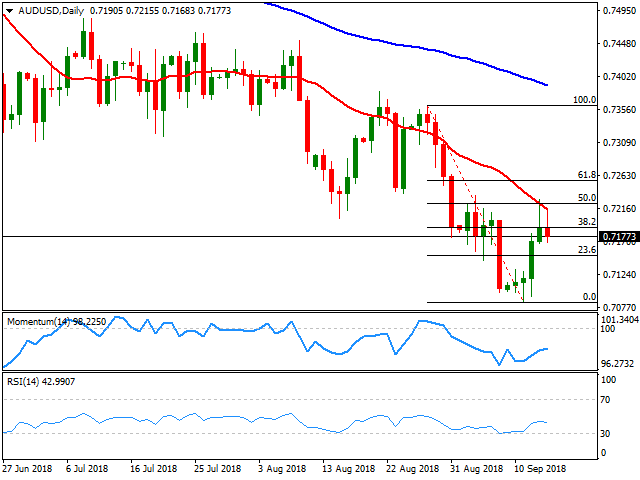

AUD/USD technical outlook

The AUD/USD pair is poised to close the week with solid gains, its largest weekly advance since early April but technically, the long-term picture suggest the latest advance remains as a mere correction. In the weekly chart, the pair remains way below all of its moving averages, with the 20 SMA maintaining a strong bearish slope some 250 pips above the current level. Technical indicators in the mentioned chart remain at monthly lows, with the RSI aiming to leave the oversold territory, hardly enough to confirm a bottom.

In the daily chart, the pair retreated for a second consecutive day from a bearish 20 SMA, while, despite correcting oversold conditions, technical indicators remain well into negative territory, with the RSI already gaining downward traction, now at 43. The chart also shows that the pair faltered at the 50% retracement of its latest decline, and is now trading a handful of pips below the 38.2% retracement of the same decline. The pair has an immediate support around 0.7150, with a break below it exposing the yearly low at 0.7085, lately followed by 0.7000. The pair would need to surpass the 0.7250 level to become a bit more attractive to bulls, with next resistances coming at 0.7310 and the 0.7350/60 region.

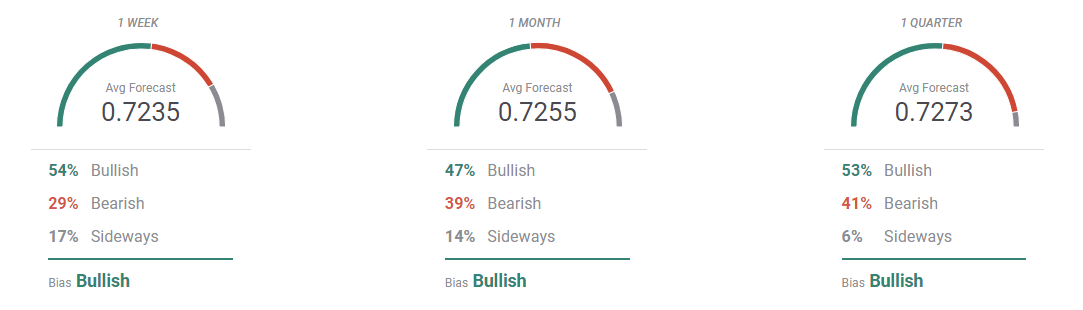

AUD/USD sentiment poll

The mood toward the AUD/USD pair is bullish, according to the FXStreet Forecast Poll, in the three time-frames under study, as it was last week, although this time, seems to be a bit more of a basis for such optimism. The average targets are higher in all of the cases by some 100 pips, although the 0.7250 area is a major psychological threshold and the poll reflects so, with average targets in the 1 and 3 months views falling around it.

The Overview chart, however, shows that only in the weekly case, the moving average has bounced modestly. In the monthly chart, the moving average maintains its bearish slow with the largest accumulation of targets at around 0.71. In the longer-term perspective, the wide spread of targets remains, although the balance leans to the downside, despite some optimistic bulls lift the average to 0.7273.

Related Forecasts

- EUR/USD Forecast: not all is lost for EUR bulls

- USD/JPY Forecast: Can the trade truce continue and help the pair rise?

- GBP/USD Forecast: Sterling pulls back before targeting 100-DMA

- AUD/USD Forecast: Aussie in recovery mode, will it last?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD inches higher to near 1.0900; next barrier at four-month highs

EUR/USD advances for the second consecutive day, trading around 1.0900 during early Tuesday's European session. The analysis of the daily chart shows a weakening of a bullish trend, as the pair is positioned below an ascending channel.

GBP/USD bullish potential seems intact while above 1.2900 mark

GBP/USD lacks firm intraday direction and oscillates in a narrow range on Tuesday. The fundamental backdrop and the technical setup seem tilted in favor of bulls. A convincing break below the 1.2900 mark is needed to negative the positive bias.

Gold's struggle with $2,400 extends amid market caution

Gold price is making another attempt to reclaim $2,400 on a sustained basis, replicating the moves seen during Monday’s Asian trading. Gold price appears to be benefiting from a typical market caution and renewed China’s economic worries and ahead of key US earnings reports.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin finds support around the $67,000 level

Bitcoin and Ripple prices are holding steady around their respective weekly and daily support levels, hinting at an imminent rally. Meanwhile, Ethereum is encountering resistance at the $3,530 mark; a decisive close above this level would signal a bullish breakthrough.

Earnings review

In recent years, the focus has been on the Magnificent 7, particularly Nvidia’s monster earnings reports, which have dominated the market. While Nvidia’s results are still extremely important for overall sentiment, there is a hope that sales growth and revenues can pick up across a broad range of global markets and sectors.