AUD/USD Forecast: At 2021 lows and set to keep falling

AUD/USD Current Price: 0.7398

- Tepid Australian data and softer gold prices undermined the aussie.

- US indexes retreated from records as the mood turned sour.

- AUD/USD is firmly bearish and heading toward the 0.7260 price zone.

The AUD/USD pair fell to a fresh 2021 low of 0.7391, closing a third consecutive week with losses near the mentioned level. Renewed demand for the greenback alongside falling equities led the way at the end of the week, with investors focusing on the slower pace of economic progress. Falling oil prices added to the bearish case, with the bright metal settling at $1,811.87 a troy ounce.

The Australian macroeconomic calendar was empty on Friday, but the local currency continued to suffer from tepid employment and inflation data released earlier in the week, which reflected the poor performance of the economy amid the latest regional lockdowns. Next Tuesday, the RBA will publish the Minutes of its latest meeting.

AUD/USD short-term technical outlook

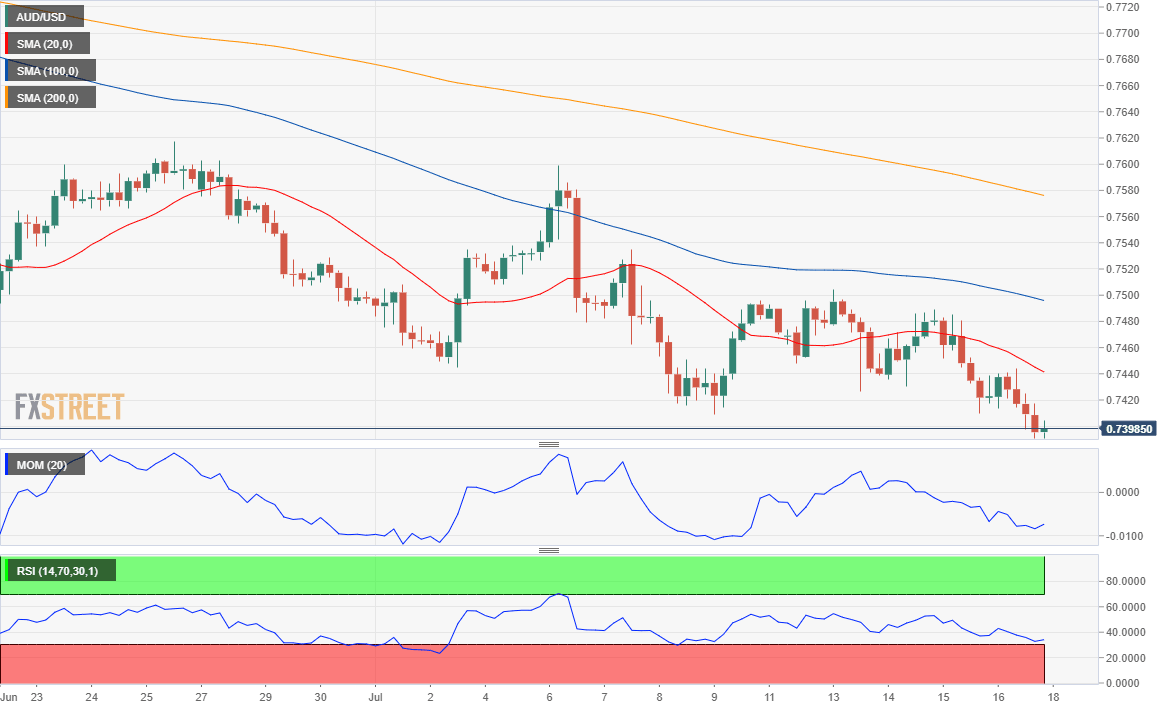

The AUD/USD pair is bearish according to the daily chart. The 20 SMA capped the upside while maintaining its downward slope below the longer ones. Technical indicators remain near weekly lows heading firmly lower and skewing the risk to the downside. The 4-hour chart indicates further declines are in the docket, as technical indicators head south almost vertically while the pair develops well below bearish moving averages.

Support levels: 0.7370 0.7325 0.7290

Resistance levels: 0.7440 0.7475 0.7510

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.