AUD/USD Forecast: An insufficient recovery

AUD/USD Current Price: 0.6425

- The AUD/USD pair climbed to 0.6458 and then pulled back, trimming most of its gains.

- Cautious markets and a stronger US Dollar are limiting the rebound.

- Consolidation could continue as market participants await the Jackson Hole Symposium.

The AUD/USD pair peaked in the European session at 0.6458, the highest level in six days, but then pulled back, approaching 0.6400. Cautious markets and a strong US Dollar keep rebounds limited, and the bias remains to the downside.

Despite the recovery on Tuesday, the Australian Dollar still faces headwinds. The smaller-than-expected Chinese rate cut and the cautious tone across markets are likely to continue constraining the Aussie, and a deterioration in market sentiment could trigger further losses.

The ANZ-Roy Australian Morgan Consumer Confidence Index experienced a drop last week, reaching 75.8. However, the four-week moving average showed a slight increase. Consumer sentiment remains significantly below the historical average. Inflation expectations rose from 5.2% to 5.5%. These shifts can be attributed in part to the decline of the Australian Dollar. On Wednesday, the Australian S&P Global PMI will be released, with the Services and Manufacturing PMIs expected to remain unchanged in August at 47.9 and 49.6, respectively.

The US Dollar remains firm across the board ahead of the Jackson Hole symposium, particularly Powell's speech on Friday. US Treasury yields reached fresh highs on Tuesday, continuing to support the Greenback. Data from the US on Tuesday showed a larger-than-expected decline in Existing Home Sales in July. More housing data is scheduled for release on Wednesday (New Home Sales). Additionally, US S&P Global PMIs are also due.

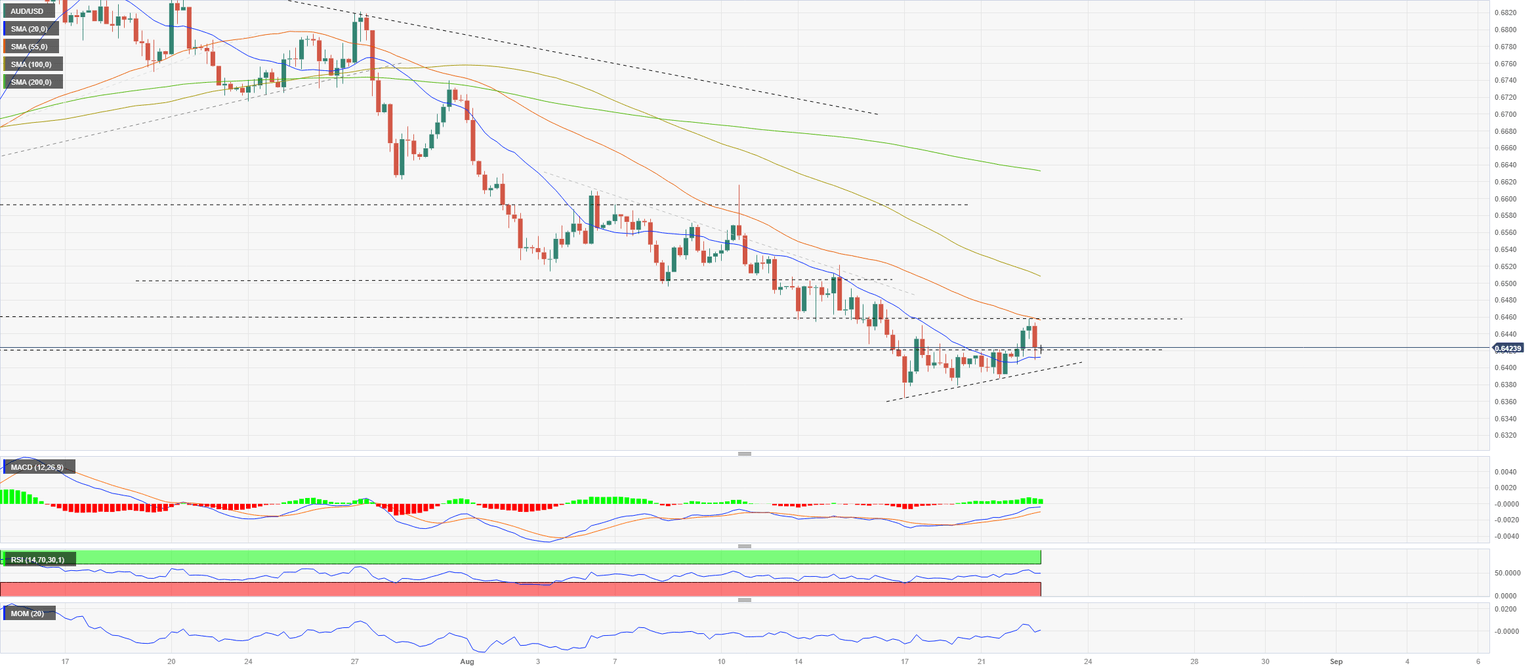

AUD/USD short-term technical outlook

The AUD/USD reached six-day highs but remains in a downtrend and appears vulnerable. The price peaked above 0.6450 but then pulled back towards 0.6400. In the very short term, there is a consolidation with a bullish bias, but it lacks conviction. The pair is about to post its third consecutive daily gain but remains near multi-month lows.

On the 4-hour chart, the recovery still has some potential as long as the pair stays above the 20-period Simple Moving Average (SMA) near 0.6420. Technical indicators offer no clear signs. The immediate resistance stands at 0.6450, and a break above could target 0.6480. On the flip side, negative pressure could intensify with a slide below 0.6400, which would expose the next support at 0.6365. Below that, the next target is located at 0.6345.

Support levels: 0.6395 0.6365 0.6345

Resistance levels: 0.6450 0.6480 0.6505

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.