AUD/USD erases pullback, eyes recent rejection region

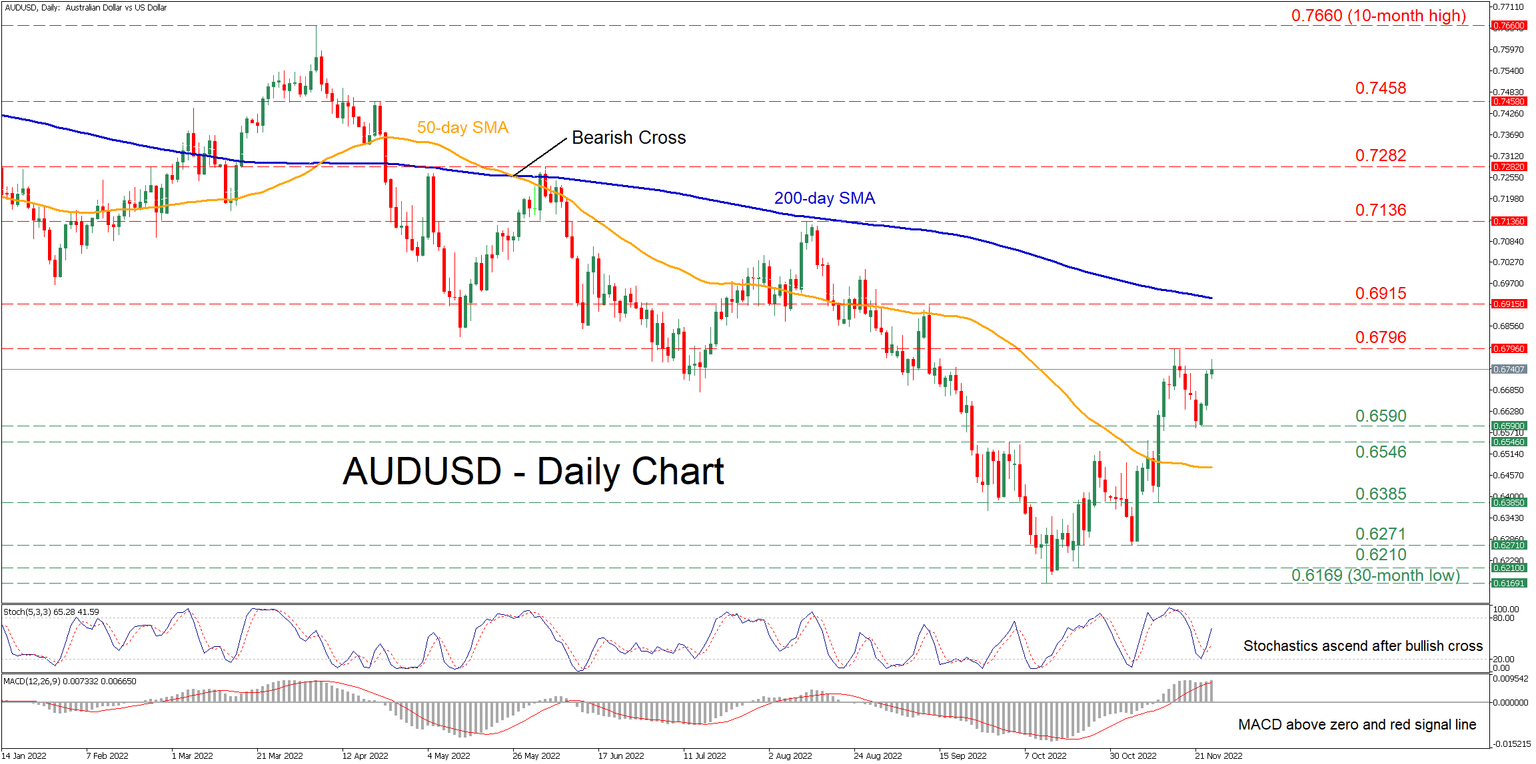

AUDUSD has been stuck in a steep downtrend since early March, but it managed to recoup some losses after bouncing at the 30-month low of 0.6169. Even though the recent rebound paused temporarily and the pair exhibited a minor correction in the short term, it has been regaining lost ground in the last few daily sessions.

The momentum indicators are endorsing this bullish near-term bias. Specifically, the stochastic oscillator is ascending after posting a bullish cross, while the MACD histogram is strengthening above both zero and its red signal line.

Should buying pressures persist, the pair could challenge its recent rejection region of 0.6796. Conquering this barricade, further advances could cease at 0.6915 before the August high of 0.7136 comes under examination. Even higher, the June peak of 0.7282 may prove a tough obstacle for the price to overcome.

On the flipside, bearish actions could send the price to test the recent support of 0.6590. Sliding beneath that floor, the bears may aim at 0.6546 before the 0.6385 support appears on the radar. Failing to halt there, the November low of 0.6271 might provide downside protection.

Overall, AUDUSD appears ready to retest its recent rejection point as the positive momentum is intensifying. Therefore, should the pair manage to profoundly cross above that ceiling, the short-term rebound is likely to resume.

Author

Stefanos joined XM as a Junior Investment Analyst in September 2021. He conducts daily market research on the currency, commodity and equity markets, from a fundamental and a technical perspective.