The Australian dollar (AUD) is witnessing a rise against the US dollar (USD) for the second consecutive day, reaching 0.6629. This upward movement is bolstered by the Reserve Bank of Australia's (RBA) current policy stance. RBA Governor Michelle Bullock emphasized today that discussions on interest rate cuts are premature despite some easing in inflationary pressures.

Inflation, according to Governor Bullock, remains uncomfortably high, with expectations for it to settle within the target range of 2-3% only towards the end of next year. This viewpoint underpinned the RBA's decision last week to maintain the official cash rate at 4.35%, marking the sixth consecutive hold. The RBA cites ongoing economic stability and persistent inflation risks as key reasons for their cautious approach.

This stance starkly contrasts with other major central banks, including the Reserve Bank of New Zealand (RBNZ), which have been more open to adjusting rates. However, the RBA's consistent and factual communication strategy has minimized speculative market reactions, contributing to a more stable forex forecast for the AUD.

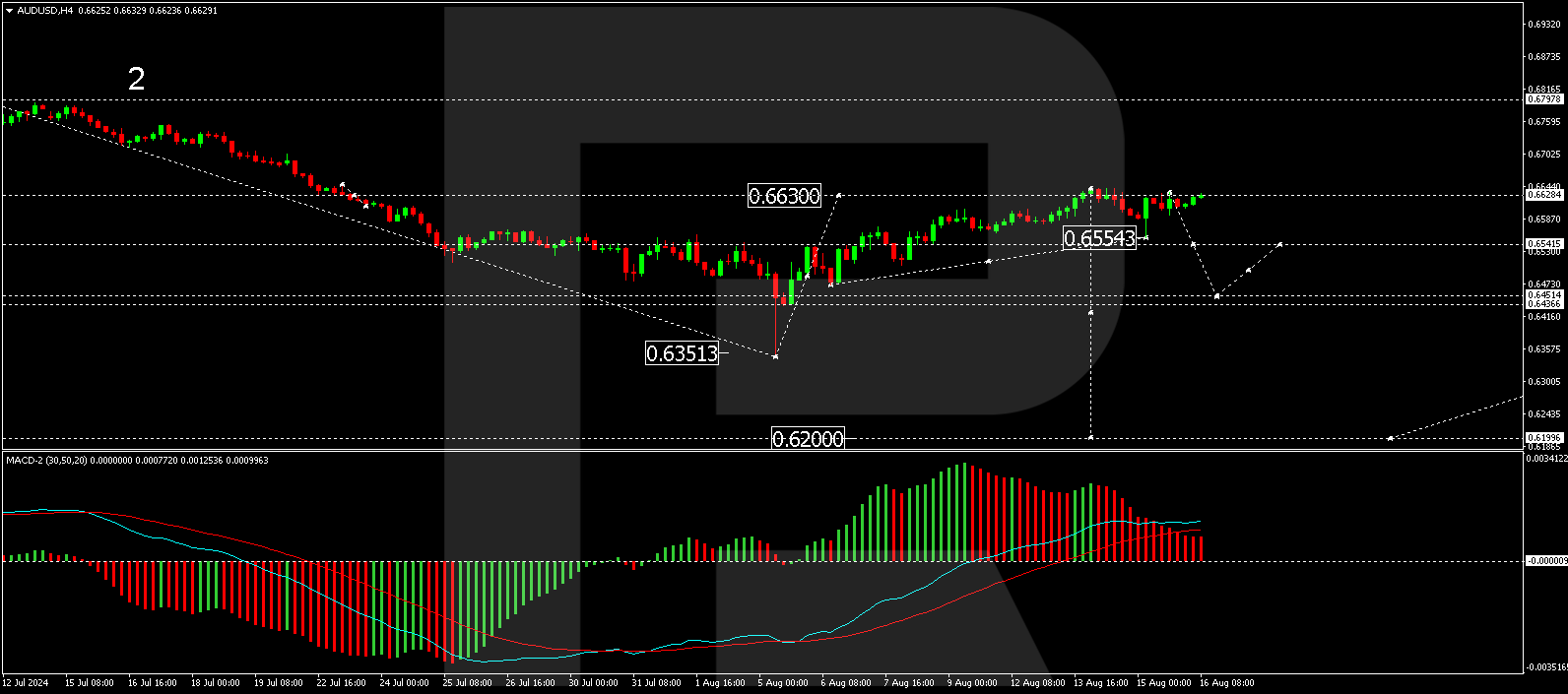

Technical analysis of AUD/USD

The AUD/USD pair has reached a peak at 0.6640 and is now showing signs of consolidating below this level. Should the pair break downwards from this consolidation, a decline to 0.6450 could be anticipated. Following this potential drop, a rebound to 0.6545 for a retest from below might occur before a further descent towards 0.6200. This bearish outlook is supported by the MACD indicator, which shows the signal line retreating from highs and gearing towards a downturn.

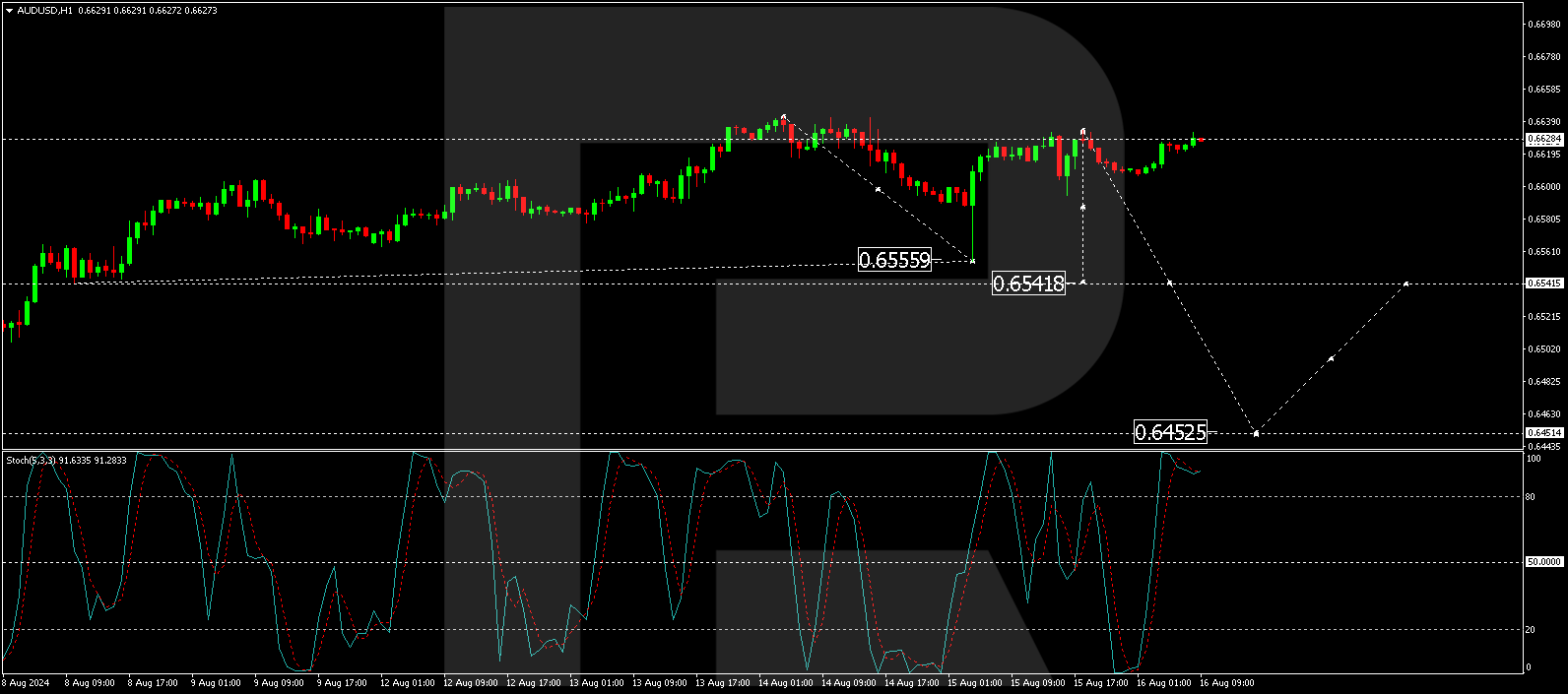

On the hourly chart, after a decline to 0.6555, the AUD/USD pair corrected upwards to 0.6628. A consolidation below this level is expected, which could lead to a new downward wave aiming for 0.6540. This bearish prediction aligns with the Stochastic oscillator readings, where the signal line is poised to move from above 80 downwards to 20, indicating potential selling pressure ahead.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to modest daily gains, stays below 1.1000

EUR/USD trades modestly higher on the day but remains slightly below 1.1000. The improving risk mood makes it difficult for the US Dollar to build on Thursday's gains and helps the pair hold its ground ahead of the weekend.

GBP/USD climbs to multi-week highs above 1.2900

GBP/USD preserves its bullish momentum on Friday and trades at its highest level in three weeks slightly above 1.2900. The positive shift seen in risk sentiment causes the US Dollar to stay under bearish pressure, allowing the pair to extend its uptrend.

Gold rises toward $2,470 as US yields turn south

Gold regains its traction and rises toward $2,470 on Friday. The benchmark 10-year US Treasury bond yield loses more than 1% on the day below 3.9% following Thursday's upsurge, fuelling XAU/USD's upside heading into the weekend.

Dogecoin price is set for a downturn as it encounters its resistance barrier

Dogecoin price is testing the resistance around the 100-day EMA at $0.1073, with an impending decline ahead. On-chain data shows DOGE's daily active addresses decreasing and dormant wallets moving again, signaling a bearish move.

Easing inflation worries despite robust sales data

The market mood got a further boost yesterday after the latest data release from he US hinted that the economy is not doing that bad, after all.