AUD/USD bears to push towards 50-day SMA?

Ahead of this week’s RBA meeting, the Australian dollar exhibits a potential bearish scenario versus the US dollar, with the monthly and daily charts indicating further softness for the AUD/USD currency pair.

50-day SMA demands attention

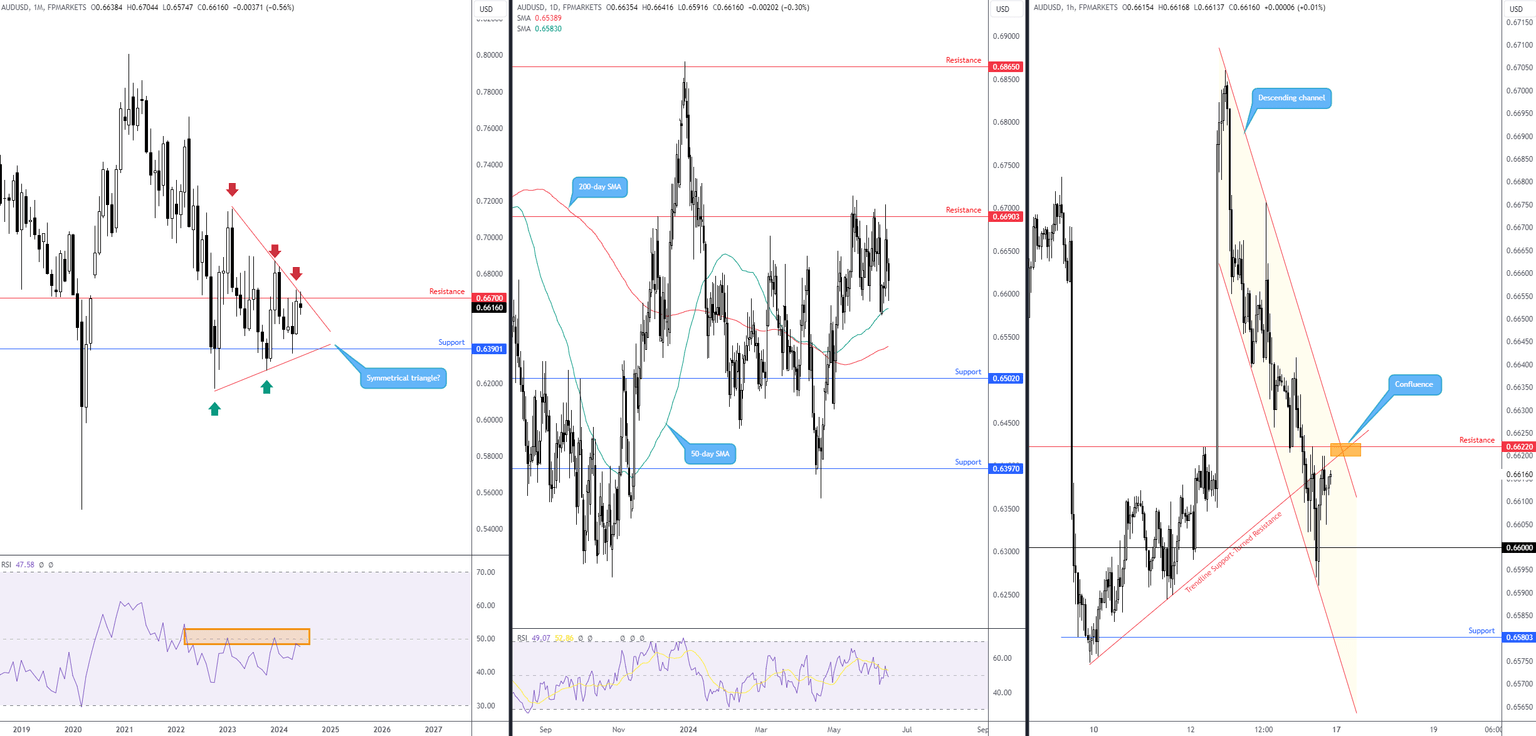

Since September 2022, buyers and sellers have squared off between two converging lines on the monthly scale, a movement sufficient to label this pattern as a symmetrical triangle (or coil). You will note that May shook hands with the structure’s upper boundary and has triggered a moderate sell-off this month (down -0.6%). Aiding the upper limit of the coil is a layer of monthly resistance coming in at $0.6670 that’s complemented by the Relative Strength Index (RSI) continuing to navigate space south of the 50.00 centreline. There’s also plenty of scope for sellers to stretch their legs at current price on the monthly chart: support is not expected to make a show until as far south as $0.6390.

Meanwhile, on the daily timeframe, resistance at $0.6690 has been a talking point since mid-May, withstanding three upside attempts. If sellers maintain their position this week and overthrow willing bids at the 50-day simple moving average (SMA) at $0.6583, this would unearth a possible bearish scenario towards the 200-day SMA at $0.6539 and neighbouring support coming in from $0.6502.

H1 confluence

Given the space for sellers to make their way to the 50-day SMA at $0.6583 on the daily chart, technical studies lean in favour of further selling towards $0.66 on the H1 scale this week, followed by H1 support from $0.6580. Therefore, the area showing H1 resistance at $0.6622 converging with channel resistance (drawn from the high of $0.6704) and a trendline support-turned-resistance line (taken from the low of $0.6575) could be a zone sellers show interest in this week.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,