AUD/USD Analysis: Stronger Australian CPI-inspired rally stalls near 0.6530 confluence hurdle

- AUD/USD spikes to a near two-week high following the release of stronger Australian CPI print.

- Reduced Fed rate cut bets help revive the USD demand and cap any further gains for the major.

- Traders now look forward to important US macro releases before placing fresh directional bets.

The AUD/USD gains strong positive traction for the third straight day and spikes to a nearly two-week high, around the 0.6530 area on Wednesday in reaction to the stronger Australian inflation data. The latest data published by the Australian Bureau of Statistics (ABS) showed that the headline Consumer Price Index (CPI) rose 1.0% in the first quarter of 2024 as compared to the 0.6% increase seen in the fourth quarter. Meanwhile, the yearly rate decelerated from 4.1% to 3.6% during the reported period, though was higher than consensus estimates and the Reserve Bank of Australia’s (RBA_ target range. This could force the RBA to keep interest rates high, which, along with a generally positive tone around the equity markets, provides a goodish lift to the risk-sensitive Australian Dollar (AUD).

The global risk sentiment remains well supported by easing concerns about a further escalation of geopolitical tensions in the Middle East, though doubts over an economic recovery in China keep a lid on the optimism. Apart from this, the emergence of some US Dollar (USD) dip-buying contributes to capping gains for the AUD/USD pair. The initial market reaction to Tuesday's dismal US PMI prints, which suggested that the business activity in the private sector expanded at a slower pace, faded rather quickly amid bets that the Federal Reserve (Fed) will delay cutting interest rates. Investors now seem convinced that the Fed is unlikely to begin its rate-cutting cycle in June and have also scaled back their expectations about the total number of rate cuts in 2024 to less than two.

The outlook, meanwhile, remains supportive of elevated US Treasury bond yields and acts as a tailwind for the buck, warranting some caution before placing fresh bullish bets around the AUD/USD pair and positioning for further gains. Market participants now look to the US economic docket, featuring the release of the Durable Goods Orders later during the early North American session. The focus, however, will remain glued to the Advance US Q1 GDP report and the Personal Consumption Expenditures (PCE) Price Index on Thursday and Friday, respectively. The crucial data will play a key role in influencing the Fed's future policy decisions, which, in turn, should provide some meaningful impetus to the USD and determine the next leg of a directional move for the currency pair.

Technical Outlook

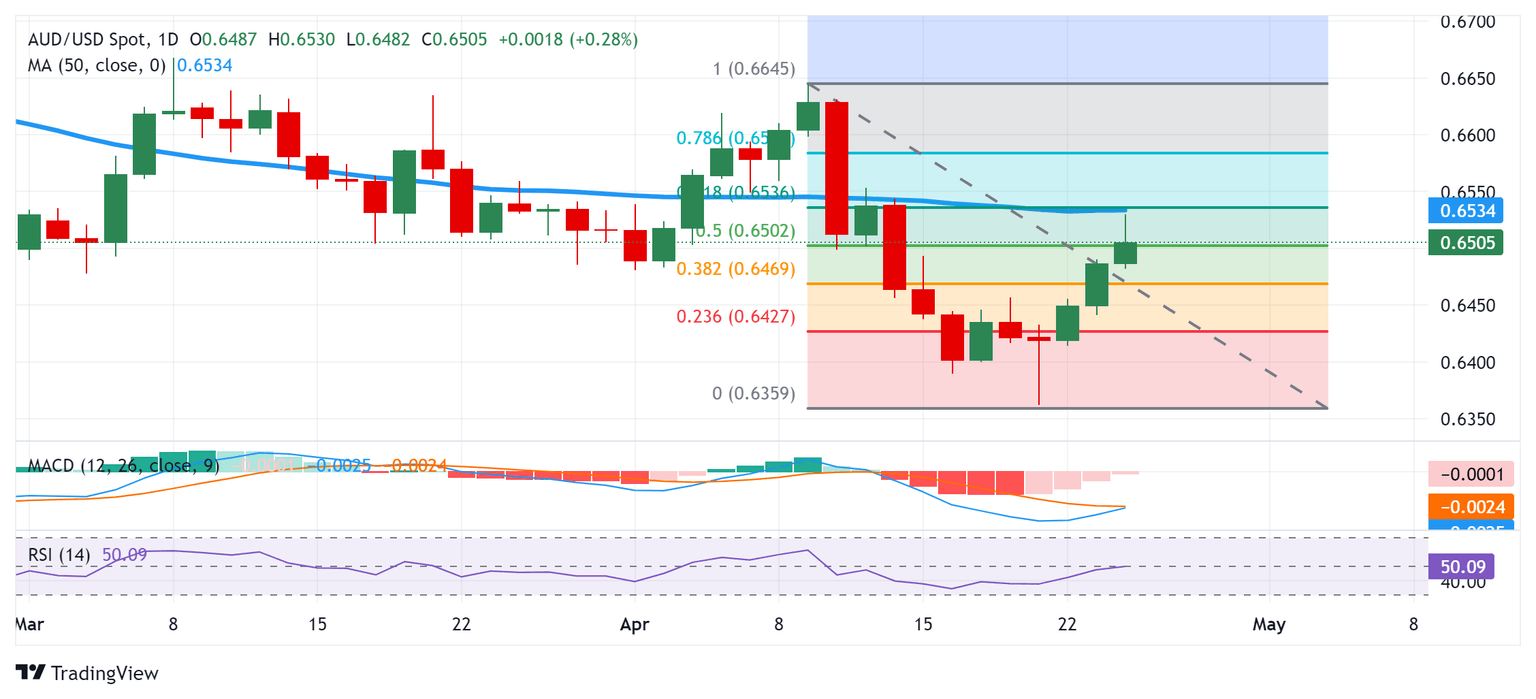

From a technical perspective, the intraday positive move stalls near the 0.6530 confluence hurdle comprising the 50-day Simple Moving Average (SMA) and the 61.8% Fibonacci retracement level of the downfall witnessed over the past two weeks or so. The said area should now act as a key pivotal point, which if cleared decisively should allow the AUD/USD pair to build on its recent recovery move from the 0.6365-0.6360 region, or the YTD low touched last Friday. Spot prices might then aim to reclaim the 0.6600 mark and climb further towards retesting the monthly swing high, around the 0.6645 zone.

On the flip side, weakness back below the 0.6500 psychological mark now seems to find decent support near the 0.6470-0.6465 region. The next relevant support is pegged near the 0.6430-0.6425 area ahead of the 0.6400 mark. A convincing break below the latter could make the AUD/USD pair vulnerable to retesting the YTD low, around the 0.6365-0.6360 region. Some follow-through selling will be seen as a fresh trigger for bearish traders and set the stage for a further near-term depreciating move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.