AUD tries to bounce back

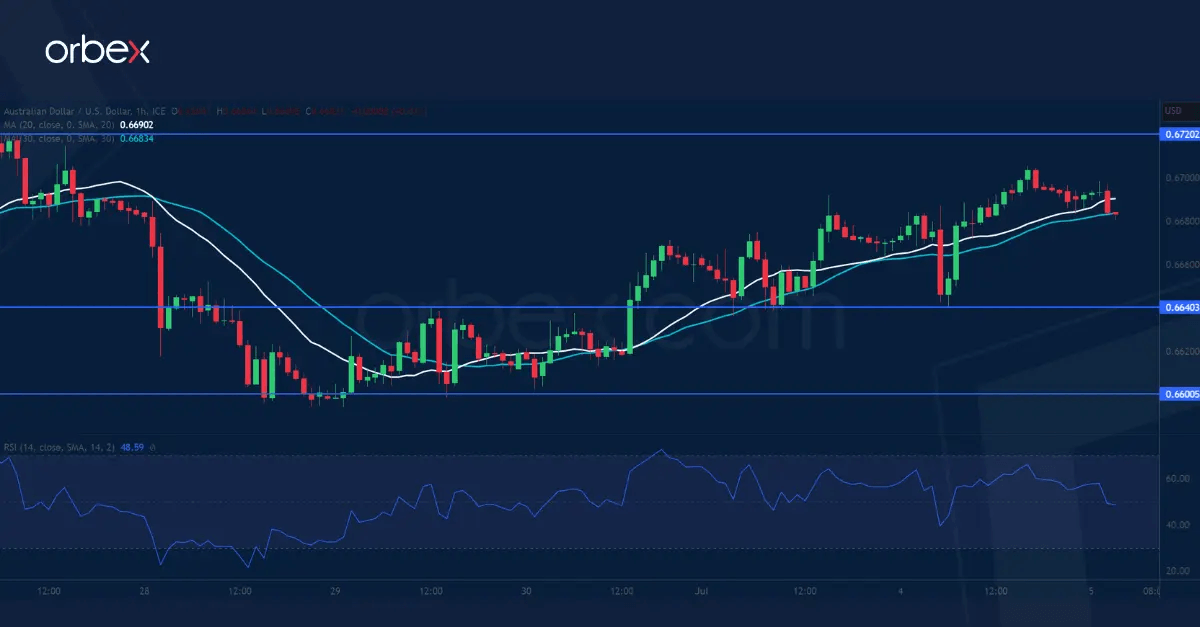

AUD/USD tests resistance

The Australian dollar inched higher after the RBA reiterated that further tightening might be needed. The price action has stabilised over 0.6600 and a steady grind upward suggests that sellers have taken some bets off the table. The top of a previous brief rebound at 0.6720 is an important resistance as its breach would prompt more sellers to take profit and ease the pressure. On the downside, 0.6640 is the immediate support to keep the rebound momentum flowing and 0.6600 is a critical floor further down.

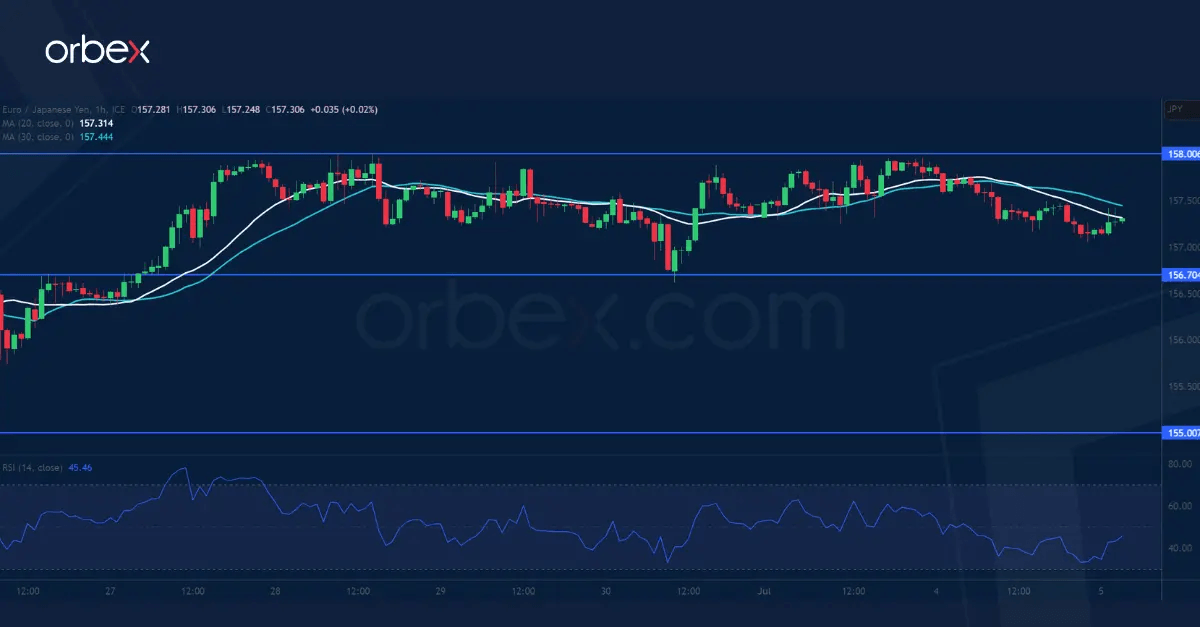

EUR/JPY grinds support

The yen holds as Japan's Finance Minister’s warning against yen selling fuels intervention chatter. As the price hovers under 158.00, the daily RSI’s overbought situation may cause a pullback if buyers are reluctant to chase after high offers. Sentiment remains extremely upbeat and the bulls may look to keep the direction intact. 156.70 is the first level to expect follow-through bids. Further down, the psychological level of 155.00 sits at the confluence of a previous swing low and the 30-day SMA, making it a major support to monitor.

FTSE 100 awaits breakout

The FTSE 100 struggles with momentum in the wake of soft UK PMI. Sentiment has turned cautious after the index touched a three-month low (7400). A bounce above the first resistance of 7515 has prompted short-term sellers to cover and given the buy side some respite. 7560 on the 30-day SMA is a key hurdle to lift before the index could enjoy a broader recovery towards June’s peak of 7685. The demand zone 7460-7500 is a major level to keep the rebound valid or a deeper correction would send the index to 7300.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.