AUD/JPY Elliott Wave technical analysis [Video]

![AUD/JPY Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/AUDJPY/forex-australia-and-japanese-currency-pair-with-calculator-4780678_XtraLarge.jpg)

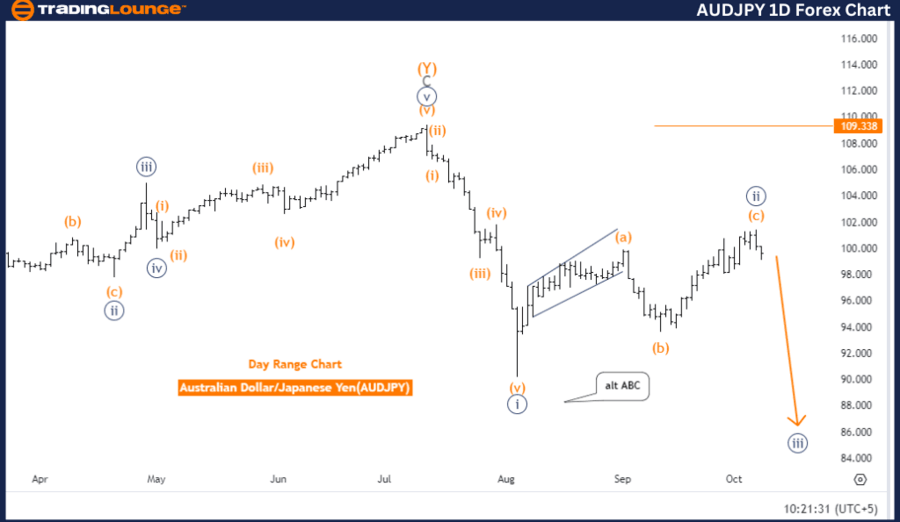

Australian Dollar / Japanese Yen (AUDJPY) day chart.

AUD/JPY Elliott Wave technical analysis

-

Trend: Bearish.

-

Mode: Impulsive.

-

Structure: Navy blue wave 3.

-

Next lower degree wave: Navy blue wave 3 (ongoing).The AUDJPY Elliott Wave Analysis on the daily chart highlights a bearish trend currently in motion. The analysis is operating in an impulsive mode, suggesting that the market is undergoing a strong downward movement. The structure being observed is navy blue wave 3, indicating a key phase within the larger bearish trend.

Wave two completion and wave three progress

Navy blue wave 2 is considered complete, marking the end of the previous corrective phase. With this completion, navy blue wave 3 has now started, setting the stage for further bearish movement. This wave is expected to push the market lower, continuing the decline observed earlier in the trend.

The analysis points out that the market is fully engaged within navy blue wave 3, implying sustained downward pressure in the near term. This wave forms part of the larger bearish structure and is anticipated to result in additional price drops.

Invalidation level: 109.338.

The invalidation level for this Elliott Wave structure is 109.338. If the price rises above this point, the current wave count would be invalidated. This would signal that the bearish outlook needs to be re-evaluated. Traders should closely monitor this level as it serves as a critical threshold for confirming the ongoing wave pattern.

Summary

The AUDJPY daily chart analysis reflects a strong bearish trend, with navy blue wave 3 currently in progress. Following the completion of navy blue wave 2, the market has entered an impulsive downward phase. Further declines are expected, unless the price exceeds the invalidation level of 109.338. The analysis indicates continued bearish pressure in the near term.

Australian Dollar / Japanese Yen (AUDJPY) four-hour chart

AUD/JPY Elliott Wave technical analysis

-

Trend: Bullish.

-

Mode: Impulsive.

-

Structure: Orange wave 1.

-

Position: Navy blue wave 3.

-

Next higher degree wave: Orange wave 2 (pending).

The AUDJPY 4-hour chart Elliott Wave Analysis highlights a clear bullish trend. The market is currently in an impulsive mode, which means a strong upward movement is in progress. The primary wave structure being analyzed is orange wave 1, which forms part of a larger trend. The position of the current price action is within navy blue wave 3, an important phase in this overall bullish trend.

Wave two completion and wave one progress

Navy blue wave 2 is considered complete, marking the end of the prior corrective phase. With the conclusion of this phase, orange wave 1 of navy blue wave 3 has started, signaling a fresh impulsive wave that is driving the price upward.

Next phase: Orange wave two

Once orange wave 1 completes, the next phase will be orange wave 2, which is expected to bring a temporary correction before the bullish trend resumes. However, the immediate focus remains on the ongoing impulsive movement in orange wave 1 of navy blue wave 3, indicating continued bullish activity in the short term.

Invalidation level: 109.338.

The invalidation level for this Elliott Wave structure is set at 109.338. If the price falls below this level, the current wave count would be invalidated, requiring a new analysis of the wave pattern. This level acts as a key reference for traders to confirm the validity of the bullish wave structure.

Summary

The AUDJPY 4-hour chart shows an impulsive upward trend, with orange wave 1 of navy blue wave 3 currently active after the completion of navy blue wave 2. The market is likely to continue moving upward unless the price falls below the invalidation level of 109.338, which would necessitate a reassessment of the wave count.

AUD/JPY Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.