AUD/JPY correction has reached short term support area [Video]

![AUD/JPY correction has reached short term support area [Video]](https://editorial.fxstreet.com/images/Resources/PremiumFirebase/AUDJPY_2023-08-16_11-41-54_XtraLarge.png)

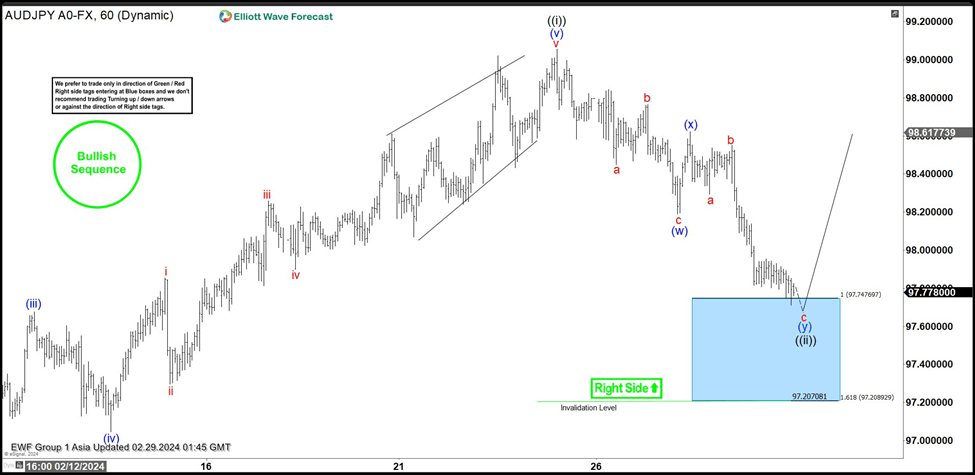

The short-term Elliott Wave View in the AUDJPY suggests that the cycle from 01 February 2024 low unfolded in an impulse sequence and shows a bullish sequence supporting more upside. Whereas the rally to 96.92 high ended wave (i), a pullback to 96.18 low ended wave (ii). A rally to 97.67 high ended wave (iii) then a pullback to 97.04 low ended wave (iv). Above from there, a rally to 99.05 high ended wave (v) thus ended wave ((i)) in a 5 wave structure.

AUD/JPY one-hour Elliott Wave chart

Down from there, the pair is doing a short-term pullback in wave ((ii)) to correct the cycle from the 2/01/2024 low. The pullback from the peak is unfolding as Elliott wave double three correction where wave (w) ended at 98.18 low in 3 swings. While a bounce to wave (x) ended at 98.62 high and started the (y) leg lower. Towards 97.47- 97.20 100%- 161.8% Fibonacci extension area of (w)-(x) blue box area. Near-term, as long as it remains above the 97.20 low the pair is expected to find buyers from the blue box area for the next leg higher or should produce a 3 wave reaction higher at least.

AUD/JPY Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com