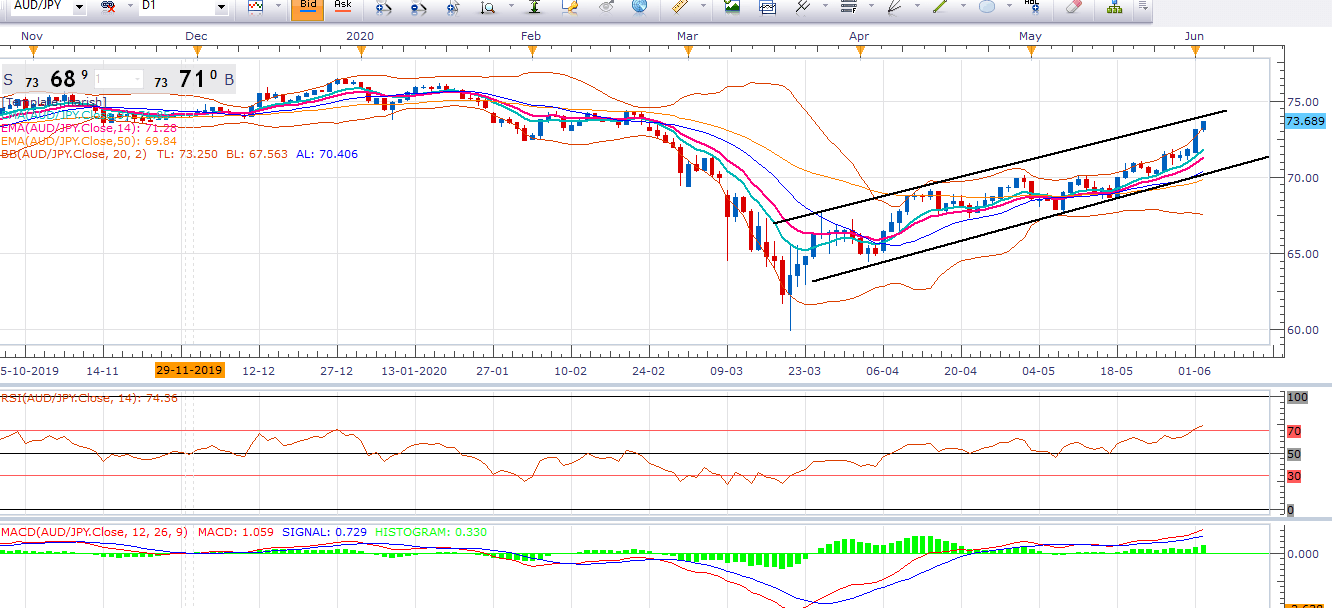

Overview: Overall pair is trading and moving in an uptrend and making successively higher highs and higher lows on day to day basis. Pair is trading at 3 month’s fresh high recently it posted a bullish marabuzo candlestick which is providing us bullish signal on the daily chart. Well the way bulls are reacting it seems like they are going to approach the 75 .00 level in the near term.

Also, bulls are in long drive mood and their upcoming destination is 75.00 and 76.50 level at least. From there we may see some relaxation mode or correction but this correction again should be taken as a buying opportunity. On the flip side, a turn lower below the 72.00 figure could be seen as bearish in the medium-term with supports possibly emerging near the 71.50 and 71.00 levels.

Technical Analysis: From a technical prospective we can see that pair is trading and moving in an uptrend channel where only bulls can be seen. Bulls are dominating the bears at every nook and corner. Overall pair is trading above all the major and minor EMA lines, which is providing us a bullish signal for the time being, however, some correction can’t be ruled out even this correction should be taken as buying opportunity.

Odds are in favor of bulls and our weekly bias remains bullish on the pair as long as pair is trading above 70.00 level. The first week of the week started with a positive note which has boosted up the buyer’s courage. On a weekly chart also a clear cut breakout of the 50 EMA line can’t be ignored by bulls which is also providing strength to the bulls.

Also, a bullish crossover on the MACD indicator is providing us bullish signal and RSI is also favoring the bulls as it is trading above 50 level on a weekly chart. The Bollinger band has been stretched out and pair is aligned with the upper band of BB. Most of the time pair is trading and sustaining above the middle line and upper line.

Trade idea: Based on the chart and studies above we can say that one can go for buy at 73.10-73.00 level for the target of 75.00 and 76.00 with the tight stop loss of 71 level.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.