AUD/JPY Analysis: When everyone comes to the party

- Cross closes on Monday at three-year high of 84.57.

- AUD/JPY is up 6.4% in 2021, 35.6% from the pandemic March 2021 low.

- Resistance lines are from first quarter of 2018, support lines are current.

- AUD/USD is boosted by the commodity complex and expected global recovery.

- USD/JPY is riding US Treasury rates higher, 10-year yield closes above 1.6% on Monday.

The AUD/JPY has had a remarkable year. From the pandemic low in March 2020, this Asian cross has risen 35.6%, the most of any currency pair. For most of 2020 the Australian dollar has been the main source of support for the AUD/JPY cross. But over the past six weeks the interest rate based ascent of the US dollar has taken over, providing new impetus and driving the cross to 84.57 on Monday, its highest finish in three years.

Pandemic accounting

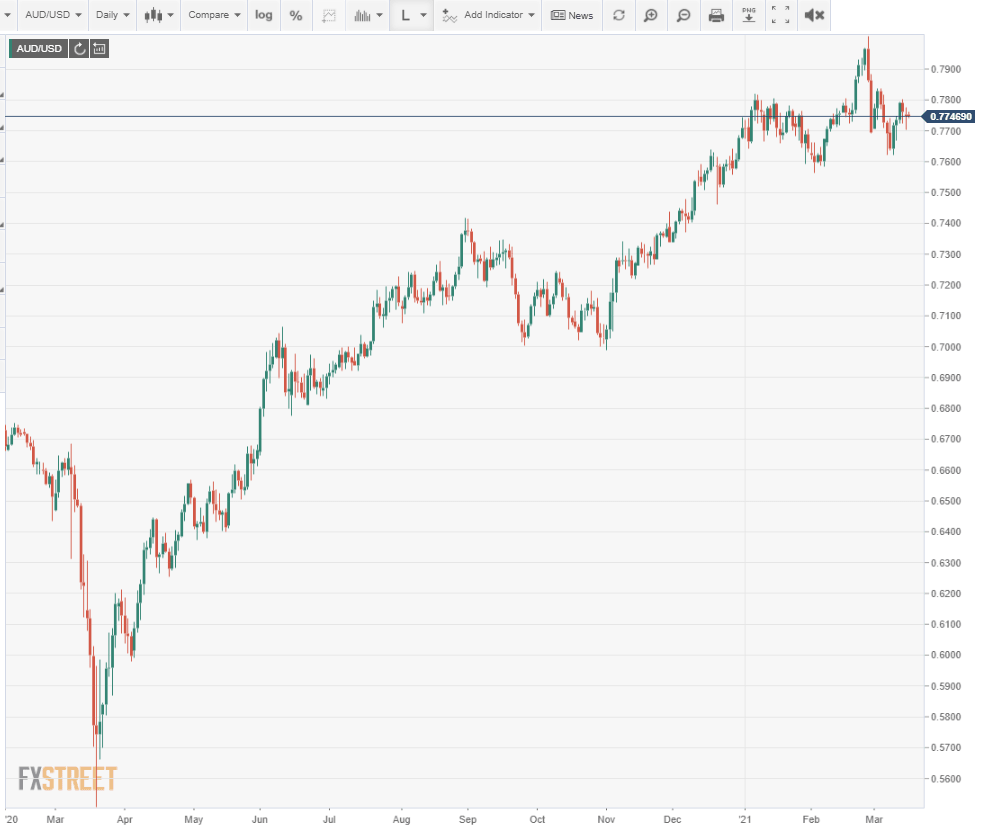

The market panic created by the pandemic pushed financial and currency markets into a headlong pursuit of US assets and the dollar. The AUD/USD dropped to 0.5508, its lowest point in 17 years in March 2020. The USD/JPY, due to its partial safety status, was more resilient. Nonetheless, it fell to three-year low at 101.18 and then, over just two-weeks of trading, reversed ten figures to 111.70.

For both currency pairs the withdrawal of the US dollar safe-haven trade lasted almost to the end of the year.

By early December the aussie had climbed beyond its pandemic peak as commodities priced in a global recovery in the first and second quarters.

Beginning in January, Treasury rates had begun to respond to the expected recovery in the US and to the near certainty of another massive stimulus package from Washington. This galvanized the USD/JPY from below 104.00 to over 109.00 six weeks later.

Rising US rates stalled the aussie at the same time that they boosted the USD/JPY.

For the AUD/JPY rate, the mathematical product of the AUD/USD and the USD/JPY, it is irrelevant if one component, or both, are rising.

From the bottom in mid-March of last year to the end of 2020, it was largely the ascending Australian dollar that kept the AUD/JPY climbing. After the aussie stalled, the USD/JPY took over as the engine and kept the cross rate advancing.

Fundamental outlook

American Treasury rates remain well below their historical averages. The benchmark 10-year bond yield closed at 1.6% on Monday. For almost three years, from October 2016 to August 2019 it held above above 2%, and for about half that period it was above 2.5%.

US 10-year Treasury yield

CNBC

The Federal Reserve's bond buying program has captured the short end of the curve. The 2-year yield is just four basis points above its August low. At 1.6% the 10-year yield is 100 basis points above that same August bottom. Despite that gap, Fed officials, including Chairman Jerome Powell , have repeatedly said that they do not consider the rise in longer Treasury yields a threat to the US recovery.

That stance may be moderated at this week's Federal Reserve Open Market Committee (FOMC) meeting, in part, to prevent further rapid increases. But there is no reason to expect a policy reversal. Over the next few months, all things being equal, the 10-year yield should move to 2% and beyond.

The prospects for the USD/JPY are aligned with rising US interest rates.

Commodities, and their associated currencies like the Australian dollar have more limited options. The Bloomberg Commodity Index closed at 85.96 on Monday, and is at a two-and a-half year high in anticipation of the global expansion. The 90.92 high of the last five years in June 2018 is only 7% from here.

One of the AUD/JPY components, the AUD/USD or the USD/JPY, will have a strong first half. It is entirely possible that both will rise.

Odds are with the Dollar yen for a greater improvement because the potential for a US economic recovery and higher Treasury rates is strong. But it is also credible that global growth will boost the Australian economy and the aussie and could even spur the Reserve Bank of Australia to increase rates.

Either way, the AUD/JPY should continue to rise through the second quarter.

Technical outlook

The sharp gains of the last five months have been founded on a fundamental change, the end of the pandemic. A US and global recovery is expected, higher interest rates, higher commodity useage and for the AUD/JPY, the unusual circumstance two rising components.

Technical considerations have provided guidance and levels for consolidation but they are not the originators of the rise. The resistance lines all date from 2018 and earlier and are weaker than the more recent support levels. The Relative Strength Index at 68.06, though slightly overbought, is not a sell signal in the current context. The 21-day moving average at 83.27 is active support. The 100-day at 79.28 and the 200-day at 77.37 are too distance for relevance.

Resistance: 85.50; 86.00; 86.80; 87.60

Support: 84.00; 83.25; 82.75; 82.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.