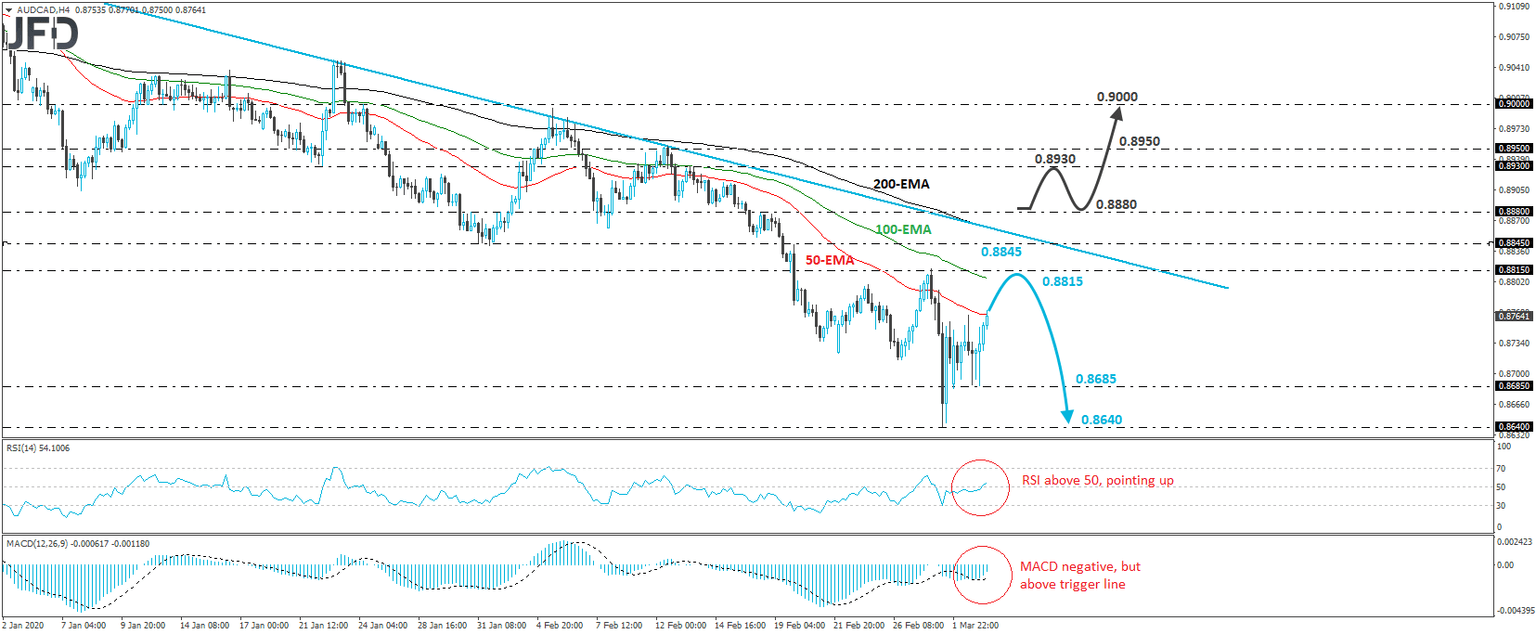

AUD/CAD Rebounds from Near 0.8685

AUD/CAD traded higher today, after it hit once again the support zone of 0.8685. The pair appears to be in a recovery mode, but bearing in mind that it continues to trade below the downtrend line drawn from the peak of December 31st, we will treat any further upside as a corrective extension before the bears decide to jump back into the action.

The rebound may continue up until Friday’s high, near 0.8815, or the aforementioned downtrend line. One of those key resistance zones may prove to be the entry point for some sellers, who could decide to shoot for another test near the 0.8685 hurdle. That said, if that barrier fails to halt a potential upcoming slide, then we may see the rate falling towards the low of Friday, at around 0.8640.

Shifting attention to our short-term oscillators, we see that the RSI lies above 50 and points up, while the MACD, although negative, runs above its trigger line, pointing north as well. Both indicators suggest that the rate is gathering upside speed and corroborate our view for further recovery before, and if, the bears decide to take charge again.

In order to start examining the case of a trend reversal, we would like to wait for a break above 0.8880, a resistance marked by the high of February 19th. The rate would already be trading above the pre-mentioned downtrend line and thus, the bulls may get encouraged to climb towards the peak of February 13th, at around 0.8930, or the 0.8950 level, near the high of the previous day. If they manage to overcome that obstacle as well, then we may see them putting the psychological zone of 0.9000 on their radars.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD